What is Masterpass, and how to use the service?

A guide to MasterPass: how to use it. Source: flickr.com

MasterPass is a free digital wallet service protected by MasterCard. It allows clients to save their card in the system and use it wherever they see a MasterPass logo. It works for both paying online and money transfers.

In other words, MasterPass is a card data warehouse, which streamlines the online shopping process and makes it safer. There is no need to enter the card number and expiration date manually if you use the MasterPass system. Thus, if you have saved the card once, the system will remember all the required details.

MasterPass advantages

- After saving the card once, you can use it in various online stores and services, in fact, at any place with the MasterPass logo. The system offers you to select the card from the list (the one you are going to use). Thus, the system guarantees that it remembers you and your personal data, so there is no need for you to enter the card details (card number and expiration date) manually

- You can save MasterCard, Maestro, and Visa cards (up to five cards, registered to one phone number). MasterCard provides you with secure storage of your card data

- There are no fees. Therefore, you can use MasterPass totally free

- The system is compatible with any kind of mobile device and operating systems

Is it safe to use MasterPass?

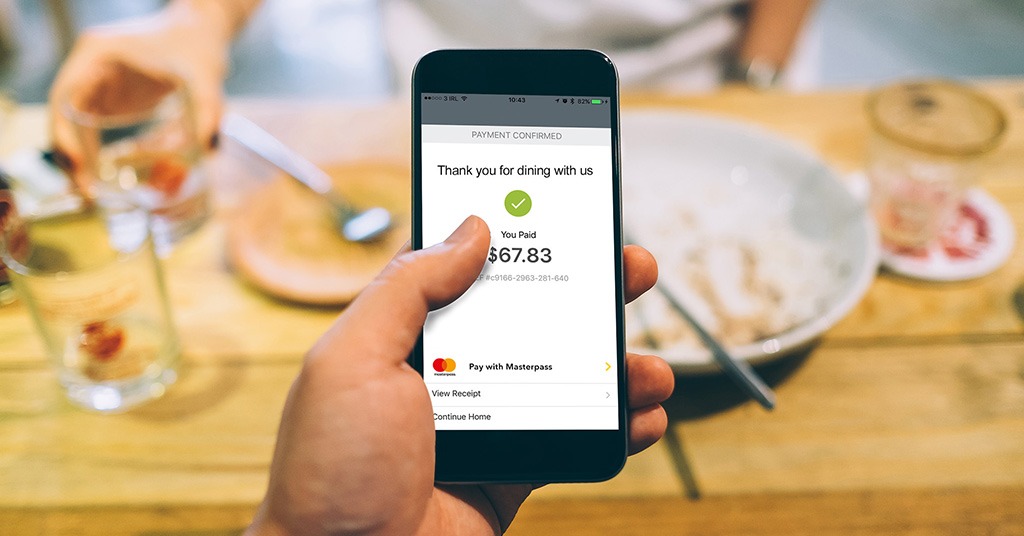

You can use MasterPass totally free. Source: unsplash.com

MasterPass is available in more than 100 countries nowadays. In Europe, more than 200M people use the system.

By registering your card details, you confirm your identity with the help of your phone. Otherwise, your bank simply will not allow you to register a card in the MasterPass service. By reporting your card details, you expose them to the MasterPass service only.

How to use MasterPass for online shopping and money transfers?

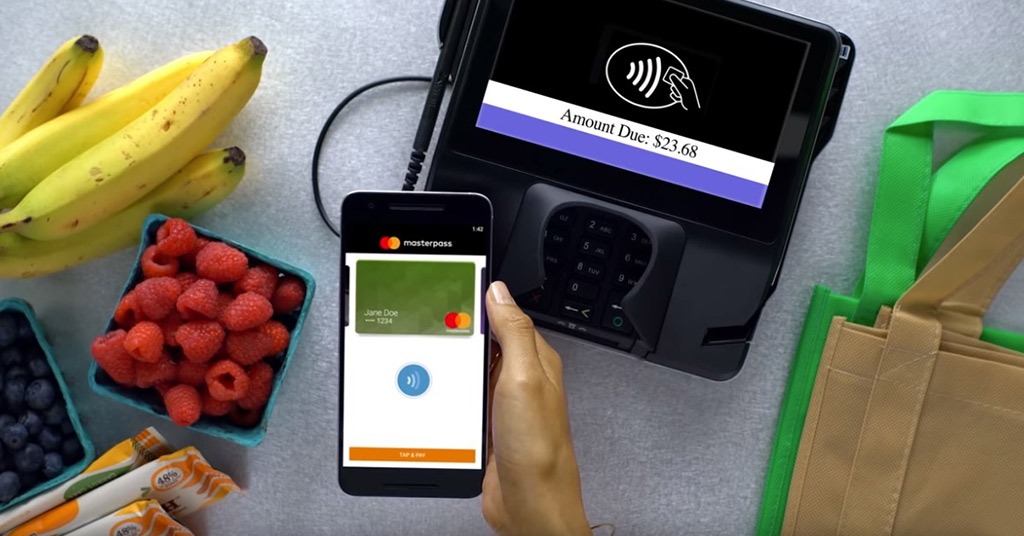

- If you already have cards saved in MasterPass, you can select a card from the list and follow the on-screen instructions and tips on the payment form.

MasterPass uses a multi-layer security system. Therefore, in some cases, to access your list of cards, the system will ask you to enter a phone number and a one-time password that will be sent to your phone. Sometimes, it will be obligatory to input your card security code CVC2 / CVV2 in order to finalize a card payment (three digits on the back of your plastic card).

- If you do not have MasterPass, you can enter the card data in MasterPass any time you want. You can also use any online service that works with MasterPass to implement this.

When buying with a card, you will be offered to save it in Masterpass. If you are ready to use the system, accept this offer and follow the instructions on screen. Sometimes, the system needs to check whether you are the real cardholder, so, in order to save a card in the system, you will be asked to enter your phone number and SMS password (that has been sent to your phone). You can also remove the card from MasterPass in the same way.

If you change your cell phone number:

- First, you should notify your bank and all the services that are linked to your phone number (especially if your phone number is key contact information there). It is important not only for MasterPass. Actually, it is important for the security of all of your personal and payment data of any kind.

- Delete all your cards (linked to the old phone number) from MasterPass beforehand and save them with the new phone number.

When buying with a card, you will be offered to save it in Masterpass. Source: youtube.com

How to use MasterPass with third-party services?

Mostly, it depends on the service you use, so it differs from site to site. However, we’ll try to list some general rules, which might help you with most services that work with MasterPass:

- First of all, most payment services ask you to register, so you must have your own account.

- Then, you’ll have to specify your phone number in order to activate MasterPass service (in case the service is not activated). Thus, you will verify your identity. Moreover, you will link your phone number to your account as well.

- Some of the services have over-complicated features, so if you want to activate the service directly, you need to figure out where the payment menu is, and follow the instructions. If you’ve done everything right, you will be prompted to activate the MasterPass service.

At this point, you need to enter the card details. Sometimes, some payment services require entering the name of a card as well. Thus, you must also enter the name of the card (at your discretion, of course). This option sometimes is very helpful, since when you pay in one click, you can easily distinguish your cards (by the name you’ve given to them). For example, you might use one card for utilities payments only, while the second card is “in charge” of online shopping. - Mostly, after entering the details, you will receive a verification code on the phone attached to your account. Therefore, the bank will be convinced that it is the cardholder who has activated the MasterPass service.

To check whether the cardholder has really activated MasterPass, some services may charge (freeze, to be accurate) a minimal sum (e.g. $1, €1, etc.) from your account, it depends on the service you use. The issuing bank reacts to this action, and usually sends an SMS to your number. Thus, under any circumstances, it is the cardholder who carries out the last verification. Then, the frozen funds (minimum sum) will be returned to your account.

SEE ALSO: