Starling, the winner of 2019 British Bank Awards offers a competitive business solution to all UK residents

Digital business banking explained: Starling. Source: facebook.com

Every business, whether big or small, needs a separate bank account. It’s essential for daily operations such as paying suppliers and logistics partners, accepting customer payments, taking out business loans, managing payroll, or paying taxes.

Choosing the best bank is not easy. Especially, since traditional institutions get serious competition from digital banks. The more services are available online, the more time and effort businesspeople can save.

Our series of articles will highlight alternative business accounts from the most popular digital banks to help you make your informed decision.

Today, we would like to tell you about Starling, the winner of 2019 British Bank Awards, which offers a competitive business solution to all UK residents.

Starling launched even multi-owner business accounts. Source: facebook.com

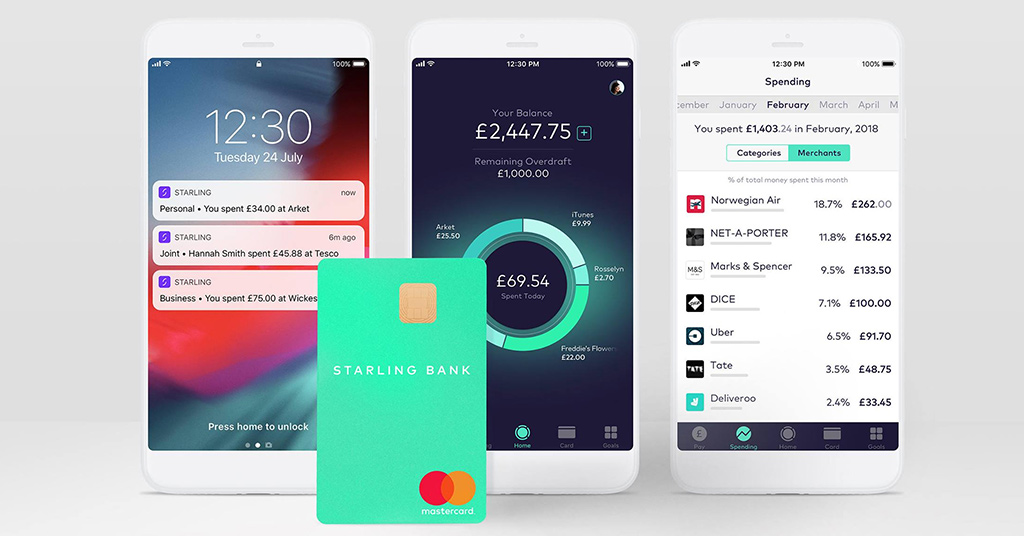

Starling business account features

- Spending Insights. The business expenses are categorized into transport, bills and services, catering, etc.

- Real-time notifications. The owners receive instant messages about every account transaction.

- CSV export. You can export your financial data in a .csv format. Comma-separated value text files are easily compatible with Microsoft Excel or accounting software like Xero and FreeAgent.

- Budget management. You can set financial goals and put money aside for reaching them, all within the app.

- Easy switch. High chances are you have both a personal and a business account with Starling bank. You can move between the two with a single tap.

- Overdraft. Some unexpected business circumstances may require a cash flow boost. Starling can provide it with some conditions. The service is still in its trial phase, so it works on an invite-only basis. If you haven’t received an invite, you may register your interest. The lending team will be in touch.

- Marketplace. The Starling Marketplace integrates a range of third party products and services in the app. The categories of partners include Savings & Investments, Mortgages, and Loyalty Schemes. Currently, the bank is only beginning to adapt its Marketplace for business customers. Accounting software solutions Xero and FreeAgent are already allowing to automatically sync transaction data. In the very near future, they plan to add a number of new partners dealing with insurance, lending, and compliance.

- Support. The customer service team is glad to help via in-app chat, telephone or email, 24/7. There are separate support divisions aimed at special cases such as debt and money troubles, dealing with major life events, etc. You can find more detailed information here.

- Multiple accounts. You can now open multiple business and Sole Trader accounts with Starling. Just tap ‘Get another Starling account’ from the Account Switcher menu on iOS or the Account Management section on Android, and enter your business details. You’ll also receive a new Starling for Business debit card for each new business account you open, printed with your business name.

Availability

Starling is available to all UK residents over 16. Source: facebook.com

Starling is available to all UK residents over 16; although you can remain a tax resident in another country and be of any nationality. You’ll need a valid government-issued photo ID document to open an account.

Opening a business account is possible if you’re the owner of a limited company – and you’re the only person with significant control over it. If you’re self-employed and already have a Starling personal account, you can open a sole trader account too.

Remember you’ll need to download Starling from the UK iOS App Store or Google Play Store. Please, bear in mind that the Starling app is designed for customers based in the UK with UK phone numbers. They don’t support non-EU phone numbers.

You can use your Starling debit card with Apple Pay, Google Pay, Samsung Pay, Fitbit Pay and Garmin Pay.

Fees

- There are no fees on electronic payments, domestic transfers, monthly account fees or ATM withdrawals if you have fewer than 10 employees and less than £1.7m in annual turnover. Business accounts are also free for larger businesses for a limited time.

- If you have an unpaid debt on your overdraft, you’ll pay 15% EAR, which accrues on a daily basis. The amount of interest is calculated on a monthly basis. You’ll receive information about the amount owing on the last day of the month and it is deducted from your Account on the 15th day of the following month. If your interest charges are less than 10p for any given month, Starling will waive the interest charge for that month.

- If you want to send money outside the UK, the bank will use the exchange rate, and charge the fees, shown on the International Payments page of the App before you make the payment. The fee is made up of the delivery fee that may vary depending on the method you choose plus 0.4% of the payment amount. Your receiver’s bank and other banks involved in processing the payment may charge additional fees for your payee to receive the payment.

- Depositing money into your account using the Post Office Counter Service: cost £3 when the sum is up to £1000. Deposits of £1000 and above incur the payment of 0.3% of the amount deposited.

- If you withdraw cash using the Post Office Counter Service, they will charge you £0.50 per withdrawal.

- Replacements of debit cards are free if your card is lost or stolen while you are in the UK. If you lose your card or it is stolen while you are overseas, Starling may charge you a fee of £60.

- If you need to get paper certificates relating to your Account, it costs £20.

There are no fees on electronic payments. Source: facebook.com

Application process

Applying for a business account usually takes about 10 minutes. You’ll need to:

- Download the app from Google Play Store or the App Store.

- Enter your personal details

- Verify your identity by sending a short video and a photo of your identification documents

- Provide a few details about your business, such as its day to day activities and online presence

- The bank makes some quick checks at the UK Credit Reference Agency and tries to approve your application asap.

To apply for an overdraft, you’ll need to have an active business account.

- Fill in the short form.

- Bear in mind that it will reflect on your credit score balance, so you need to give your consent for a credit check.

- The lending team may need some additional information from you, such as bank statements or serviced financial accounts. Be ready to provide them.

About the Bank

Starling Bank Ltd. is a member of the Financial Services Compensation Scheme and the Financial Ombudsman Service. That means all eligible deposits are protected by the FSCS up to £85,000 and the bank activities are regulated by the PRA and FCA.

SEE ALSO: