![]()

Bader Al Hussain

PaySpace Magazine Analyst

Introduction

The year 2020 was one of the toughest periods for the global tourism, hospitality, and travel industry. As the cruise industry is intrinsically linked to the travel and tourism sector, this industry has also borne the brunt owing to lockdowns on the backdrop of the COVID-19 pandemic. However, as the vaccination process is being swiftly rolled out around the world in general and Europe and North America in particular, things have started to look sanguine for the industry.

Cruise industry forecast: what’s coming next? Source: pexels.com

Economics of cruise industry

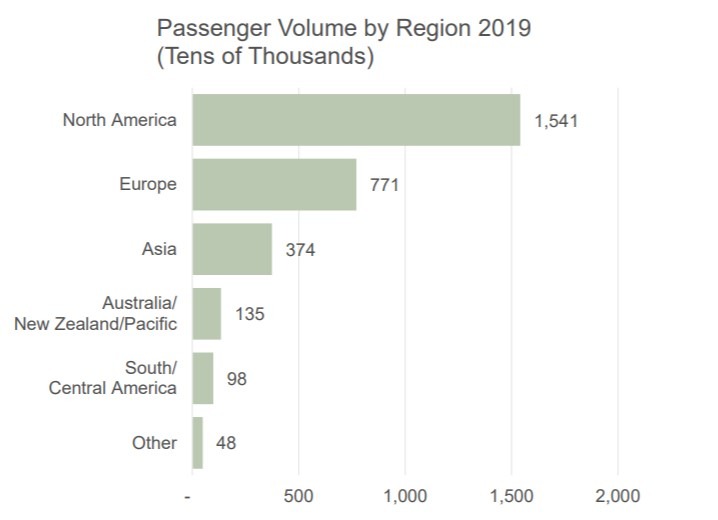

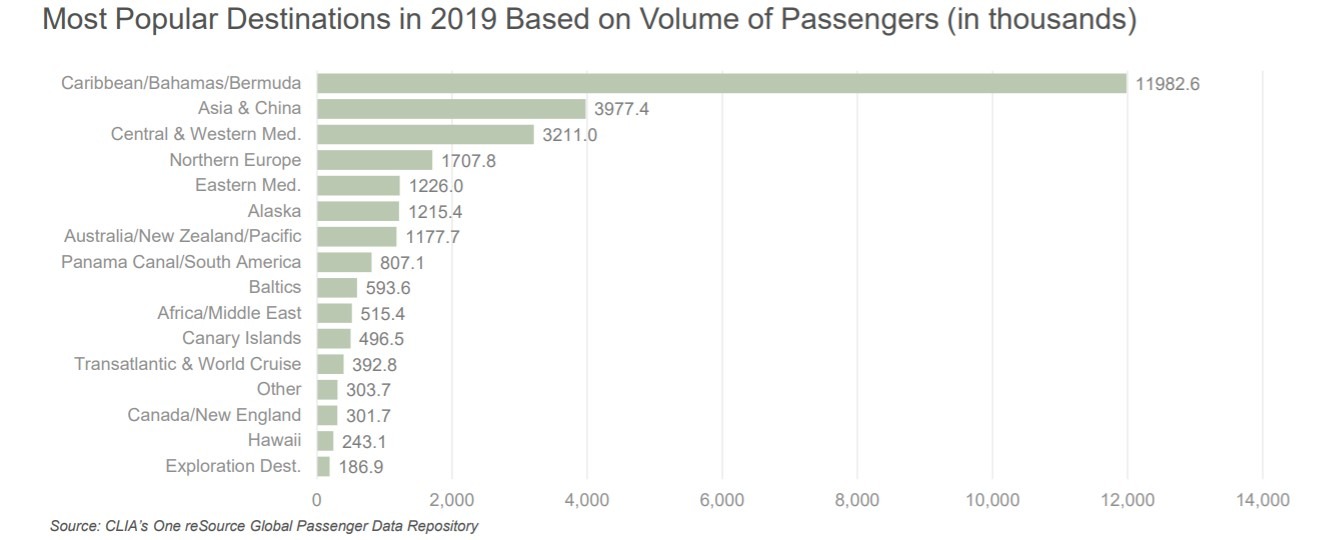

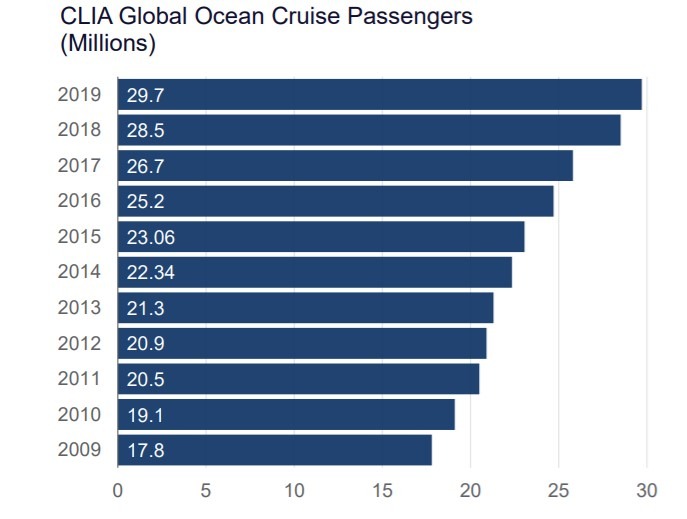

In order to put things in perspective, the cruise industry caters for 29.7 million passengers per annum and generates a total output of $154.5 billion globally in a year. Further, the industry employs approximately 1.17 million people, giving approximately $50.53 billion in salary and wages to these workers.

The average passenger spending at the port before boarding a cruise is $ 385, whereas an average passenger spending in the port while visiting during a cruise is $100. Additionally, to estimate the loss of jobs due to COVID-19, 30 cruisers create one job in this industry. Thus, a significant drop in the number of cruisers risked the employment of 518,000 jobs last year.

Global economy and the cruise industry

The cruise business is cyclical in nature. Thus, it has a high correlation with economic activity in the world. Especially the economic performance of the developed and industrialized countries as these countries provide a large chunk of tourists to popular destinations in the world. According to the IMF, the world’s economy is expected to expand by 6% in 2021 as compared to the negative 4.9% last year. Therefore, broadly speaking, cyclical industries are going to perform well on the back of upbeat demand.

Like any other tourism-linked sector, the advent of COVID-19 swept away many small cruise businesses around the globe, particularly small, and medium enterprises. Only those businesses that have the strong cash flow or liquid assets on their balance sheets. On the other hand, businesses that were debt-laden went bust and declared bankruptcy as they were unable to pay off their debts amidst dried-up revenue proceeds.

The spring season for the remaining businesses is on the verge of manifestation as adventurers are just waiting for laxity in COVID-related travel restrictions to taper away, so they can indulge in their pursuits.

As the table below illustrates, the United States is one of the largest sources of tourists in the world. The recent stimulus packages given by the subsequent administrations to tame the effects of lockdown in economic activity has made the country’s households cash-rich to a large extent. According to analysts, such economic developments are expected to boost the demand for tourism-related services in the world.

Measures taken for phased resumption

According to Cruise Lines International Association (CLIA), the cruise industry has taken multiple measures to re-open its operations after the advent of COVID-19. Strict protocols have been enforced with the support of local and regional authorities to mitigate the risk of COVID-19 among passengers, crew, and the destinations cruise ships visit, thus, resuming operations gradually all over the world. CLIA reports from early July 2020 to December 2020, there were more than 200 sailings.

Hence, the success of these above-mentioned sailing numbers demonstrates that the new protocols are working as expected. Therefore, the industry is now on the verge of resuming its operations in the United States, Canada, Mexico, the Caribbean, and elsewhere in 2021.

Better performance than pre-Covid times

As the economic effects of the pandemic subside, there will be a large degree of recoupment of lost revenues to the industry. However, as we have earlier alluded to. Some of the small players in this fragmented cruise industry have halted their operations due to financial distress. Hence, the players who have survived are expected to garner higher revenues largely due to recoupment and lower competition in the market. This means their operating earnings might even surpass that of pre-COVID levels in 2021.

As per CLIA-Qualtrics, in December 2020, 4,000 International vacationers each, eight countries, U.S, Canada, Australia, UK, Germany, France, Italy, and Spain were selected to perform the survey. The results are enumerated as follows:

- 74% of cruisers are willing to cruise in the next few years.

- 2 out of 3 cruisers are likely to cruise within a year.

- 58% of international vacationers who have never cruised are likely to cruise in the next few years.

The above survey indicates our point related to the recoupment of earnings for the cruise business.

Sustainability measures by the cruise industry in 2021 and beyond

The cruise industry is also committed to a cleaner and more sustainable future. Therefore, in this regard, the industry participants have taken the following steps:

- Invest approximately $23.5 billion in ships with new technologies and cleaner fuels to reduce carbon emissions.

- The industry aims to reduce carbon emissions by 40 percent in 2030 compared to 2008.

- The order book shows that by 2027, 24 ships have committed to being powered by liquified natural gas (LNG).

Furthermore, the cruise industry plans to fulfill the above-mentioned steps through the below-mentioned cutting-edge maritime environmental technologies.

- Liquified Natural Gas (LNG): Virtually zero sulfur emissions and up to a 20% reduction in greenhouse gas emissions. According to CLIA’s annual 2020 Environmental Technologies and Practices Report, 49% of the new capacity on order will rely on LNG for primary propulsion.

- Advanced Water Treatment Systems: Advanced waste treatment technologies that rival the best and most sophisticated shoreside treatment plants. 99% of new ships on order will have these systems in place, bringing global capacity served by these systems to 78.5%.

- Exhaust Gas Cleaning Systems (EGCS): Removes 98% of sulfur content from the exhaust and significantly reduces particulate matter.

- Shoreside Electricity: Enables cruise ships to “plug-in” and turn off their engines in the 14 ports worldwide where this capability is provided, and clean power is available.

Conclusion

The cruise industry is poised to register upbeat earnings on the back of a rebound in the global economic activity together with relaxed international travel restrictions. The current cash-rich balance sheets of households in developed countries is also expected to boost the demand for the tourism industry, indirectly benefiting the cruise industry also. To conclude, the cruise industry is not only also generating employment and economic dividends for the world community but also contributing to sustainable development to cater to the effects of climate change.

SEE ALSO: