Ray Slater Berry

Ray Slater Berry

Content lead

“Paper money is going away,” claims Elon Musk.

He isn’t just saying this, though. His company Tesla invested $1.5 billion in bitcoin in February this year. He even announced that Tesla will accept bitcoin as a payment method across the US.

The world knows it’s onto something with blockchain technology. It’s the volatility that scares the bejesus out of everybody.

The fear is justified. Looking at bitcoin’s price movement over the past 12 months will show why. However, if someone had invested in bitcoin 10 years ago, they’d have earned a 5-digit return; maybe more.

What investors need to look for is the next champion in the crypto-verse. For now, if there’s one currency that’s showing signs of massive growth, it’s LINK.

5 reasons why you should buy LINK now. Source: chain.link

5 Reasons why LINK could be the next big thing

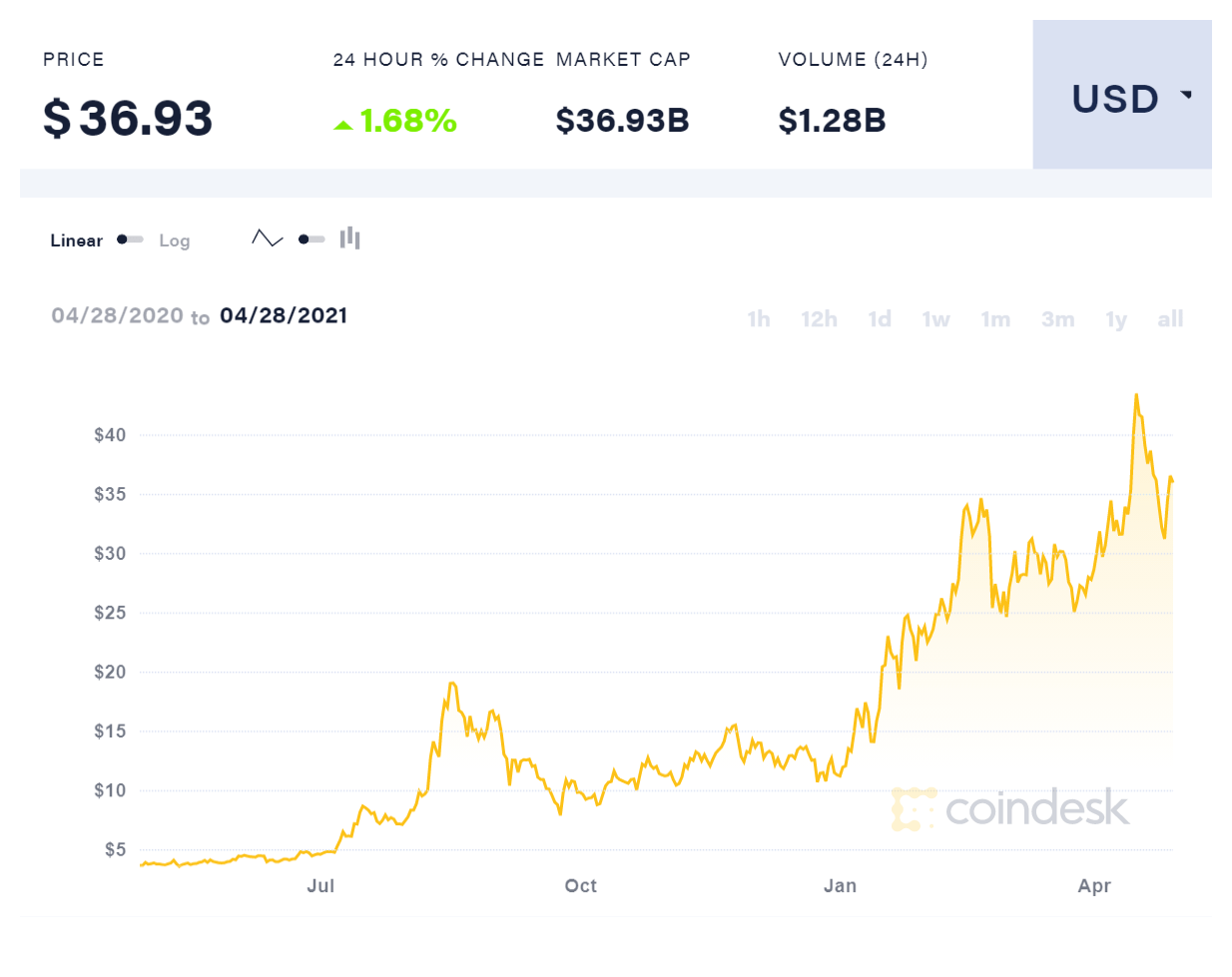

LINK has delivered over 300% return since the beginning of 2021 and quotes at $36.36 as of this writing. Here’s how the price moved over the last 12 months:

Impressive, right?

While these returns could wipe out if things start to go south, LINK is a fundamentally compelling cryptocurrency that simply shouldn’t be ignored.

LINK could easily outshine other coins given its strong fundamentals in the long term. Let’s talk about a few reasons why LINK could be the next big thing.

1. Chainlink’s strong network

LINK has turned heads all over, and even large corporations are paying attention. This is inducing confidence among investors regarding LINK’s prospects, which could quite possibly be the future of smart contracts.

When the likes of Google and SWIFT partner with a company, you know it has something of value. A 2019 Google blog post revealed that the company intends to build hybrid blockchain applications with Google Cloud and ETH, and has therefore acquired LINK’s oracle services.

Google is not the only large corporation LINK has managed to impress.

SWIFT, the world’s largest electronic payment messaging system, is another entity associated with LINK. LINK’s founder Sergey Nazarov’s company SmartContracts had been partnering with SWIFT for the supply of enterprise oracle solutions long before LINK even existed.

LINK is also the beneficiary of some of the most robust partnerships in the blockchain space. Some of LINK’s most established partners include Accord, Polkadot, Morpheus, and OpenLaw. Its business associations enable LINK to position itself as a leader in oracle services and off-chain computation.

The token holds massive appeal for both legacy enterprises and the blockchain universe. Investors that buy LINK now will likely benefit as its value appreciates over the next few years.

2. Chainlink integrates with legacy systems

The latter part of the 21st century belongs to smart contracts. They bring efficiency and confidence to transactions that benefit all involved parties. The lack of a bridge between legacy systems and applications facilitating smart contracts is currently a hindrance to widespread acceptance of smart contracts.

Smart contracts will become a universally accepted tool only when this gap between legacy systems and blockchain disappears.

Why? One might wonder. The gap renders smart contracts incapable of accessing information that resides in our current systems, consequently eliminating their ability to trigger execution.

For instance, assume that a smart contract has been initiated and the execution is set up to trigger based on the result of a cricket match. If team A wins, the party to the contract who bet on team A winning automatically receives the funds.

Neither party to the contract is required to take any action to execute the contract.

Blockchain has access to an extremely small portion of data. To enable generalized use of smart contracts, something must be done to facilitate the exchange of information between the legacy systems and the distributed ledger technology (DLT).

Guess what could bridge this gap? LINK.

LINK is, you guessed it—the link we need, between these systems. LINK accomplishes this through APIs and hopes to leverage the data stored in our legacy systems, thereby introducing businesses to a world of possibilities.

Both legacy enterprise systems and blockchain can co-exist and thrive with LINK connecting them.

All major tokens in the crypto-verse aim to supplant the legacy systems. Realistically, the legacy systems have immense inertia and will likely stick around for at least a few more decades.

LINK seems to have realized this and is therefore putting efforts towards integrating blockchain with legacy systems rather than trying to replace it.

3. LINK’s positive correlation with BTC

We’ve been discussing fundamentals that strengthen LINK’s position in the crypto-verse. However, there’s one thing about LINK that will intrigue almost all crypto investors—its correlation with bitcoin.

Friends and colleagues might suggest that BTC is perhaps the only token that deserves a sincere investor’s attention. Investing in others may be touted as gambling. While this may have been true a decade ago, the world has moved on. If you’re a BTC fan, you should buy LINK now; let’s talk about why.

The quarterly averaged prices for LINK and BTC show a positive correlation, with a correlation coefficient (r) of 0.83. For investors that slept through their Statistics classes—an r of 0.83 tells us that the quarterly averaged prices of LINK and BTC moved in the same direction 83% of the time.

Source: unsplash.com

Short-term investors and traders, though, will need to practice more caution. The correlation coefficient for daily prices of LINK and BTC falls to 0.662. This makes mathematical sense. Cryptocurrencies are excruciatingly volatile assets, so a drop in correlation over shorter time frames is natural.

Long-term investors, nevertheless, will find LINK and BTC’s long-term correlation of 83% more appropriate for their analysis. Effectively, long-term investors wouldn’t be better off (or worse off) by a broad margin than had they invested in BTC.

Investors need to understand what these correlation numbers convey. A strong correlation doesn’t indicate the LINK will always follow BTC’s price movement. However, it may (or may not) do so 83% of the time.

4. LINK is leading the DeFi disruption

DeFi, or decentralized finance, is a wave waiting to sweep the financial service industry off its feet. LINK is leading this disruption wave, says ADVFN, following a close second after UNI.

DeFi will empower users by facilitating the creation and use of financial tools, applications, and services, and change our view of the financial services industry for good. DeFi will influence every single financial service we use including banking, insurance, loans, investing, among many others.

Chainlink has managed to differentiate itself from others in the DeFi space by streamlining the process of solving core issues that are impeding DeFi’s implementation.

Chainlink is taking remarkable steps and inviting valuable partnerships from large corporations to up its game as it works on building this new ecosystem.

Prominent organizations in the DeFi space like AVA, bZx, Synthetic, Kyber Network, Opium Network, and Graph Protocol have integrated Chainlink’s oracles.

Furthermore, Chainlink has also agreed to integrate its oracles into China’s national blockchain service network (BSN) as part of the country’s national blockchain project.

LINK ultimately aims to weave off-blockchain data into smart contracts and enable smooth information exchange between financial services and blockchains. While achieving this will take a fair amount of time, DeFi will eventually redefine the way the financial services industry operates.

Meanwhile, the LINK’s price will continue to factor in the value of its success in the DeFi space.

5. LINK’s innovative team

The DLT is in an early stage and will require at least 10 years to develop sufficiently. To leverage its full potential, a team requires a farsighted strategy that will help them tackle challenges the future holds.

LINK’s team has been working on a common blockchain issue by constantly focusing on developing off-chain computation proficiencies for smart contracts with groundbreaking methods known as Trusted Execution Environments (TEE).

Implementation of Trusted Execution Environments will enable Chainlink to improve privacy for legacy systems and smart contract platforms.

Privacy remains one of the most common concerns that deter businesses from using smart contracts, and LINK’s team is committed to resolving this issue.

Investors may find it reassuring that LINK’s team has been consistently engaged in the development of computational features and privacy solutions, and is collaboratively involved in research with Cornell’s IC3.

The team’s objective approach to recognizing issues regarding adoption, privacy, and scalability and their drive to devise innovative technological solutions will lead the way for LINK’s bright future.

Conclusion

Equities shined their way through the previous century as an asset class that delivered stellar returns. It’s still one of the best asset classes to invest in, but markets are now far more efficient than they used to be.

Cryptocurrencies are now the talk of the town. Granted, their volatility can be nightmarish, but they are capable of delivering massive returns provided the money is put into a fundamentally strong token.

Just as 10 years ago, this token would have been BTC, the spotlight is now on LINK. LINK has all the characteristics of being the next big thing.

While it’s unwise to allocate a giant portion of your portfolio to cryptocurrencies, investors should start to buy LINK and accumulate as and when they see the ticker turn red.

Ray Slater Berry is the content lead at Outreach Humans. He has been working in social media, content marketing, and SEO for nine years. He specializes in the tech, innovation, design, and product sectors. He is also a published psychological thriller author with his first novel, Golden Boy.

SEE ALSO: