If you are a foreign visitor, then you have a chance to get a VAT refund on any purchase of goods

EXPLAINED: How to shop tax-free. Source: shutterstock.com

What is Tax-Free shopping? It is a VAT refund option. It gives international shoppers an opportunity to purchase some goods in the country they are visiting under a condition of exporting these very items out of the country in question.

Today, PaySpace Magazine suggests to you how to use a Tax-Free shopping option, and what you need to succeed with a VAT refund.

How to get a VAT refund

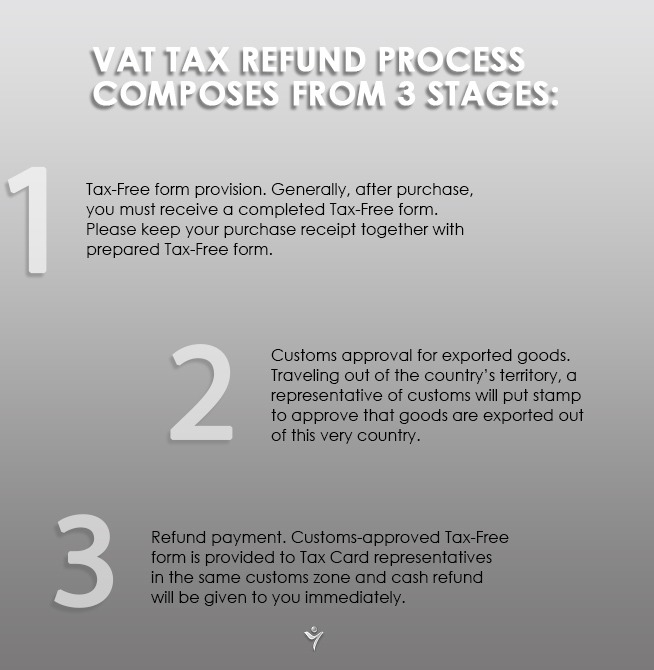

Buying items and claiming a refund is quite a convenient option. This means foreign visitors can buy different things while visiting a country and obtain prepared Tax-Free forms. The most important condition for Tax-Free shopping is to document that you leave a country (where you’ve apparently bought specific goods), thus get a customs Tax-Free stamp, which informs the system that you intend to export goods out of the country. This way there is a chance for a traveler to get a VAT refund.

There is also possible to send customs-approved Tax-Free form by post. At this point, a Tax-Free form would be addressed, and the refund payment would be forwarded to the traveler’s bank card account/personal account via the payment system they choose (PayPal, Payza, Western Union, WebMoney, Easypay, etc).

You should also keep in mind such a definition as the “minimum purchase amount”, which means that you can get VAT refund only when a total cost of purchased goods exceeds the required threshold (depends on the country). Usually, VAT refund does not apply to spirit drinks, tobacco, fuel, and gold jewelry, but it also depends on the country you buy these things in.

What is VAT?

As a visitor to a specific country who is going to go back to your native state or continuing to travel and going to another country, you have the right to purchase goods free of VAT in special shops.

Now it’s time to figure out who can be considered to be a “visitor”. It is any person who lives in a state outside the country, or any kind of political/economic union (for example, EU) in question. You can easily prove that you are a visitor with the help of your documentation (passport or any kind of appropriate ID), where your residence is clearly indicated.

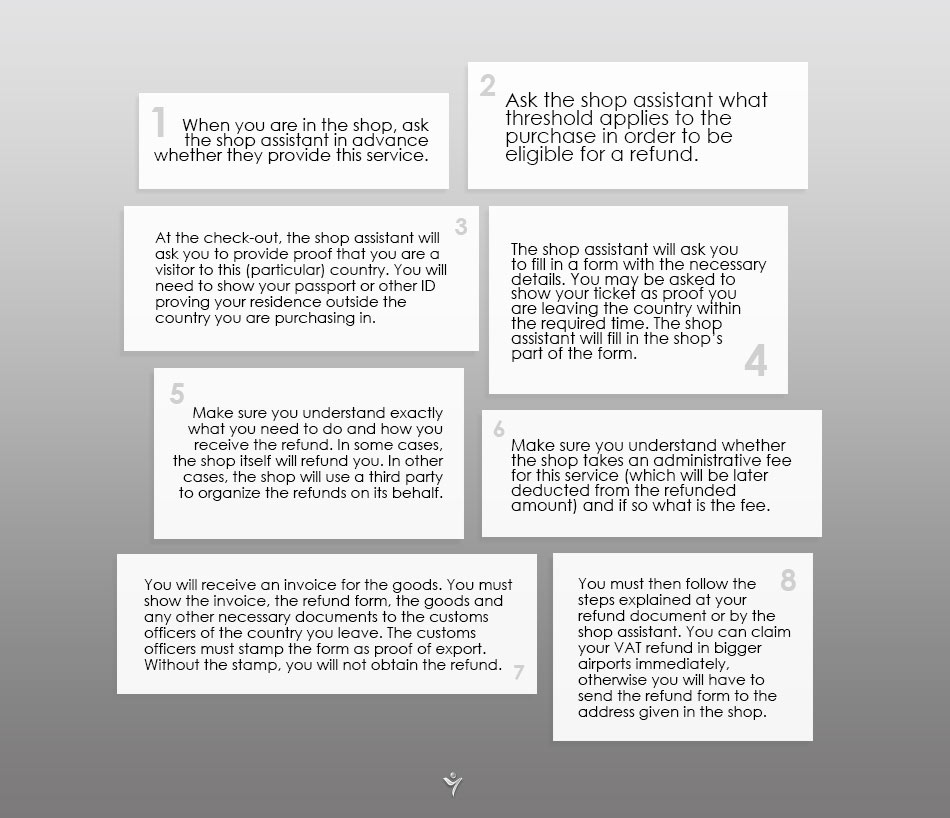

How to handle an issue in a Tax Free-friendly shop

You should remember that shoppers mostly don’t get a 100% refund, since some part of the total sum goes towards the administrative charge for the service. Be attentive while following the step-by-step instructions above.

Be attentive while following the step-by-step instructions above. Source: shutterstock.com

The standard VAT rate of different countries

- China – 16% (Minimum purchase amount: 500 CNY);

- Denmark – 25% (Minimum purchase amount: 300 DKK);

- Germany – 19% general goods (VAT rate 7% for food, books, antiquities, medical supplies);

- Ireland – 23% (Minimum purchase amount: 30 EUR);

- Poland – 23%; VAT rate 8% for some food and medicines (Minimum purchase amount: 200 PLN);

- Slovakia – 20% (Minimum purchase amount: 100 EUR);

- Switzerland – 7.7% (Minimum purchase amount: 300 CHF);

- Italy – 22% (Minimum purchase amount: 154.95 EUR);

- Turkey – 18% (Minimum purchase amount: 118 TRY);

- Finland – 24%; VAT rate 14% for food (Minimum purchase amount: 40 EUR);

- Japan – 8% (Minimum purchase amount: 5,400 JPY);

- Netherlands – 21%; VAT rate 6% for food (Minimum purchase amount: 50 EUR);

- Spain – 21%; VAT rate 10% for food;

- United Kingdom – 20% (Minimum purchase amount: 30 GBP);

- Austria – 20%; VAT rate 10% for food (Minimum purchase amount: 75.01 EUR per day);

- Belgium – 21%; VAT rate 6% for food and books (Minimum purchase amount: 50 EUR);

- Czech Republic – 21%; VAT rate 10% for food and books (Minimum purchase amount: 2,001 CZK);

- France – 20%; VAT rate 5.5% for food and books (Minimum purchase amount: 175.01 EUR);

- Norway – 25%; VAT rate 15% for food (Minimum purchase amount: 315 NOK (215 NOK for food));

- Sweden – 25%; VAT rate 12% for food (Minimum purchase amount: 315 SEK).

SEE ALSO: