The payments sector is expected to recover gradually by the end of Q2 2020

Global Data released forecast for New Zealand payment market. Source: pixabay.com

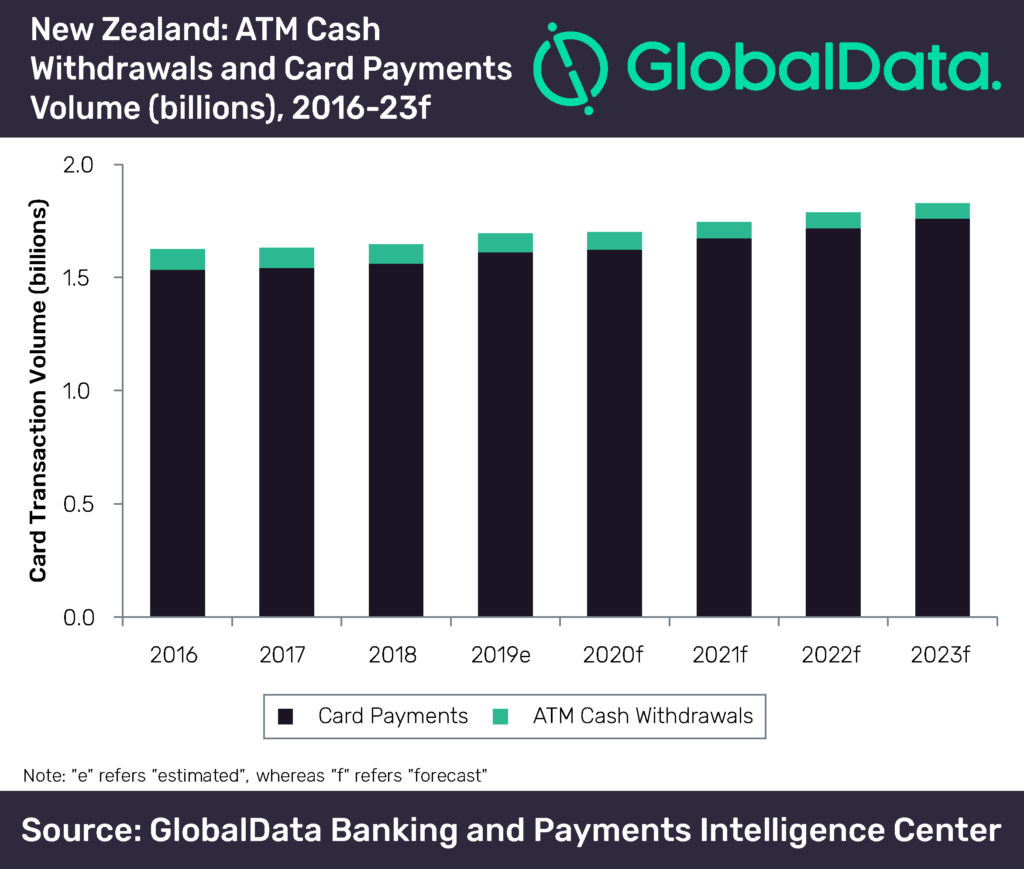

Cash payments in New Zealand are set to face the decrease over the next four years as COVID-19 pandemic causes growing concerns, according to GlobalData.

The report found that the number of ATM cash withdrawals will decline by a compound annual growth rate (CAGR) of -4.8% by 2023. At the same time, card payments at POS will rise at a CAGR of 2.2% during the same period.

According to the statement, consumers are shifting from in-store to online purchases in order to avoid exposing themselves to disease vectors such as cash and POS terminals.

Besides, they are choosing online purchases since local stores are running out of stock due to delayed shipments. This way, they can stockpile items and avoid busy public places at the same time.

We’ve reported that the cash share in the overall payment transaction volume in Japan is set to drop in 5 years, since banknotes can transfer coronavirus.

SEE ALSO: