The country has over 60% of the unbanked population

Here’s when card payments in Philippines are set to rebound. Source: pexels.com

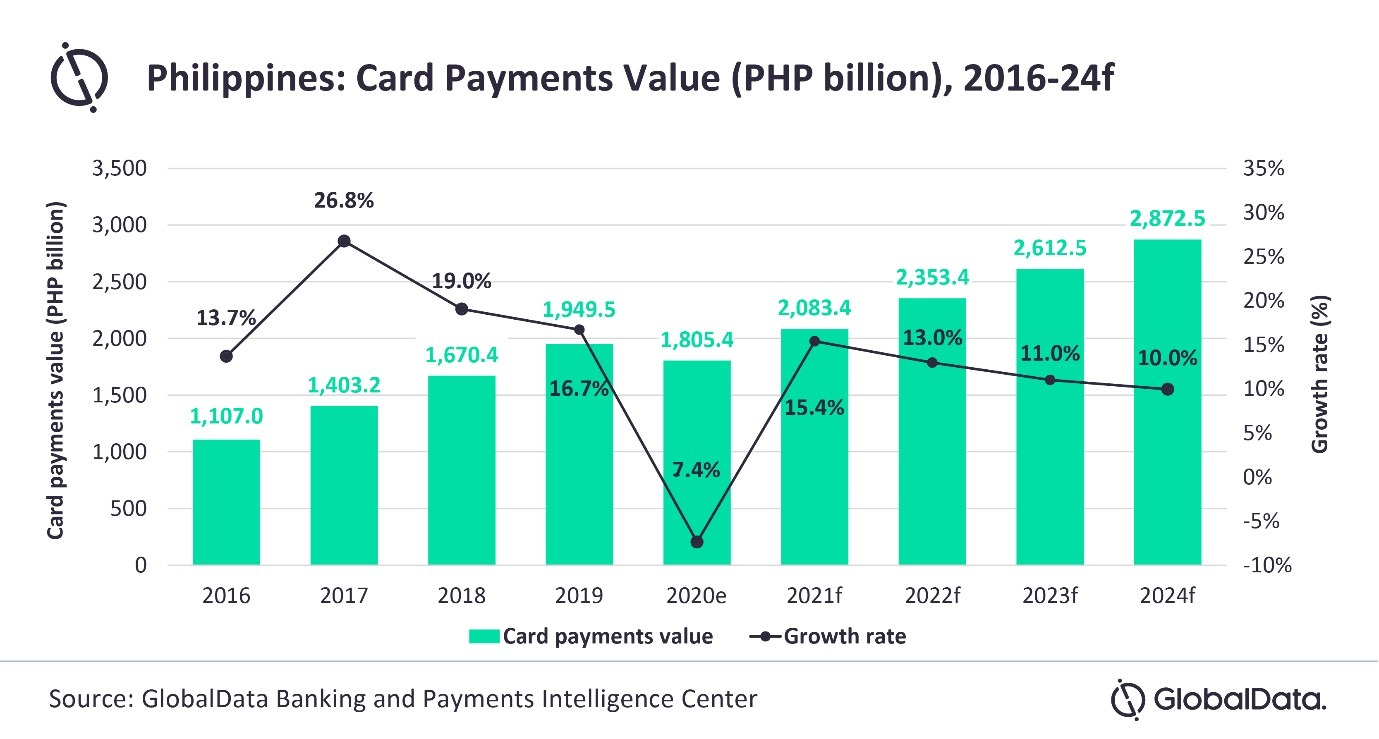

Card payments in the Philippines are expected to rebound strongly with 15.4% growth in 2021, with a slight recovery in consumer and commercial spending, according to GlobalData.

The report has found that the value of card payments in the Philippines is anticipated to register a compound annual growth rate of 12.3% and reach $56.5 billion in 2024.

The Philippines Statistics Authority has reported that the country’s GDP contracted by 9.5% in 2020. With the opening of businesses and easing of lockdown restrictions, the economy is expected to revive in 2021 with an expected GDP growth rate between 6.5%-7.5%.

Despite the fact that the Philippines is a cash-based economy, the government has been taking initiatives to grow card penetration and usage.

This way, in September 2020, it passed a regulation to cap credit card interest rate at 2% per month (or 24% annually), compared to the average annual rate of 42% previously. This move is expected to further push credit card usage.

We’ve reported that card payments in the Asia-Pacific region set to rebound strongly this year.

SEE ALSO: