Gold price has climbed over 50% year-to-date, surpassing $4,000 per ounce. Here’s why the precious metal reached its highest level ever and what investors should pay attention to.

Gold is on track for its strongest annual performance since 1979, with prices surpassing $4,000 per ounce and posting a more than 50% increase compared to the end of 2024. The last time the precious metal appreciated this rapidly was during the global oil crisis of the late 1970s.

This year’s surge has been fueled by a weaker U.S. dollar, renewed Federal Reserve interest rate cuts, and growing demand for safe-haven assets amid global economic uncertainty.

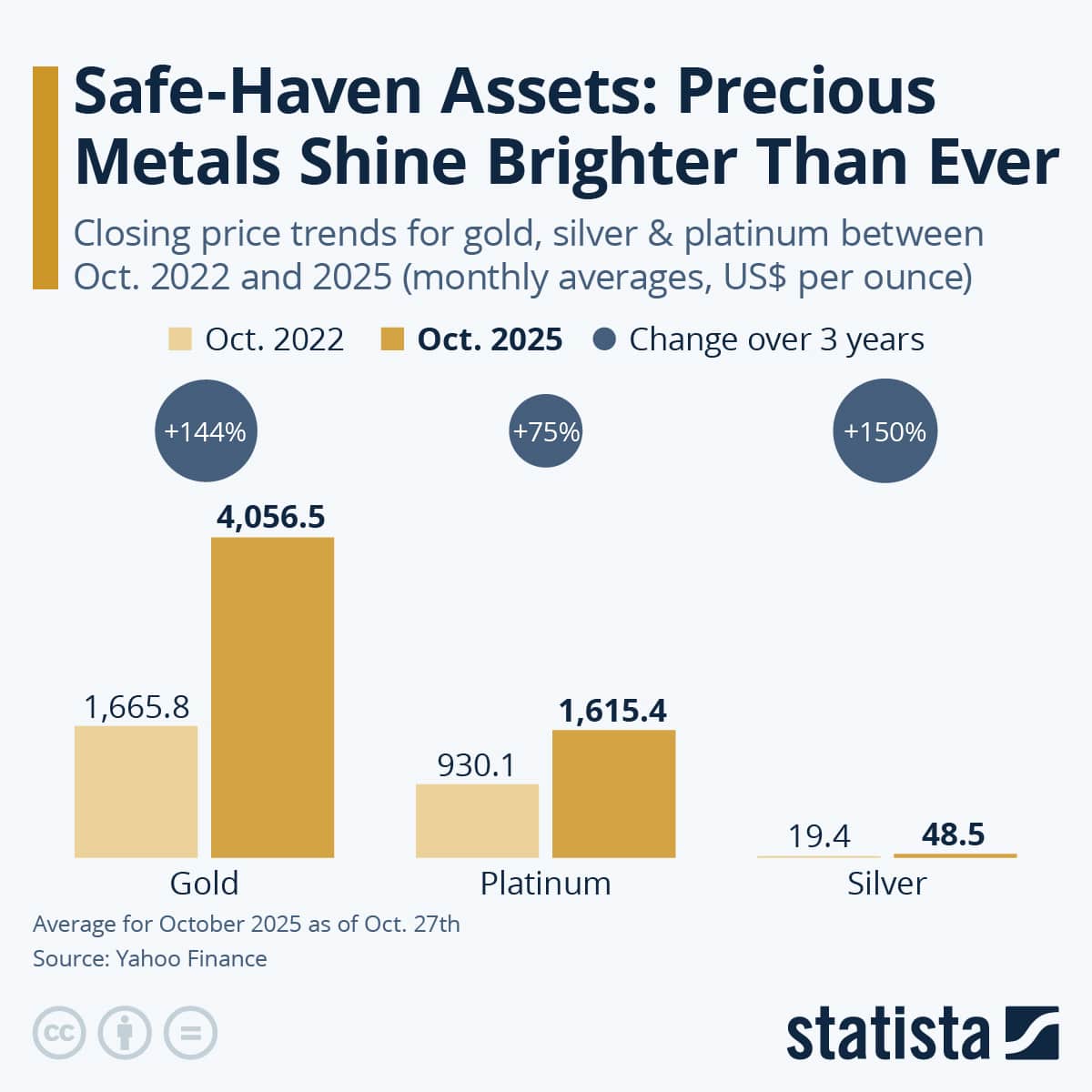

According to Statista data, gold has significantly outperformed other precious metals such as silver and platinum, cementing its status as the top-performing asset of 2025.

Image by: Statista

The world’s above-ground gold reserves are now estimated at around 212,000 metric tons, with jewelry accounting for about 46%, private investment for 22%, and central banks holding approximately 17%.

Here are some of the major central banks and institutions holding the most gold reserves globally:

-

Federal Reserve Bank of New York (United States): ~ 8,133 tonnes of gold, making it the largest single holder.

-

Deutsche Bundesbank (Germany): ~ 3,350 tonnes.

-

Banca d’Italia (Italy): ~ 2,452 tonnes.

-

Banque de France (France): ~ 2,437 tonnes.

-

Central Bank of Russia (Russia): ~ 2,330 tonnes.

-

People’s Bank of China (China): ~ 2,264 tonnes.

Analysts say the rally underscores gold’s enduring appeal as both a store of value and a hedge against financial instability. Gold’s accelerated demand reflects both structural and cyclical factors. Large-scale buying by central banks and steady inflows into gold ETFs are creating sustained, institutional-level demand, while renewed retail interest translates those flows into immediate market pressure.

Expectations of U.S. rate cuts and a softer dollar have lowered the opportunity cost of holding non-yielding gold, enhancing its appeal as a store of value. At the same time, geopolitical tensions and economic uncertainty are reinforcing safe-haven buying. Supply dynamics amplify these effects: with gold reserves largely tied up in jewelry and long-term holdings, available supply for immediate delivery is limited, so price adjustments can be sharp when demand rises.

Considering the ongoing rally, investors should definitely keep gold as a portfolio diversifier. While conservative investors may aim for a small, steady gold sleeve (roughly 3–7% of portfolio) to add diversification without changing their risk profile, aggressive and macro-hedge investors would probably consider a larger allocation (around 10–15%) as they want a material hedge against currency and debt stress.

Given the crisis-induced nature of the 2025 gold rally and any potential for sharp corrections brought by the limited available supply, spreading purchases over weeks/months reduces timing risk. Thus, financial commentators and portfolio managers recommend having a gold purchase plan rather than “buy everything now.”

To invest in gold, individuals and businesses must also select the right vehicle according to their goals and risk tolerance:

- Physical gold (bars, jewellery, and coins) is good for long-term, outside-system hedging, but incurs additional storage, insurance, and liquidity costs.

- Physically backed ETFs are convenient, liquid, and low-friction, and thus are suitable for most investors.

- Futures or levered products, along with gold miners and equities, offer leverage to gold moves but bring extra volatility and counterparty operational risk, so you should use them only if you understand those associated risks.

- Digital gold is a newer, tech-driven option that lets investors buy fractional amounts of gold online, stored securely by a provider and often verified on blockchain systems. It offers easy accessibility and transparency but depends on the platform’s credibility and regulation.