Director and Head of APAC in ECOMMPAY, Audrey Ottevanger, gives her advice on introducing business into the Asian market

Top 4 things you need to know before starting a business in Asia. Source: shutterstock.com

How to expand your business into Asia, what difficulties and opportunities await entrepreneurs when entering the Asian market, and how consumer behaviour differs between the people of China, Singapore, Indonesia, etc. from other countries – these and other topics were addressed in the speech of Audrey Ottevanger, Director and Head of APAC in ECOMMPAY (international payment service provider and direct card acquirer).

PaySpace Magazine highlighted key points from the expert’s talk which took place early this month at the ECOMMTALKS 2019 conference in Riga, Latvia.

1. Why is the Asian market so profitable for business

The Shoppes at Marina Bay Sands in Singapore. Source: marinabaysands.com

Asia is one of the fastest-growing and developing regions in the world, with 49 countries and a total population of 4.5 billion people. China is currently transacting half of the e-commerce sales (for instance, Chinese transacted $39.6 billion during Singles’ Day, on Monday).

Asia leads in the number of millionaires, while the middle class is also growing in the APAC. Over the next 5 years, among the middle-class newcomers, 88% will be Asian citizens (in particular, from Indonesia and Vietnam) with an average age of 30 years old.

The rapid growth of e-commerce thanks to emerging industries such as e-commerce retail, online travel, and online media.

Highest smartphone usage. Asian people skipped the generation of desktop computers and went straight to mobile phones. In China, 8 out of 10 transactions are made through mobile phones, therefore, to attract Asian buyers, you should provide either a mobile application or adapt the site for mobile devices.

Healthy funding. Ottevanger highlighted, in recent years, the volume of investment into the region amounted to $35 billion.

Ecosystem challenges are being resolved. For instance, logistical problems of the region have been solved by numerous startups and established players.

Digital financial services, including online and offline payments, reach an inflection point. This, in particular, was achieved thanks to numerous startups that provide access to financial services for customers without a bank account. Nevertheless, it was noted that despite the high level of digital financial services usage, cash is still heavily utilised in the region to pay for goods and services.

Director and Head of APAC in ECOMMPAY Audrey Ottevanger during her speech. Source: ecommpay.com

4 fastest growing online segments – user adoption:

- Online travel

- E-commerce

- Online gaming

- Ride-hailing

Top e-commerce merchant segments:

- Travel

- Consumer electronics

- Clothes & apparel

- Household goods

- Groceries

- Heath & beauty

- Others

According to Ottevanger, for successful implementation of their business in APAC, entrepreneurs should develop different business strategies for each country within South-East Asia.

2. What business should keep in mind before entering Asia

Always keep in mind cultural sensitivities before expanding your business successfully in Asia. Source: Flickr.com

Prioritize the size of the market. Entrepreneurs who wish to start a business in the SEA region, should remember that the more established the market is, the greater the competition. Ottevanger also advised not to introduce a product or service to all countries of the region at once, but to identify 1-3 key markets, grouping them by a common attribute, for example, language (Chinese or Bahasa speaking market).

Note. As an example of successful expansion, Ottevanger mentioned a company that opened a business in the Philippines, Thailand, and Indonesia, the countries with the most promising markets due to the rapidly growing middle class.

Cultural sensitivities. It is necessary to adopt a business strategy that takes into account the cultural features of each SEA country.

In particular, Ottevanger noted the importance of establishing good relations before getting down to business, as well as helping a business maintain a good image (Western tactics of straight to brass tacks are not welcome across the SEA region!).

Ottevanger also emphasized the importance of localisation for most markets in the SEA region, while English can be used in Singapore, Malaysia, the Philippines, and Hong Kong.

Regulations. It is necessary to study the features of local laws, taxes and legal repatriation of funds to one’s home country.

Note. As an example of countries with strict financial regulation, the expert cited Malaysia and Indonesia, whose national currency (Malaysian Ringgit and Indonesian Rupiah) can’t be traded outside the country. Vietnam has a 10% withholding tax on all transactions.

Ottevanger highlighted Singapore as the best start for the expansion of the SEA due to its open international market, English usage, and a large number of expatriates residing in the country, thanks to whom 55% of all operations in the e-commerce sector are international transactions.

3. Features of consumer behaviour in Asia

Most Asians prefer to buy products using their smartphones. Source: shutterstock.com

Omnichannel. Asians are the most integrative shoppers, “I can start my purchase on a mobile phone, I check out on a laptop, I pick up in a store. And I can do combinations of any of these three”.

How Asian consumers shop:

- Check prices

- Read reviews about products and services they are about to buy

- Look for special offers or promotions

Asians heavily use social media to shop. Thai buyers using the messenger, Line, are able to directly communicate with merchants or customer service, asking any questions before buying a product. Chinese customers use social media to leave both positive and negative reviews for purchased goods and services. Indonesian customers are the most numerous and active users of Twitter in the world. Thus, the merchant should actively use social media in order to find an approach to Asian customers.

Features of consumer behaviour in China, Indonesia, Singapore, Thailand, Philippines, Vietnam, Malaysia, and Japan

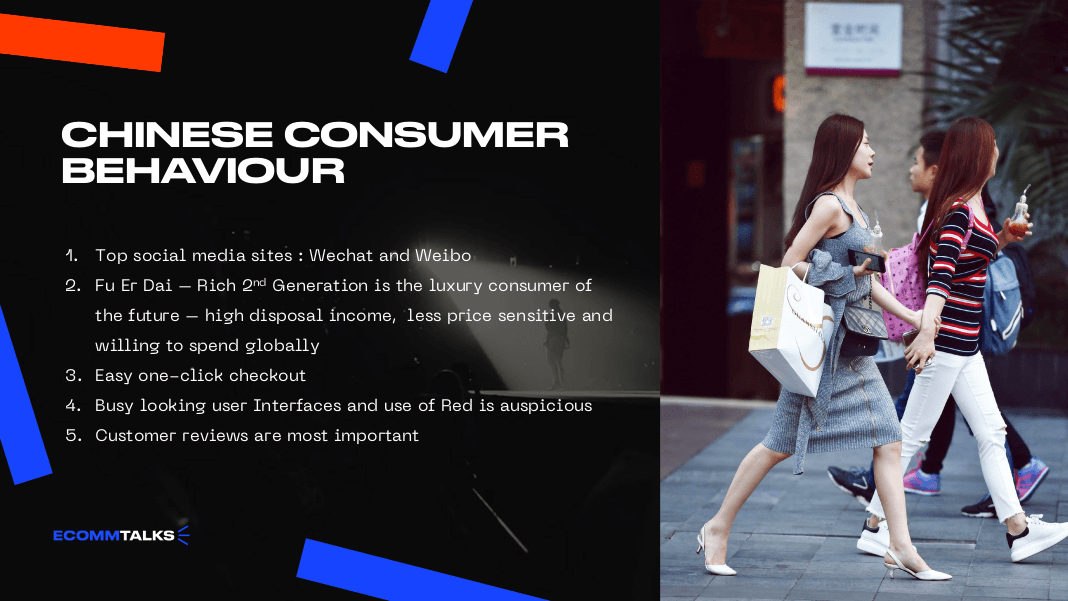

- Consumer behaviour in China

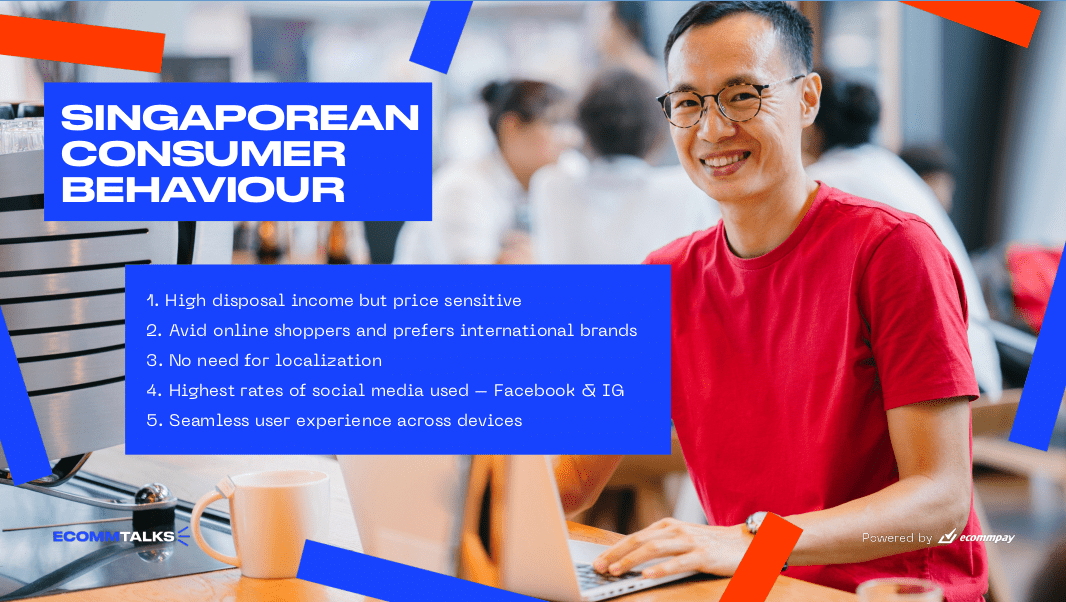

- Consumer behaviour in Singapore

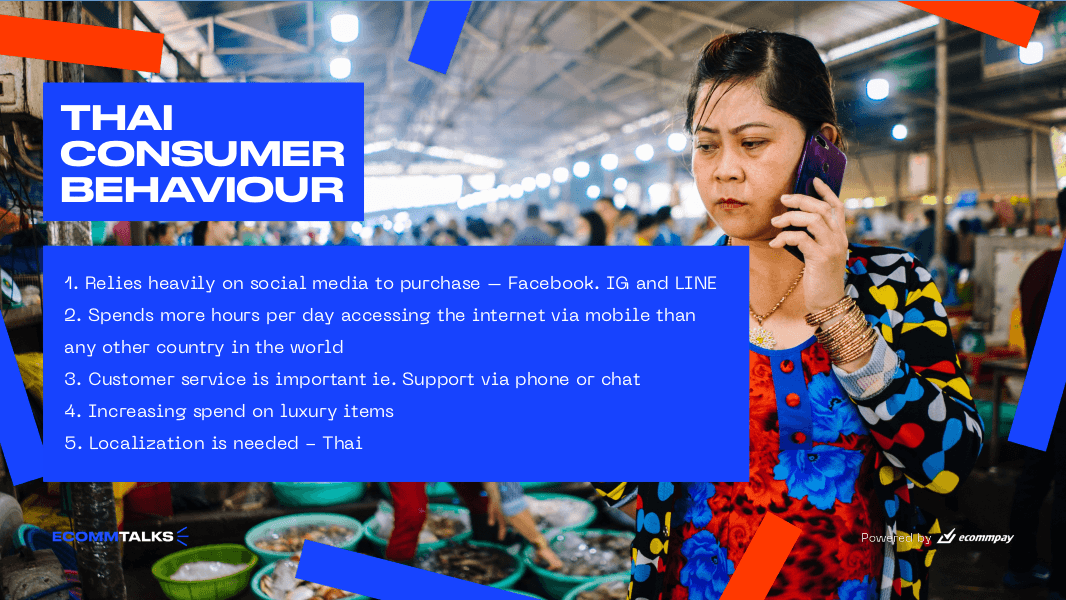

- Consumer behaviour in Thailand

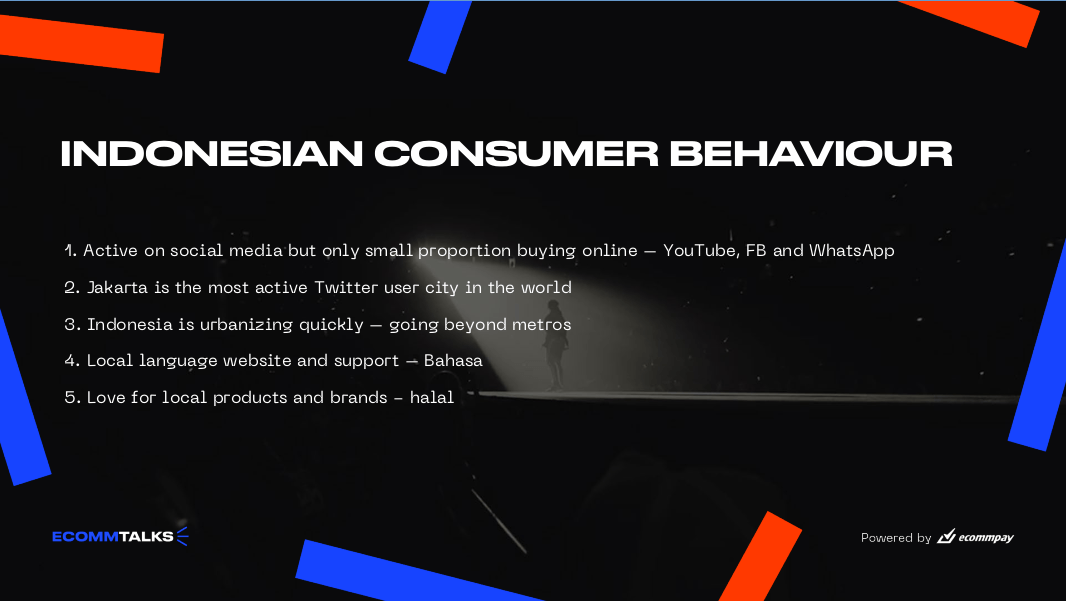

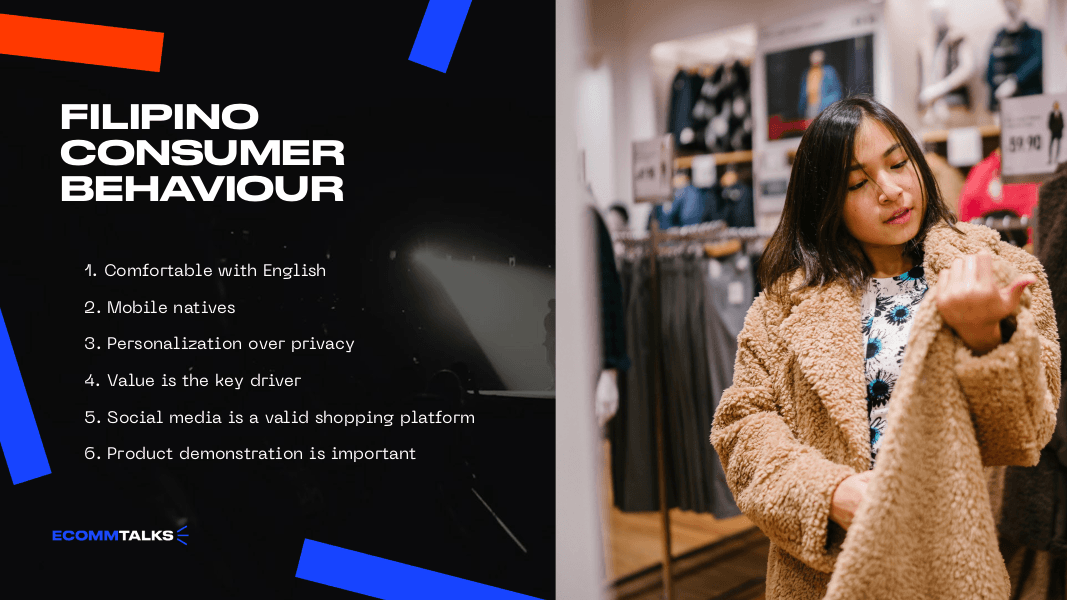

- Consumer behaviour in Indonesia

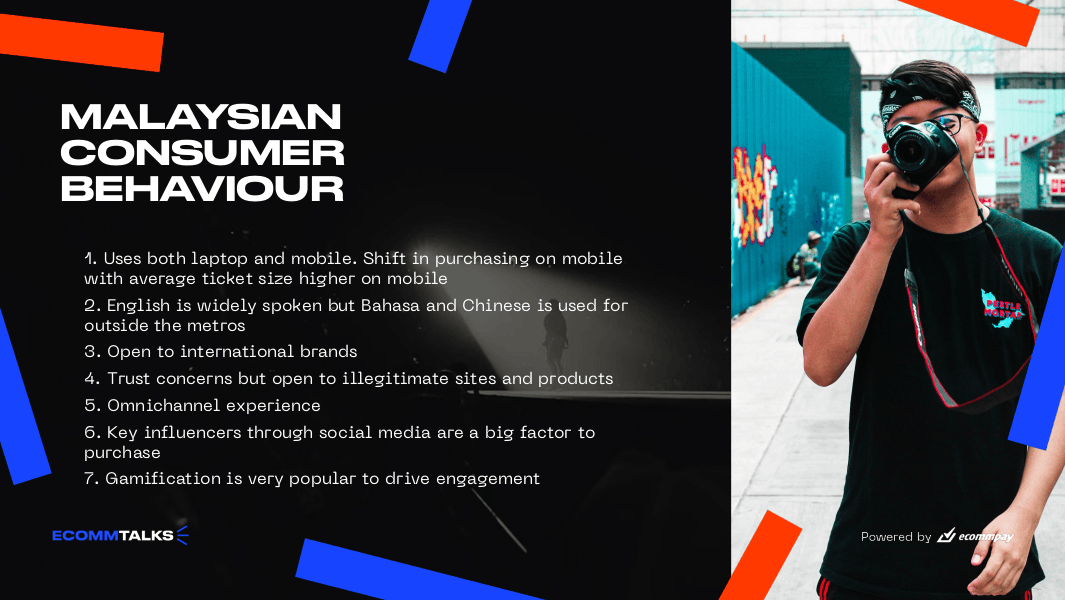

- Consumer behaviour in Malaysia

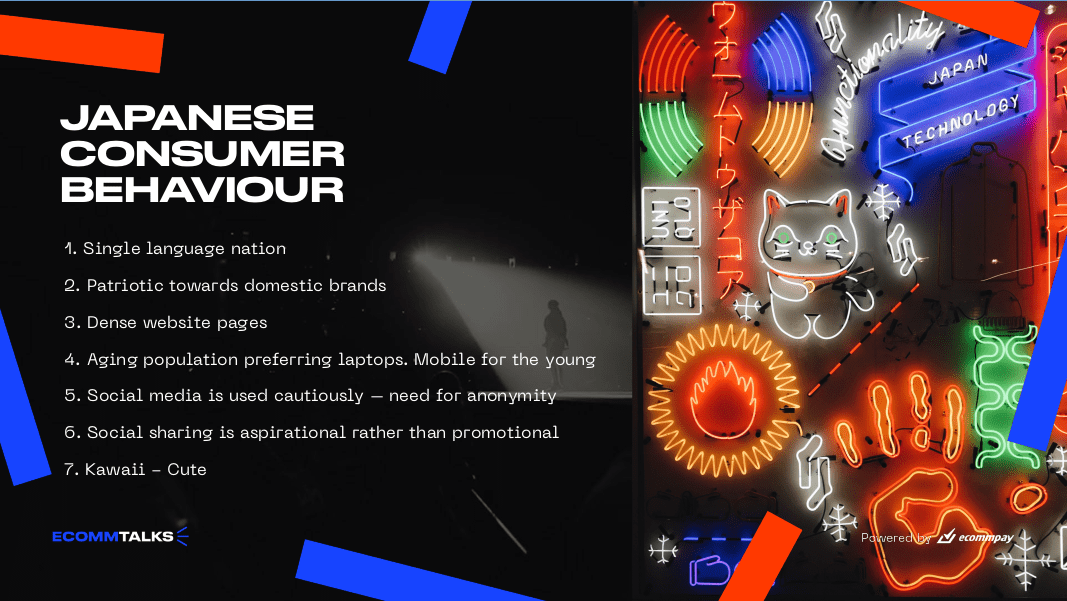

- Consumer behaviour in Japan

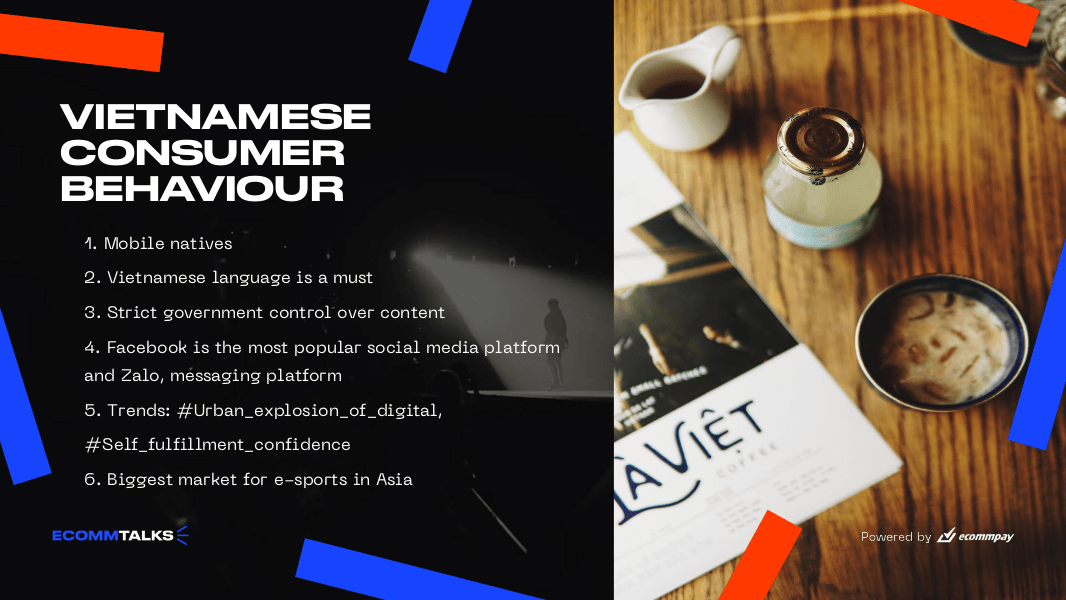

- Consumer behaviour in Vietnam

4. Accepting payments. Pick the right solution for your target market

How Asian customers prefer to pay. Source: shutterstock.com

Bank transfer. This payment method is most popular in Malaysia, Thailand, Vietnam, Indonesia, and the Philippines. Asian people get used to payment pages which redirect them to their local banks or generate a 16-digit code, which the customer then needs to use for payment by bank or via ATM.

Credit/debit cards. Card payments are most often used in Singapore, Malaysia, and Hong Kong. In other countries across South East Asia, credit card penetration is “pretty low” – about 10% or less. SEA citizens also use local cards which aren’t Visa or Mastercard. These cards are valid only in that particular country, since their acquirers are domestic banks.

Digital wallets. E-wallets are the fastest growing payment method in Asia. Among the most popular solutions are Alipay, UnionPay, WeChat Pay, as well as regional services – GoPay and GrabPay. Some countries also use their own e-wallets for domestic transactions, for example, the digital wallet, Boost, in Malaysia.

Cash-based payments. This payment method is most popular in Indonesia, the Philippines, and Thailand. The consumer can pay for goods and services with cash in the bank or pay for products in 7-Eleven or supermarkets.

Others. Cash on delivery.

Note. Before expanding a business in any particular Asian country, it is necessary to study the most popular payment methods for the target audience and provide them for customers. For example, young people in Indonesia prefer to use e-wallets for payment, while the older generation prefers to pay in cash. In this case, the cash payment method implies the ability to pay for the product or service in local currency.

In addition to using a mobile application and/or a mobile version of a website, it is important to simplify payment check-out for Asians consumers as much as possible. Filling out numerous forms when placing an order can lead to drop off. Therefore, the best solution for Asian buyers is to add a one-click purchase option.

Payment methods in different countries of Asia

Alipay is one of the most-used apps for payments in Asia. Source: shutterstock.com

| Country | Payment methods | Insights |

| China | E-wallets (AliPay, WeChat Pay, UnionPay) – 54% Cards – 21% Bank transfer – 11%Cash – 10% Other – 4% |

Mobile sites are key for e-commerce business No local entity required or local bank account needed for cross border payments High per transaction value for goods and services |

| Indonesia | Cards – 34%

Bank transfer – 26% E-wallets – 20% Cash – 14% |

Indonesia is a highly regulated market and the Indonesian rupiah (IDR) can’t be repatriated Low credit card usage, bank transfer is preferableHigh mobile phone usageRise of E-wallets |

| Singapore | Cards – 59%

Bank transfer – 10% E-wallets – 14% Cash – 14% |

SGD can be accepted from outside Singapore USD is acceptable for online purchases High penetration of credit cards 3DS enabled transactions |

| Thailand | Cards – 30%

Bank transfer– 23% E-wallets – 23% Cash – 15% Other – 9% |

Online bank transfers and cash-based payment methods are predominant Payment fraud is prevalent so merchant security credentials are important THB has to be offered |

| Philippines | Cash, e-wallets, OTC payments – 65%

Bank transfer – 30% Cards – 5% |

Cash type payments are preferred Authorisation rates tend to be lower in the Philippines than in other marketsLower average spending compared to the rest of SEA |

| Vietnam | Bank transfer – 34% Cards – 22%E-wallets – 19%Cash – 19%Other – 6% |

Card payment here is greater with debit cards than credit cards using local banks Digital wallets are on the rise Cash is still popular but will be decreasing Withholding tax on all transactions of 10% |

| Malaysia | Bank transfer – 46% Cards – 29%Other – 11%E-wallets – 7%Cash – 7% |

Online banking is the most popular

FPX is not available for cross border payments with no local incorporation Strong financial regulation control, and the Malaysian Ringgit is a non-tradable currency that can’t be settled outside the country 3DS is mandatory |

| Japan | Cards – 65%

Bank transfer – 14% Cash – 13% E-wallets – 2% |

Cards are the primary way to pay – JCB Cash via Konbini is popular amongst teens Low fraud rateLocalisation is a must in every aspect |

SEE ALSO: