The government strongly supports the increase of credit cards use

Here’s how Pakistan’s card payment market will grow in 2021. Source: pexels.com

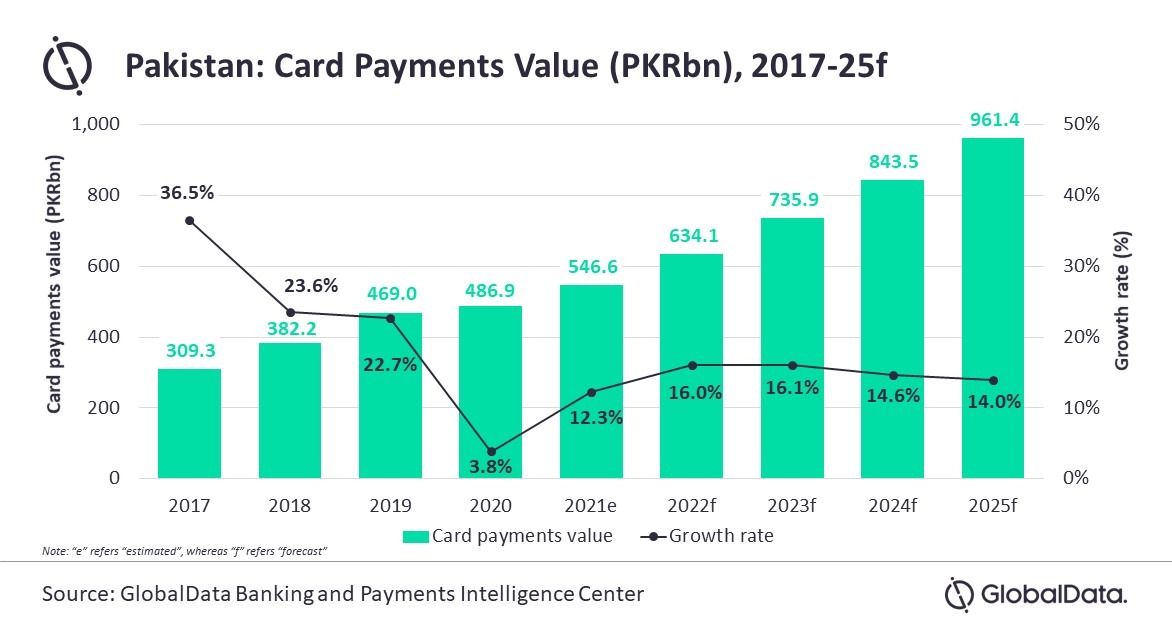

The card payment market in Pakistan will grow 12.3% in 2021 with the expected economic recovery following the COVID-19 pandemic, GlobalData predicts. Growth will be supported by government initiatives to expand access to financial services and gradually improve the payment infrastructure.

According to data, card payments in Pakistan grew by an average of 23.1% between 2017 and 2019. However, in 2020, there was a slower growth of 3.8% due to lower consumer spending amid the COVID-19 pandemic.

As the country is gradually recovering from the pandemic, consumer and commercial activity is gaining momentum. As a result, the value of card payments is estimated to grow by 12.3% in 2021 to PKR546.6 billion ($3.4 billion). The compound annual growth rate (CAGR) is projected to reach 15.2% and reach PKR 961.4 billion ($6.0 billion) in 2025.

We’ve reported that Ebanx unveiled its payments platform for LatAm companies.

SEE ALSO: