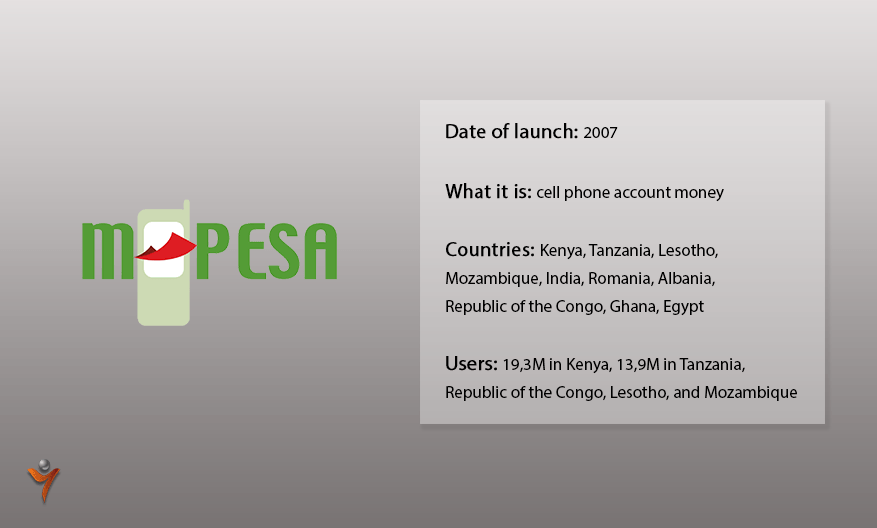

M-Pesa (translated, it means “mobile money”) — the payment system, which allows customers to use a mobile phone for financial management

M-Pesa evolution: from big button mobile phones to contactless cards

Kenya had 740 bank offices as of 2007. Bank accounts haven’t been widespread at present. Statistically, only 19% of the population have ever used bank accounts. The service was just too expensive for most of the population. People had to carry large amounts of cash in their pockets or just had to risk giving it into the hands of intermediaries (bus drivers, for example).

Safaricom, a subsidiary of Vodafone, has found a great solution. Taking into account that more than 50% of Kenyans have used mobile phones at some time, and hence keep money on their phone accounts, Safaricom proposed to use this infrastructure as financial service development.

M-PESA — it’s not just money on your mobile phone account

Some people often say that M-Pesa is just about using a mobile phone account balance to make payments. The truth is, it is a more complicated system. A user can’t just top-up a mobile account and start paying for goods and services.

A user needs to open a special account and upload some money into it. This can be possible only if you visit an M-Pesa agent. A client gives cash to the agent, who transfers that amount from his mobile wallet minus his fee.

M-Pesa transactions are not anonymous. You have to produce your passport to open an account, which is PIN-code secured.

Moreover, you should know that not all Safaricom SIM cards support mobile payments. You must buy a card with the pre-installed M-Pesa menu to use this service.

Not only Kenyans can use M-Pesa now. Tourists can open an account in this system too, even if they only spend a couple of days in the country. It is enough to buy a Safaricom SIM card which costs from 50 cents to $2.

M-Pesa latent capacities

M-Pesa became much more than just a button mobile phone payment service. In the 11 years of the existence of M-Pesa, this solution became a universal instrument, which helps people with fund management.

Let’s consider more unusual ways to use mobile money:

M-Shwari — it is a bank account, which offers deposits and loans. This service was developed jointly with the Commercial Bank of Africa and is available only for M-Pesa clients. A client can open an account remotely. All they have to do is to follow several commands using their mobile phone. The next step is to open a saving account at an interest rate of 2-5% or credit at an interest rate of 7.5% monthly. Around 4.5 million Kenyans use such accounts.

Lipa na M-Pesa allows merchants to accept payments.

Any M-Pesa client can use this service. You just go to the M-Pesa menu on your phone and enter the merchant’s number. A merchant has to register a special SIM card and link its specific number to his point of sale or till.

M-Tiba — it is a kind of health insurance. M-Pesa users can deposit money on their M-Tiba account. It can be used for medical care payments, if necessary.

M-Pesa 1tap — contactless payments service. A user can link a bank card, NFC, or a wristband to a SIM card. Thus, a user can pay contactless at points of sale (apparently, M-Pesa – friendly ones). Payments will be charged from the mobile account.

MySafaricom allows M-Pesa services on modern smartphones. It makes payments much easier due to the user-friendly interface.

In which countries you can use this service?

M-PESA is available in 10 countries, and it is called different brand names in each country. Most of the users are from Kenya (19.3M users) and Tanzania, Congo, Lesotho, and Mozambique (13.9M users). There are lots of similar solutions available nowadays, which were launched on the same basis as Vodafone (for example, M-Paisa in Afghanistan).

SEE ALSO: