Investors expect BTC to tumble to $10,000 rather than rally back to $30,000 – the crypto winter is worsening

Source: pexels.com

According to the latest MLIV Pulse survey, highlighted by Bloomberg, 60% of the 950 investors believe the cryptocurrency’s crash will get only steeper. Only 40% of the respondents think BTC may go the other way and regain the $30,000 price tag.

The Bitcoin price is $20,445.55, a change of -3.85% over the past 24 hours as of 10:19 a.m. Other major altcoins like ETH and BNB have also lost 3-4% of their value today.

The crypto industry is having tough times. Troubled lenders, collapsed currencies, and an end to pandemic stimulus cash that fueled a speculative frenzy in financial markets wiped away $2 trillion of the market value.

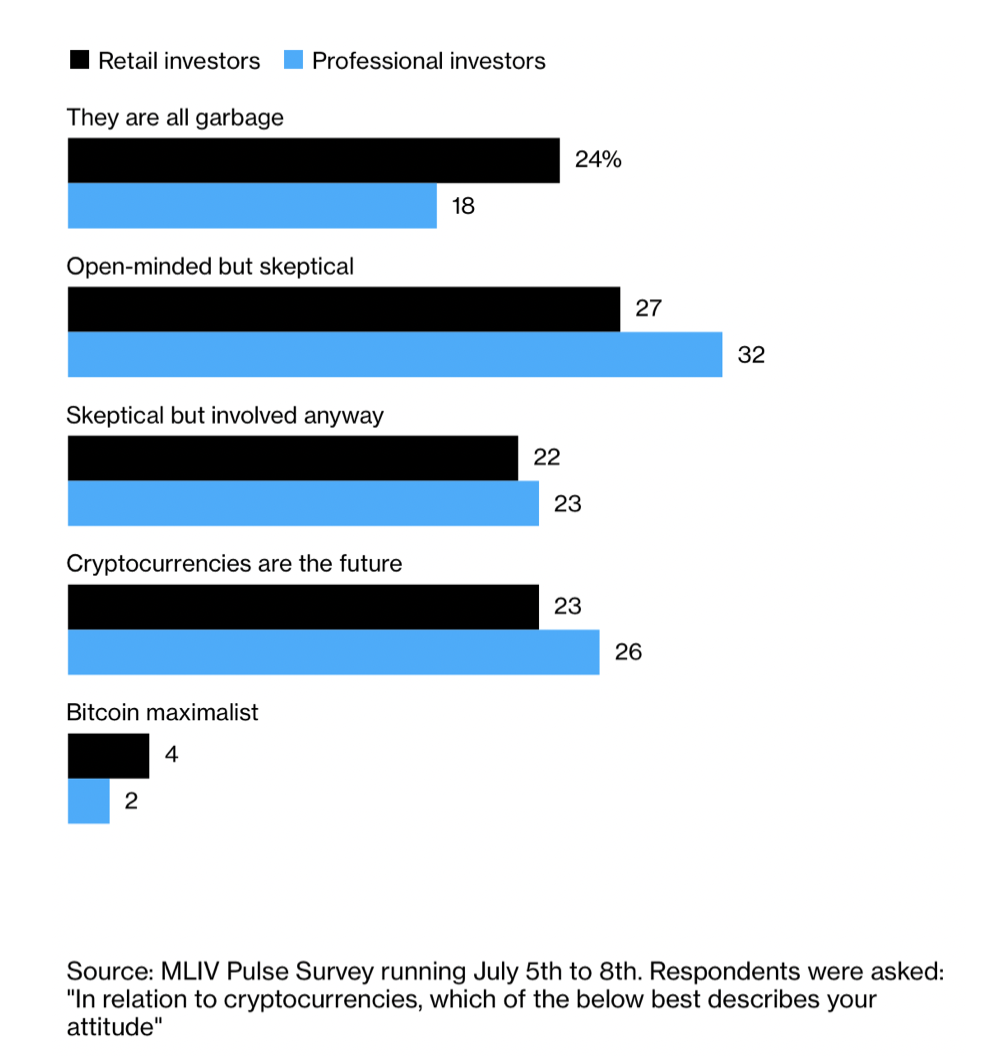

Although surveyed retail investors were more apprehensive about cryptocurrencies than the representatives of large institutions, even those open-minded remain sceptical about the industry’s future. Almost a quarter of all respondents believe the asset class to be “garbage”.

The crypto crash and public fears of market uncertainty are likely to pressure governments to introduce proper regulations to the industry. Most respondents also anticipate that central bank digital currencies will soon become the backbone of the crypto market. Nevertheless, the two dominant tokens, Bitcoin and Ether, will remain a driving force in the next five years.

Another broad consensus among surveyed investors is that NFTs are just art projects or status symbols, with only 9% seeing them as an investment opportunity.

SEE MORE:

Four things to consider before using a bitcoin or crypto debit card