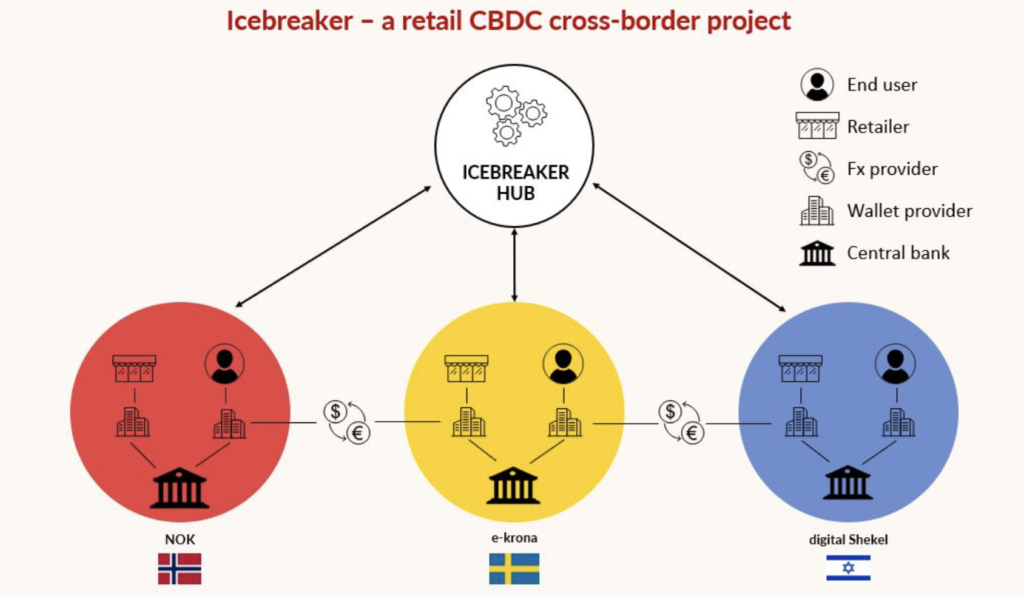

BIS and the central banks of Israel, Norway and Sweden teamed up to find out how CBDCs can be used for international retail and remittance payments

Source: bis.org

The Project Icebreaker is a joint initiative of the central banks of Israel, Norway and Sweden along with the Bank for International Settlements (BIS) aimed to explore CBDC use for international retail and remittance transactions.

As BIS plays a key role in the G20 programme, it pays extreme attention to cross-border payments that have recently been pushed up the political agenda. The segment faces international scrutiny over high costs, low speed, limited access and insufficient transparency. CBDCs may be a solution to these pervasive issues.

Now, the Bank of Israel, Central Bank of Norway, Sveriges Riksbank and BIS Innovation Hub Nordic Centre will run the Project Icebreaker to connect domestic proof-of-concept CBDC systems. The study will continue until the end of the year, testing specific key functions and the technological feasibility of interlinking different domestic CBDC systems.

The project’s architecture enables immediate retail CBDC payments across borders, at a significantly lower cost than existing systems typically based on the correspondent banking system.

SEE ALSO:

Bitcoin think tank suggests rejecting CBDCs in favor of BTC and stablecoins