A2A payments are a hot topic in finance today. They can underpin a digital wallet, QR payment, or even a cryptocurrency transaction at a fraction of the cost charged by card networks

A2A payments: market presence and forecasts

What is A2A?

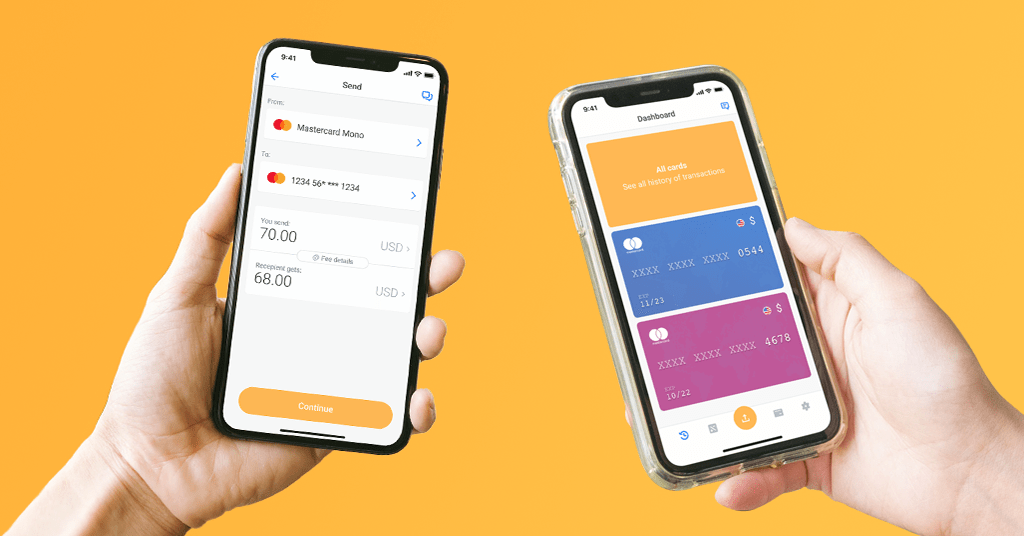

Account-to-account (A2A) payments describe direct money transfers from one account to another without intermediaries, such as bank cards or wallets. Simply put, money moves directly from the payer’s bank to a merchant or service provider’s bank. Historically, A2A technology catered for transactions specific to bank accounts, such as direct debit.

However, today it has got new use cases due to the rise of open banking and real-time payments. Besides, the accounts involved could be bank accounts, but not necessarily. For instance, many A2A transfers in developing countries are from one mobile wallet account to another. In addition, some innovative account-based payment solutions allow using POS terminals, making the process resemble traditional card payments.

A2A payments divide into two types:

- push payments – initiated by consumers, although possibly triggered by APIs

- pull payments – companies automatically withdraw money from the payer’s account

A2A trend development

Traditionally, push and pull A2A payments occur when consumers make one-off or recurring payments to merchants or service providers. For instance, pull payments are typical for subscription services. After getting explicit consent, merchants initiate payments from the customer’s account. Push payments, on the other hand, require payers to manually send money from their bank account to the recipient’s account.

With the development of open banking, licensed payment initiation service (PIS) providers expanded the A2A payment market. The payments became more technologically advanced and convenient for users. Today, licensed third-party PIS providers can initiate a single direct payment from the consumer’s bank account to the merchant’s account with the consumer’s consent.

By providing a range of benefits, A2A payments have the opportunity to shift from an alternative payment method to a mainstream one. Although payment intermediaries, such as bank cards and wallets, have become dominant forms of payment, they are expensive. Card network schemes may have large-scale reach and provide the best conversion rates, but A2A benefits boosted by open banking could outweigh bank card payments.

A2A benefits

Account-to-account payments strengthen businesses and serve end-users well. The main advantages are:

- extended client reach – any person with a bank account or a mobile wallet account can use A2A payments

- increased conversion rates – simplified user experience reduces the number of incomplete purchases

- lower costs – paying directly from a bank account eliminates card network fees, thus, reducing transaction costs

- improved speed – the money from one bank account can reach the other bank account instantly if it doesn’t have to travel through intermediaries

- better user experience – since cards are out of the process, users don’t need to enter their card details, which makes the checkout process simple and convenient

- stronger security – A2A payments require robust multi-factor customer authentication methods which reduce fraud

We’re already observing an increase in use cases for A2A payments in Europe and the USA. Source: pexels.com

A2A market presence

While A2A payments can lower transaction costs, they haven’t had enough reach for a while due to the barriers put up by fragmented banking rails. Open banking-enabled A2A payments presented immense potential growth in adoption.

We’re already observing an increase in use cases for A2A payments in Europe and the USA. For example, account-based transactions now enable e-commerce purchases and paying bills. However, the fastest-growing use case is debt repayments.

In the UK, consumers can settle one-fourth of credit card debts using an A2A payment. Some European countries offer nationwide A2A payment solutions, such as Dutch iDeal or German Giropay. At the same time, major American card issuers – Discover and Bank of America – enabled account-to-account payment solutions in 2022.

Besides, A2A transfers using debit are also soaring. Account-to-account transactions, including those made via P2P wallets, leapt nearly 60% in 2020, following 100% growth in 2019. One study found that A2A payments in 2021 accounted for 13% of all European checkouts and nearly 6% of all US checkouts.

The Second Payment Services Directive (PSD2) implementation facilitates higher A2A popularity in Europe. However, the US federal financial initiative FedNow will provide new opportunities to the American A2A market. It is a real-time payment rail leveraging A2A transfers to facilitate instant settlements and clearing. The official launch is scheduled for summer 2023.

Forecasts

FIS’ Global Payments Report 2020 predicted that A2A payments will account for 20% of all e-commerce payments, surpassing credit and debit cards by 2023. Besides, A2A payments have already been identified by payment issuers and acquirers as the number one opportunity of open banking, according to Omdia’s ICT Enterprise Survey (ICTEI) 2020/21.

McKinsey & Co Global Payments Report 2019 stated that A2A payments would eventually ‘threaten cards’ leadership in non-cash retail payments. The proliferation of fintechs that need consumers to fund their accounts – such as challenger banks and trading accounts – will be a major adoption catalyst. Besides, consumers appreciate the seamless and secure customer experience of A2A transactions.

In addition, merchants alarmed about rising payment costs are ready for alternative payment methods. A2A payments deliver significantly lower costs than traditional payment methods and are independent of payment values. They also deliver greater liquidity, offering an instant settlement. Therefore, Worldline has also flagged account-to-account payments as a ‘global payments megatrend’ for 2022.

SEE MORE:

FIS introduced A2A real-time payments platform

FIS offers central banks real-time payments and CBDC tech solution

HSBC launches variable recurring payments for open banking customers