Experts suggest top critical factors that may force loyal customers to leave their initial banking provider

Biggest threats to banking in 2019. Source: shutterstock.com

Traditional banking undergoes significant changes as it strives to compete with the fintech giants. Consumers these days are inclined to look for optimal solutions. More and more customers consider alternative banking options with more technologies involved. In times like this, noncompliance with clients’ expectations threatens banks with major revenue loss.

Tolerance is good for interpersonal relationships, but in the business world, it is not widely practiced by clients. They are not eager to tolerate a bank’s imperfections while there are tempting personalized alternatives. Experts suggest top critical factors that may force loyal customers to leave their initial banking provider:

- Unethical or illegal activities.

- Nickel and dime fees.

- Uncompetitive prices.

- Data breaches.

- Overdraft charges.

- Poor digital and customer experiences.

Customers are now more change-eager than ever before. Source: shutterstock.com

Overall tendencies show that bank customers are now more change-eager than ever before. Vast financial opportunities, increased transaction mobility, fierce competition, and comparative tools tempt people to try out new financial possibilities. Making informed weighed choices is easier today due to global information access. People can share their feedback about an institution’s service and influence both loyal and prospective bank customers.

Being unethical dooms any banking business. Some examples of unethical conduct are: dishonesty or concealment of facts by the management; exposure of fraud and embezzlement; fees charged without prior notice; discrimination. For instance, news of fraud and questionable activities significantly lowered Wells Fargo’s popularity. Public trust is the main asset of any organization. A spotless reputation and integrity are among the most valued qualities of a banking institution.

Public trust is the main asset of any organization. Source: shutterstock.com

Constantly charging their clients with nickel and dime fees or overdraft fees is frankly annoying. Customers prefer all their complementary expenses to be listed at once. They get especially annoyed when they choose a banking provider because of cheapness only to further discover surprising hidden fees which level this institution’s rates on a par with others. Thus, Bank of America received a lot of complaints last year for such charges. Considering the competition, numerous complaints are a serious alert to change their policies. Not to mention that even the most reliable and long-operating banks may lose their clientele due to overpricing. No matter how long the client has stayed with a bank, wise money management will force them to look for better interest rates elsewhere.

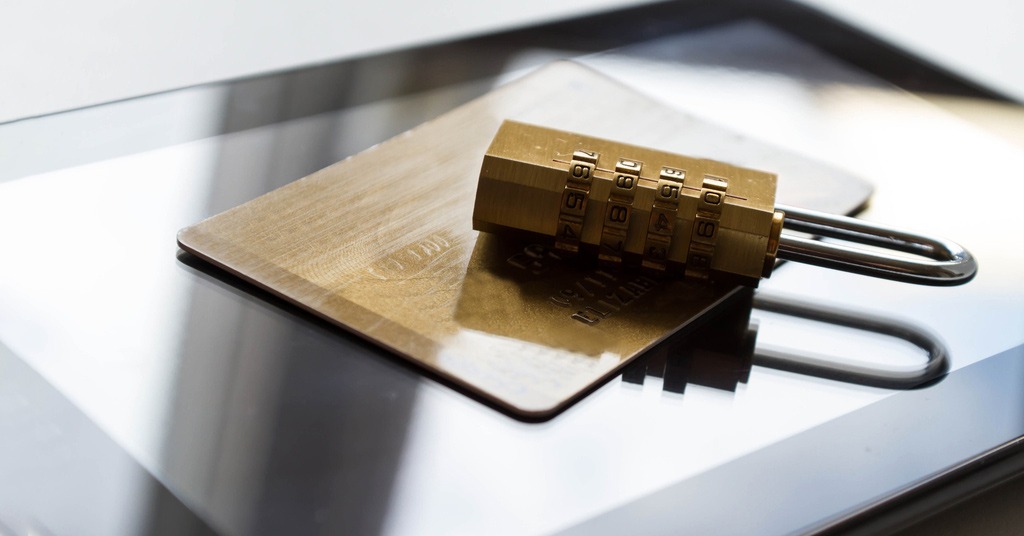

Digital security and privacy are very important for average users. Source: shutterstock.com

Data breaches are modern curses of the ledger system. While money is usually securely stored in a bank, not all institutions pay similar attention to their data storage. Yet digital security and privacy are very important for average users, not to mention the upper social classes or public figures.

Finally, revenues and fees are not the only crucial aspects of today’s financial market. Customer-centered economies pay increasing attention to service quality, innovation, mobility, and convenience of banking technologies.

Traditional banks may consider modern consumers hard-to-please, but they should surely transform along with the competing fintech ecosystems to preserve client loyalty.

SEE ALSO: Top 10 banking industry trends for 2019