Even though cash remains the preferred mode of payment in Thailand, its share in the country is on a gradual decline

Thailand’s e-Payment Master Plan: the way to less-cash economy. Source: shutterstock.com

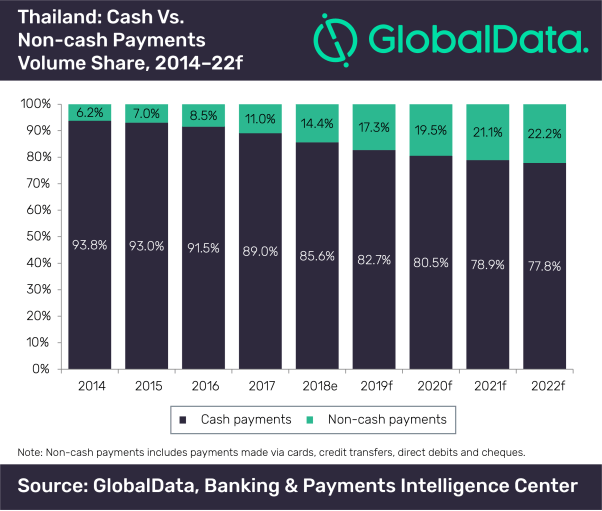

Even though cash remains the preferred mode of payment in Thailand, its share in the country is on a gradual decline due to the concerted efforts by the government to promote electronic payments under its National e-Payment Master Plan, according to GlobalData.

The share of cash in the overall payment volume is expected to decline from 85.6% in 2018 to 77.8% in 2022. During the same period, the total card payment value is expected to increase from THB1.8 trillion ($56.1bn) to THB2.7 trillion ($83.8bn).

As part of the National e-Payment Master Plan, the Thai government launched a nationwide program in 2017 to drive POS installation among smaller retailers and government agencies. Merchants were offered benefits such as tax deduction, fee waivers on POS issuance and rental, and a cut down on merchant discount rates.

In 2016, the Bank of Thailand launched a faster payment system, PromptPay, allowing users to make peer-to-peer transfers and payments through their mobile phone using only the recipient’s mobile number or national ID number. As of December 2018, 46.5 million users, over half of the country’s population, had registered for the system.

In August 2017, the central bank collaborated with American Express, JCB International, Mastercard, UnionPay, Visa and other financial services providers to introduce the Thai QR Code Payment standard, with an aim to create an open, interoperable payments infrastructure.

SEE ALSO: Cashless economy: pros & cons