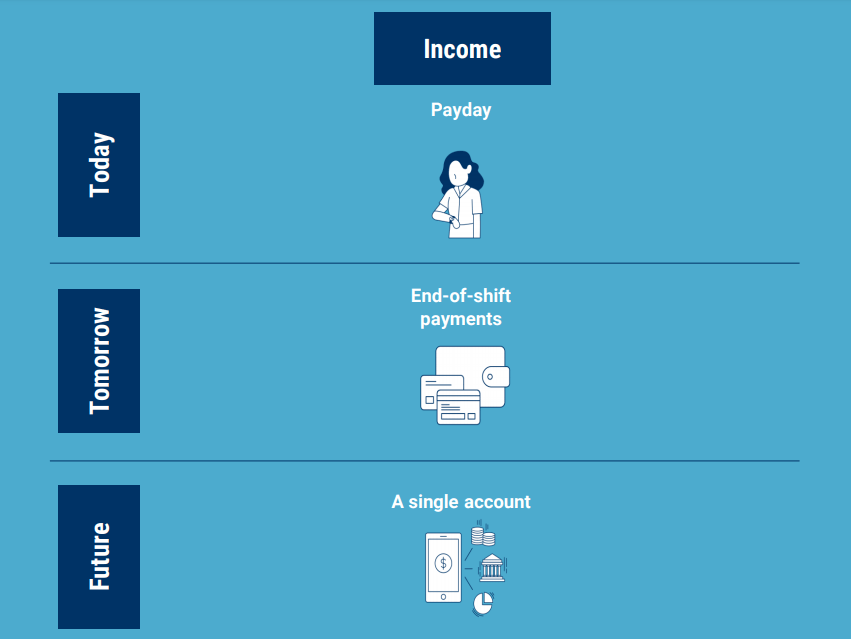

In the nearest future, we’ll witness the rise of end-of-shift payments which will eventually lead to single payment accounts

Payroll evolution: how will we receive salaries in the future? Source: shutterstock.com

Payment solutions are becoming more and more flexible every day. We have digital wallets, P2P transfers, wearables with NFC and even digital currencies. Yet when it comes to the mode of receiving money for work, the situation has remained quite stable for some decades now. Don’t get me wrong, it’s nice to have a stable salary on a fixed due date. However, some experts predict a little flexibility may positively impact our financial plans without hindering payroll stability.

Payroll today

Today, the majority of employees wait for a certain date to receive their salaries by means of direct deposits, paychecks, payroll bank cards, or sometimes cash. The situation doesn’t change much despite the working conditions. Whether you work standard office hours, shifts, part-time, or on a freelance basis, you’re most likely to receive your remuneration monthly or bi-monthly.

Technology could make payroll faster, giving employees more freedom with their money. Source: cbinsights.com

Yet, according to the CBInsights report, such payment schemes lead to the frequent use of credit balance, extra risky loan patterns, and enormous overdraft fees. For instance, only in 2017, US consumers paid USD 84,7 billion of those bank charges.

Some may say, the system is not the problem. People are just used to living on credit. They have lost financial responsibility. Well, yes and no. We are fond of instant payments and bombarded by quick deals. It’s easy to lose track of your spending. At the same time, not only shopaholics struggle with an overdraft. Multiple responsible households face this issue. Our payrolls simply don’t keep up with the changing speed of purchases enabled by e-commerce and mobile payments.

Change is coming

CB analysts say it’s going to change soon. In the nearest future, we’ll witness the rise of end-of-shift payments which will eventually lead to single payment accounts. There’s already a number of startups working on payroll liquidity available at low cost or free of charge.

This app uses your location data to see if you’re still at work. Once you’ve finished your shift, you can get paid for that day instantly to your account. How is it possible? You connect your bank account, enter employment details, and choose the amount of your paycheck you’d like to cash out. When your salary arrives via direct deposit, the app automatically debits back the amount you cashed out. Basically, you are just getting some money in advance. The difference is that you don’t have to return it to the credit account with interest. The app is free to use. Though you can leave some tips on every transaction to help the startup strive.

The app charges $1 per month to help you monitor your spending and get up to $75 in advance from your future paycheck. It’s much easier than getting actual credit since they don’t check your credit score. Moreover, the app performs the role of a financial consultant helping you prepare for upcoming expenses and abstain from excessive spending with timely notifications. It analyses your regular bill payments and shopping habits to do that.

It’s an automatic money manager. It provides money on-demand at the expense of your future paycheck. You can get up to 50% of your salary in advance. The limitations are that it works with selected employers and functions best with major banks. Nevertheless, Walmart (which is the biggest US employer) is on the list, so the number of potential users is still large.

After acquiring Caviar, the food delivery service, Square allowed its couriers to get their money for completing deliveries instantly. Their special platform Square for Restaurants also offers performance tracking, as well as monitors tip splitting. Therefore, food service employers can rate individuals while employees get more control over their earnings.

Stripe payments are quite flexible too. Not only do they offer a choice between monthly and weekly payouts but also marketplaces using Stripe Connect can send instant payouts to sellers or service providers on their platform.

Their open API platform offers a simplified way of managing payment programs. After registering on the app, freelance workers automatically get both a virtual payment account and a physical bank card. After every performed task/job money is loaded into a company account which can be managed similar to an ordinary bank account.

The online & mobile banking company partnered with Uber so that their drivers can access payments for every ride instantly.

This payroll provider has developed a Flexible Pay solution allowing employees to have access to the money they’ve earned when they need it.

In the future, such flexible payroll models will bring employees more financial freedom. It will also change the way they treat their expenses. It’s not a secret that mobile wallets are already substituting traditional banking experiences.

Crypto payroll

Some people believe that in the future crypto payroll will also become commonplace. We’ve reached out to Kiril Ivanov, founder of 2BUIDL, to hear his expert opinion on such a payroll method and whether it seems promising to him.

Crypto apologists always fantasize about people paying with crypto for everything, bypassing banks and government institutions. However, the harsh reality is that in 98% of cases, the payment chain looks like: fiat → crypto → payment → back to fiat. And this is the way.

There is no doubt that crypto payroll and the possibility to make basic payments with cryptocurrency would mean a huge step towards mass adoption.

I’m not sure that at the moment someone is paying salaries with crypto. Although, as far as I heard, some companies, at the request of the workers, can pay partially in bitcoins. I’m not sure what is the benefit of it. Maybe it’s about taxes. In fact, it’s just an “Envelope Salary”.

I know that during the ICO boom some companies have paid bonuses with their own tokens. This is a good idea, success sharing. Like, “let’s become millionaires together.” I myself paid for non-editorial services with my tokens. It’s cheap for me (free of charge, actually) and promising for an employee (maybe, who knows what will happen next).

The main trend in crypto payroll now is crypto micropayments for hours spend or for a task completed. There are obvious benefits – you can pay even per minute of work done. It will be also cheaper and even cross-border. However, this way of paying salaries can be considered as the case of tax evasion. Among the famous platforms for crypto payments are Chronobank and Gitcoin. Those are the most popular.

Single banking accounts

According to CBInsights, they will soon become the main banking alternative for P2P transactions, shopping, and bill payment. A single account will be the smartest banking solution instead of numerous debit and credit cards that only complicate financial management and bring additional fees.

The benefits of a single account are significant:

- Fewer commission and maintenance fees.

- Instant savings and investments.

- There’s no need to transfer interest and earnings to a separate account to spend or invest them.

- It facilitates microtransactions, eliminates the need for «bridge» financing, and enables real-time lending options.

SEE ALSO: