Electronic payments have been sustainably growing for the last few years in South Korea

Rise in spending will drive card payments across Korea: research. Source: unsplash.com

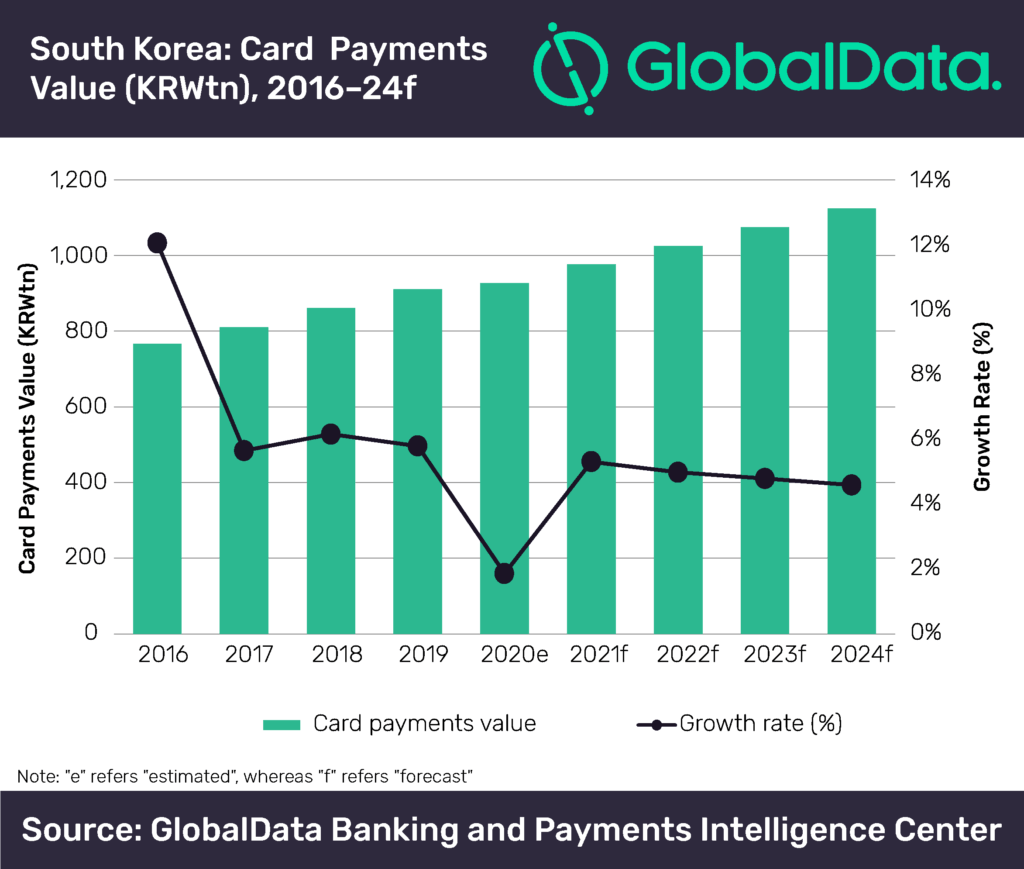

According to GlobalData, a rise in consumer and commercial spending is expected to further drive card payments in the country.

The data reveals that card payments value is forecasted to grow at a compound annual growth rate (CAGR) of 4.3% from $791 billion in 2019 to $976.8 billion in 2024. Meanwhile, ATM cash withdrawals are set to decline at a CAGR of -3% during the same period.

In order to boost consumer spending, the government provided emergency payout of up to $866.14 to South Korean households.

The amount is credited to households’ credit card accounts in the form of points. They can be used for payments at select merchants but not for personal savings.

We’ve reported that nearly half of Germans are currently using cards more often than cash. This shift is apparent in common for all age groups, but especially for middle-aged people.

SEE ALSO: