The rise in online spending has also benefitted other e-payments methods such as mobile wallets and contactless

Argentina starts embracing e-payments over cash. Source: pixabay.com

According to GlobalData, consumers in Argentina are now gradually embracing e-payments despite the fact that cash has been the most preferred payment method there.

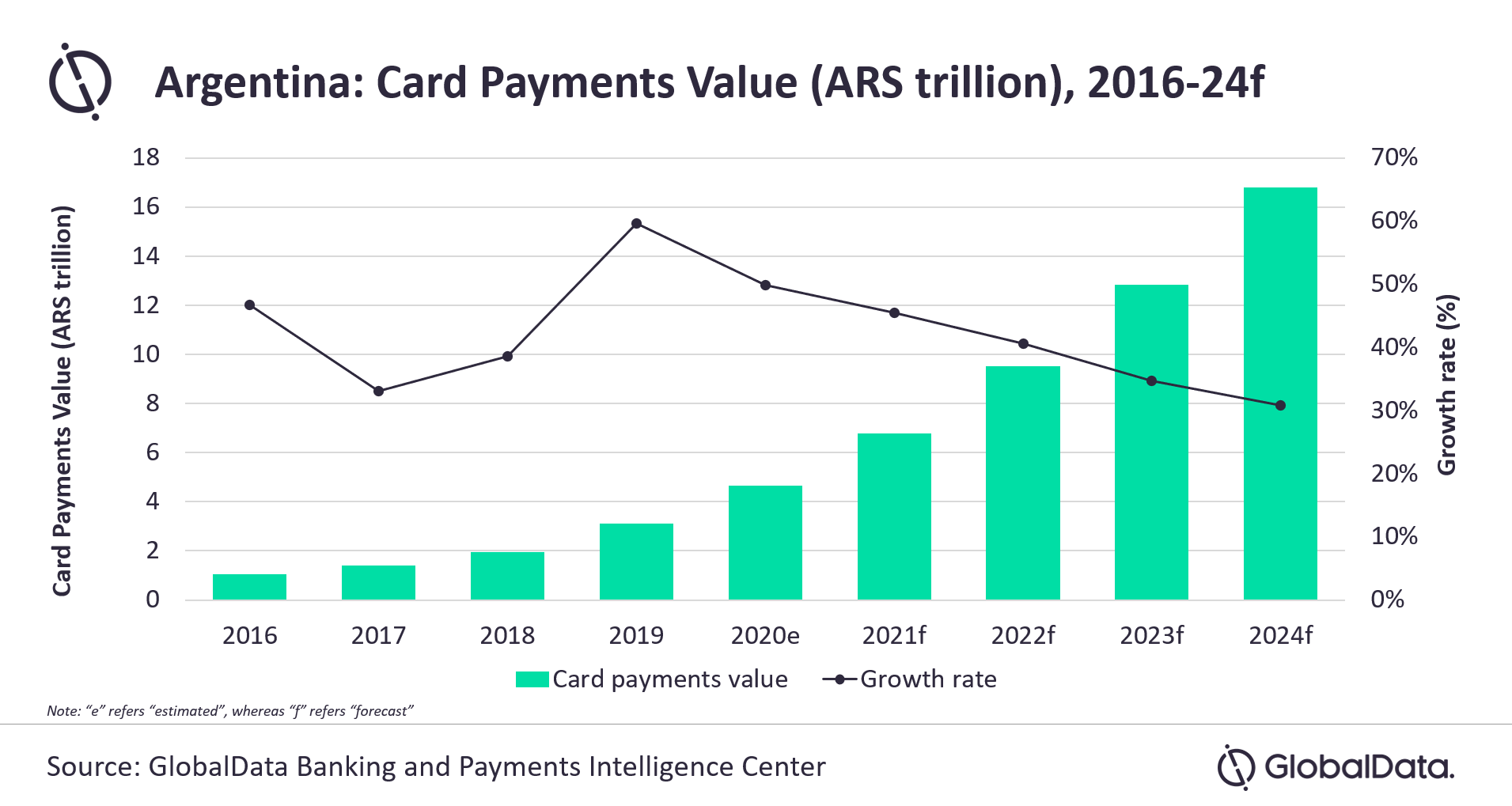

The report has found that the rise in e-commerce and contactless payments amid the COVID-19 pandemic will drive card payments, which are expected to grow to reach $199.8 billion by 2024.

While GlobalData expects Argentinians to begin splashing out with their cards in the future, this payment method is already seeing robust growth. There’s a 45.5% rise expected by the end of 2021, reaching $80.6 billion.

Sharma states that his near-term growth is supported by the government’s promotion of payroll cards and the lowering of both interchange fees and merchant service charges.

Meanwhile, sellers have been encouraged to install POS terminals in their stores. These changes will both give shops the means to offer digital payments and give customers a wider choice.

We’ve reported that BDO American Express virtual card introduced.

SEE ALSO: