Chime has been successfully operating in the US since 2013

Chime mobile bank review: features, capabilities, initiatives. Source: facebook.com

Chime is on a list of those financial institutions which has experienced record growth of users amid the COVID-19 pandemic. Not only has this mobile bank enabled smooth contactless transactions that are crucial today, but also it has reportedly given over 230 thousand people early access to their stimulus checks that amount to $1B.

SEE ALSO: Stimulus checks 2020 in detail: how to receive & track it

In fact, eligible neo-bank customers who have received a minimum of $250 in payroll payments over the past 34 days could have received a cash advance of $200 through the SpotMe feature of their accounts while waiting for their stimulus checks. Ten thousand lucky users have been chosen randomly.

Nevertheless, the bank has received controversial feedback from its customers. Its love-hate relationship with account holders may be partially influenced by repeated service outages taking place last year. Other issues members mention are customer support communication policies and some security issues. Still, the majority (91%) of reviews on TrustPilot are positive, ranking the bank 4.5 out of 5 stars.

About the Chime bank

Chime has been successfully operating in the US since 2013. Throughout these 6 years, it has grown to the most valuable US digital bank and a fintech unicorn. This San Francisco-based startup was founded by Chris Britt and Ryan King.

Britt, a former senior product leader at Visa and one of the first executives at Comscore, the media analytics company, used his valuable expertise to create a new financial product people would love. Prior to Chime, King was the VP of Engineering at Plaxo, a social networking pioneer. Ryan earned his M.S. in Computer Science from Stanford University and a B.S. in Computer Science from UCLA. Hence, he’s the man behind the “tech” part of this project.

The neo-bank is digital-only and its services are free of charge. At the same time, its revenues are expected to have reached nearly $200 million in 2019. The system of Chime’s earnings is not new – the revenues come from Visa whose flagship debit card the bank has chosen for offline transactions.

Whenever the card is utilised, Visa collects an interchange fee from the merchant for processing the payment. Chime then gets a small portion of those fees.

According to Business Insider Intelligence, Chime boasted 5 million accounts held by around 3.3 million customers in 2019, while being the second most popular digital-only bank in the US behind Ally Bank. Due to the coronavirus outbreak, its popularity rose. The user number passed seven million accounts in January 2020 and kept growing enormously ever since.

As of 2019, Chime had raised approximately $300 million of investment, valuing the business at $1.5B – the highest valuation among other U.S. challenger banks. Currently, its funding rose to $805 million with the latest valuation $5.8B according to Forbes.

Products and features

About the Chime bank. Source: facebook.com

Spending Account with a personalized Chime Visa Debit Card.

- The typical Chime account can receive direct deposits. It supports pre-authorized withdrawals as well as interbank transfers through the Automated Clearing House (ACH) Network.

- Chime accounts are FDIC-insured up to the standard maximum deposit insurance amount of $250,000 through the partner banks, Stride Bank, N.A. or The Bancorp Bank.

- Opening an account doesn’t involve a credit report using ChexSystems. It gives everyone a second chance at banking services.

- You can also pay bills electronically with Chime Direct Debit (ACH Debit).

- Linking an external bank account you own to your Chime Spending Account is possible using the Chime app. Transfers from the external account should not exceed $200.00 per day and $1,000.00 per month.

- If you wish to deposit cash to your Chime Spending Account, you can do it at 90,000 Green Dot retail locations with a limitation of $1,000.00 per 24 hours or $10,000.00 per month.

- Chime also offers Mobile Check Deposit for some eligible members enrolled in direct deposit with their Chime Spending Accounts. This feature may require an additional ID verification.

- Visa Debit Cards come with the EMV chip that improves payment security.

Savings Account

- When you open your Chime Spending Account, you have an option to open your Savings Account too.

- The current Annual Percentage Yield (APY) for the Chime Savings Account is 0.06% which is not very competitive. The bid changes quite often, which makes savings with Chime unstable. The new 1.6% interest rate announced after the latest funding round had a sharp fall this year.

By comparison, Chime’s main online rival – Ally Bank – had an average APY of 1.9% in 2019. At the same time, traditional banks like Chase, Wells Fargo or Bank of America kept their annual rates under 0.04%. - You can deposit money directly from your Spending Account, or send 10% of every direct deposit of $500 or more with the Save When I Get Paid function.

- Automatic Savings program is another feature helping you to save some money without overthinking it. The round-up from every purchase that involves a connected Chime Visa Debit Card automatically goes from your Spending Account to your Savings Account.

Chime Checkbook

Some bills like rent, credit cards, student loans, and other payments sometimes require you to pay with a check. Free Chime Checkbook option allows you to mail your check (or checks) within the 50 United States, including DC. The maximum amount that you can send per check is $5,000. Payment requests submitted through Chime Checkbook are processed by the next business day. Your payment typically takes 3-9 business days to arrive.

Early Payrolls

- You can get paid up to 2 days earlier compared to traditional bank operations.

- If the payer supports this option, your funds will be transferred immediately.

Fee-free overdraft SpotMe

You have the option to leave Chime an optional tip to pay forward. Source: facebook.com

- This is a limited offer to those customers whose monthly direct deposits total at least $500. Your SpotMe credit limit starts at $20 and can be increased to around $100 based on your banking activity.

- The overdraft amount is automatically withdrawn from the next deposit.

- You have the option to leave Chime an optional tip to pay forward, but no compulsory fee will occur on your payment list.

- SpotMe only covers debit card purchases. SpotMe does not cover ATM withdrawals, Pay Friends transfers, ACH transfers (including direct debits and services like Venmo or Square Cash), or Chime Checkbook transactions.

Free cash withdrawals

- Chime offers free cash withdrawals of up to $500 per day at over 38,000 ATMs nationwide through its partners, MoneyPass and Visa Plus Alliance (VPA) networks.

- Moreover, if you are using app version 3.4 or later, the ATM Finder identifies an additional 38,000 cashback locations at major merchants across the US, such as Walmart, CVS, Bed Bath and Beyond, Target, and major grocery chains like Whole Foods, Trader Joe’s, and Safeway.

- The maximum cashback amount allowed by the merchant varies by merchant. Generally, grocery stores allow for up to $100 cashback whereas drug stores like Walgreens and CVS allow for $40 cashback.

- You can also request a cash withdrawal at any bank or credit union office. However, there is a $2.50 fee every time you withdraw cash this way with a limit of up to $500.00 per day.

P2P Payments

- P2P payments are made easy with “Pay Friends”.

- You can transfer up to $2.000 per calendar month to any of your contacts that are also Chime members. If a person isn’t on your contact list, you can use their mobile number, email, and Chime nickname for this transaction.

- When you use Pay Friends to send money to somebody who is not a Chime member, they will receive a text or an email notification. It asks them to open a Chime Spending Account to claim the money transfer. It can be done within 14 days or else the money rebounds.

Chime Mobile App

- The app works on both iPhone and Android devices.

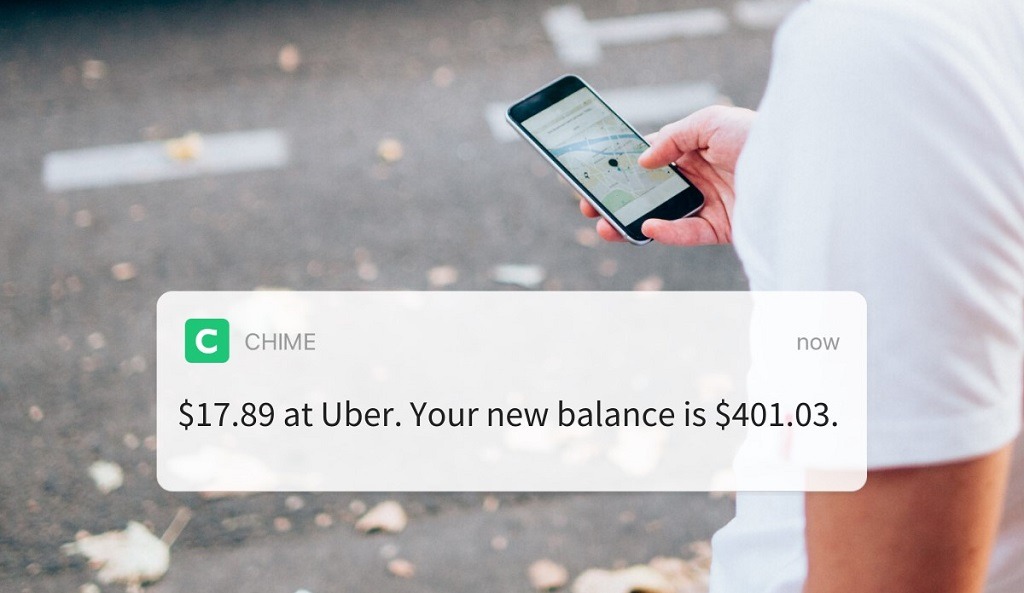

- Daily balance notifications and instant transaction alerts give users more control over their finances.

- You can access the Help Center in one tap from the Home Screen in iOS 10.

- Many customers like the Chime notifications enlivened with emojis. You can also enable Chime stickers within the “iMessages” in the App Store.

- Disabling the card or switching off cross-border transactions is one tap away.

- The app camera can take a picture of the check tand use it as a Mobile Deposit.

- Chime supports mobile payment apps including Apple Pay, Google Pay, and Samsung Pay.

#ChimeIn Initiatives

#ChimeIn Initiatives. Source: facebook.com

The bank is popular not only due to its products, but also because of its initiatives to support local communities.

Giveaway Sweepstakes

Trying to help Americans in these dire times of the lockdown uncertainty, Chime has announced an unprecedented Sweepstakes money giveaway.

During April 20 – May 12 participants had to follow Chime on Twitter or Instagram and share their post with a relevant comment. Every week, 1250 random winners would get $200. It makes the total prize fund equal to $1 million.

To claim a prize, the winner must have opened a Chime Spending Account.

Charity

The bank motivates its users to make a change with their contributions by covering charity topics in its blog and even offering some perks. For instance, they gave $5 back to those donating over $25 to DonorsChoose.org and provided benefactors with more spending power when they donated to UNICEF in 2015.

SEE ALSO: