For years, help with tax compliance has been a top request from Stripe users

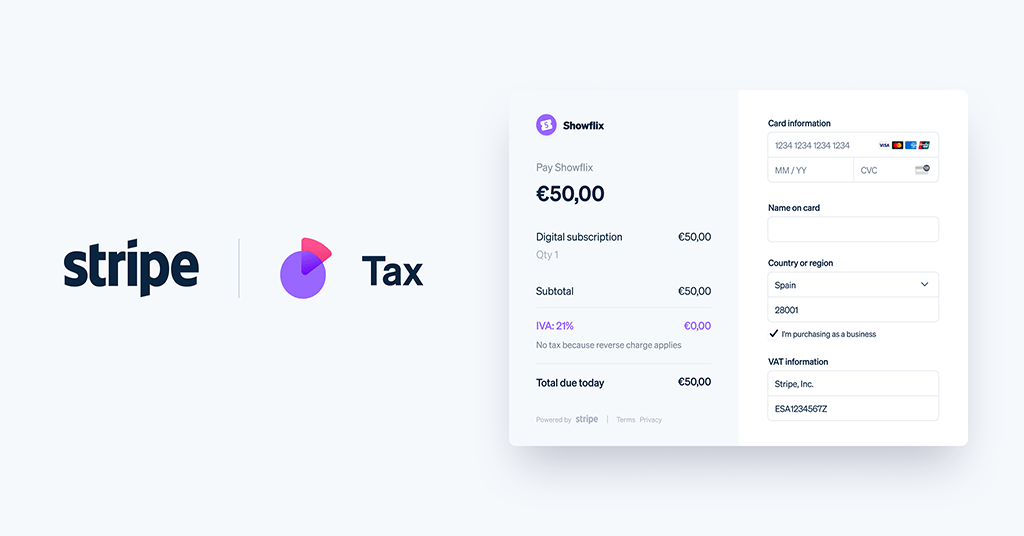

Stripe introduced tax compliance tool. Source: stripe.com

Stripe has announced the launch of Stripe Tax to help businesses automatically calculate and collect sales tax, VAT, and goods and services tax (GST) in over 30 countries.

Features include:

Real-time tax calculation

By determining the end customer’s precise location, and matching that to the product or service being sold, Stripe Tax always calculates and collects the right amount of tax, and keeps up to date with rate and rule changes so businesses don’t have to.

Frictionless checkout

B2C businesses can reduce checkout friction with Stripe Tax, by using location information to calculate and show taxes in the most familiar way to their customers.

Tax ID management

For B2B businesses, Stripe Tax collects the tax identification number from customers, and automatically validates VAT IDs for European customers, applying a reverse charge or zero VAT rate when necessary.

Reconciliation

Stripe Tax saves businesses the pain of reconciling thousands of transactions by creating comprehensive reports for each market in which a business is registered to collect tax, speeding up filing and remittance.

Instead of taking weeks of work, all this can be done automatically by adding a single line of code or updating a single setting in a business’s Stripe Dashboard.

We’ve reported that Stripe to help businesses with fraud prevention through new acquisition.

SEE ALSO: