Government-backed RuPay ends Visa and Mastercard duopoly in India, says GlobalData

Visa and Mastercard duopoly comes to end in India. Source: shutterstock.com

Indian domestic card scheme RuPay registered exponential growth both in terms of cards in circulation and transaction value between 2015 and 2019, and in the process has ended the dominance of American payment giants Mastercard and Visa, according to GlobalData.

An analysis of GlobalData reveals that the number of RuPay debit cards more than doubled from 263 million in 2015 to 605.3 million in 2019. Launched by the National Payments Corporation of India (NPCI) in 2012, RuPay surpassed Visa and Mastercard combined in 2017, in terms of the number of debit cards in circulation.

The rapid upsurge in RuPay cards was primarily driven by the government’s financial inclusion program, Pradhan Mantri Jan-Dhan Yojana (PMJDY), launched in August 2014. As part of this program, low-cost bank accounts are offered along with RuPay debit cards.

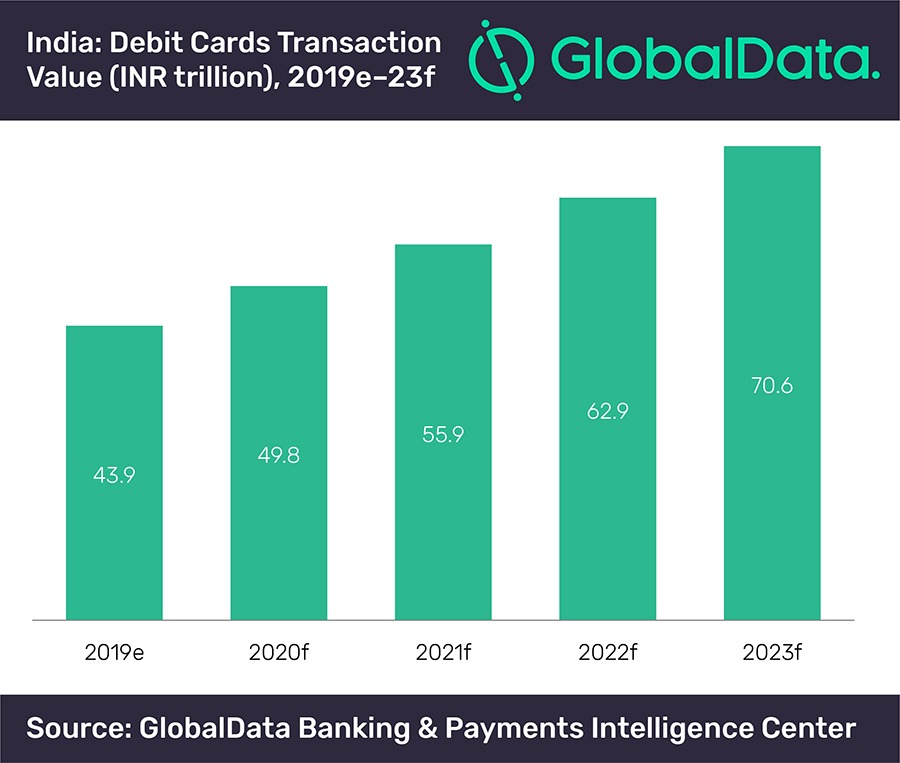

According to GlobalData, the total transaction value of debit cards in circulation in India is expected to increase from INR43.9 trillion in 2019 to INR70.6 trillion in 2023.

While RuPay leads the way in terms of debit cards in circulation, Visa and Mastercard remain dominant in terms of number and value of transactions. However, RuPay is growing strongly here as well. In terms of transaction value, the share of RuPay cards in the overall debit card market grew at a compound annual growth rate of 59.3% from 6.1% in 2015 to 24% in 2019.

Having achieved success in the debit card market, RuPay entered the credit card space in June 2017. It now offers credit cards with partners such as HDFC Bank.

To take RuPay cards global, NPCI has partnered with US-based Discover Financial Services and Japan-based JCB. In August 2019, RuPay was launched in the UAE and Bhutan, and the scheme has signed a memorandum of understanding in Bahrain. The card was previously launched in Singapore in May 2018.

SEE ALSO: Cashless economy: pros & cons