UK consumers express a lack of confidence in their personal finances

UK consumers expect their finances to get worse. Source: shutterstock.com

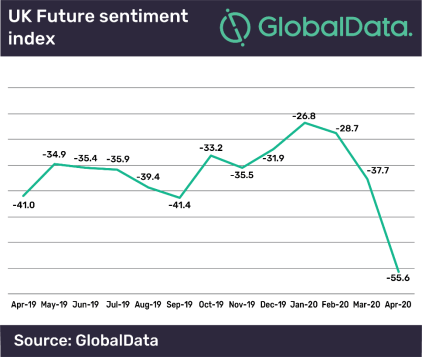

The UK future sentiment index dropped in April to the lowest level seen since tracking began in April 2012, according to GlobalData.

The reason for that is pessimistic feelings around the future of the country’s economy, bringing bad news for retailers that will be expecting a post-lockdown increased expenditure.

When consumers were asked to reveal their thoughts towards changes in the UK economy over the six months, 78.5% of them said they expected it to get worse.

The UK respondents highlighted that that the nation’s worries haven’t been eased despite measures announced by the UK government to support jobs and businesses.

The survey also found that 45.5% of respondents expect their finances to get worse since many workers being on furlough leave and fears around unemployment levels rising.

We’ve reported that since Americans started losing their workplaces, some of them no longer have health insurance as the two are often connected. The data found that unless US citizens have private health insurance, they will face upfront payments to obtain medical treatment.

SEE ALSO: