Anastasiia Bilous

COO New Media Services

Payment fraud is an ideal use case for machine learning and has a long record of usage. When consumers get a call, text, email, or in-app messages from their card issuer asking them to validate a transaction, or informing them of fraud on their card, they may not even suspect that behind this bit of excellent customer service are a brilliant set of algorithms.

Fraud detection with the help of machine learning. Source: unsplash.com

Recently, however, there has been so much hype around machine learning in fraud detection that it has been difficult for many to distinguish myth from reality. At times, you might come to the conclusion that machine learning has just been invented, or just been applied to payments fraud for the first time!

Here’s a brief definition of what we’re talking about: machine learning refers to analytic techniques that “learn” patterns in datasets without being guided by a human analyst. Machine learning helps data scientists efficiently determine which transactions are most likely to be fraudulent, while significantly reducing false positives.

The techniques are extremely effective in fraud prevention and detection, as they allow for the automated discovery of patterns across large volumes of streaming transactions. If done properly, machine learning can clearly distinguish legitimate and fraudulent behaviors while adapting over time to new, previously unseen fraud tactics.

According to the report of PwC, there are next findings, 47% of companies experienced fraud in the past 24 months. Nearly half had suffered from at least one fraud, but an average of six per company. The most common types were customer fraud, cybercrime, and asset misappropriation.

40% of frauds were committed by employees and the same number – 40% – external parties. The rest 20% falls to the collusion between the two.

The total cost of these crimes is close to $42 billion. That’s real money stolen from real people like you and me.

But what scares more is the minimum amount of companies who responded effectively. Only 56% conducted an investigation of the incident. And barely one-third reported it to the board. Following up you can guess that only a few had implemented some instruments to detect fraud and fight against it!

So the threat of fraud is current and growing. It’s a risk most of the companies owners ignore or underestimate. And unfortunately, too many businesses are doing just that.

Last tendencies: mobile fraud + COVID-19

Last tendencies: mobile fraud + COVID-19. Source: pixabay.com

The last tendencies are highly negative with smartphones spread worldwide and the COVID-19. Mobile fraud is one of the fastest-growing threats, increasing 117% over the previous year.

COVID – 19 fraud cases:

● Promotion abuse

● Item-not-received fraud

● Fake charities requesting donations

● Sites claiming to provide a coronavirus vaccine

ML against fraud

ML against fraud. Source: pixabay.com

There are a number of factors that need to be considered when implementing an effective machine learning strategy, which includes:

- Supervised models are based on the tagging of data as fraud or non-fraud so that a computer can determine legitimate or illegitimate patterns. Unsupervised models employ a form of self-learning, grouping data points together in order to fill the gaps when there is little or no tagged data.

- Behavioral analytics uses machine learning to anticipate and understand the behaviors of each account holder, e.g. transaction behavior patterns. From this, the machine is able to identify anomalies in behavior. In cases of uncharacteristic spending, algorithms can assume that this is illicit behavior.

- Generic behavior models pose a lot of risks when applied to fraud. While generic models may be able to detect obvious anomalies, specialized models are capable of detecting more subtle and less obvious fraud events, e.g. when a fraudulent transaction arises but appears to be in-line with the cardholder’s typical behaviors. Specialized analytics uses advanced profiling, fraud-specific predictive characteristics, and adaptive capabilities to separate themselves from generic models.

- Machine learning improves accuracy when it has a large amount of data to learn from. In fraud detection, millions or even billions of data points enable the computer to build a comprehensive understanding of what is and is not a fraud. With evolving crime, it is important that machines encounter as many examples as possible to be effective. While the initial data input is important, best in class models use adaptive technologies that continually learn from any additional data that is input so that it can adjust its decisions based on current environments.

Given the digital nature of the business world today, fraud identification, prevention, and elimination are usually at the top of every company’s list of priorities.

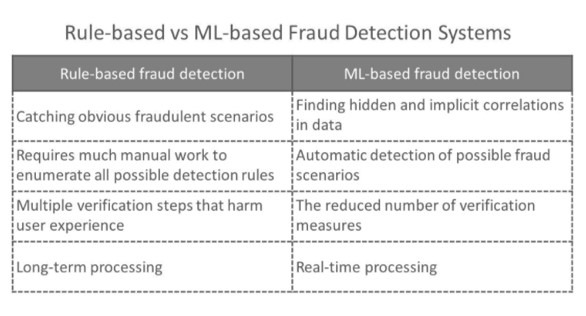

Still, many of them perform these processes manually, following outdated, rule-based methodologies that involve review and analysis of potentially fraudulent events by human staff. Not only this way of identifying incidents is time-consuming, inaccurate, and expensive, but it is also generating many false positives, which also need to be investigated further.

Machine learning can solve many of these issues, helping identify and process risky transactions at the fraction of a second, thanks to big data, advanced algorithms, and processing power.

Machine learning can be both supervised and unsupervised, and businesses should ideally use both in building holistic fraud prevention and identification strategy. That is the only long-term solution to keeping up with hackers and fraudsters who are becoming increasingly more sophisticated, agile, and technologically advanced.

SEE ALSO: