Citi’s new report reveals the significance of crypto donations in perspective of the cost of living crisis

Digital Assets Can Boost Philanthropy. Source: unsplash.com

Citibank’s recent report ‘Philanthropy and the Global Economy’ has registered a decline in donor base in recent years. Considering the economic pressures of today, the institution believes digital assets can provide new opportunities within the global reach of philanthropy.

Last year, Citi estimated that $550 billion is annually donated to charities worldwide. However, it also noted that the number of donors is gradually shrinking, calling for higher-value charitable transactions.

Furthermore, in 2022 the cost of living crisis poses additional challenges for robust philanthropic movement. Firstly, the demand for financial support rises, as the vulnerable population finds the rising costs unaffordable. Besides, the number of refugees seeking asylum across the globe has increased greatly this year. At the same time, donors themselves are facing harsher economic conditions, predictably limiting the amounts of their financial support. Finally, maintenance costs for charities also go up.

How crypto can help mitigate the negative impact on charities?

Citibank’s report argues that donation amounts can increase if philanthropic organisations utilised all the assets available to them, including crypto. Allowing acceptance of digital assets can open up a further $2.4 trillion in funding, per Citi estimations.

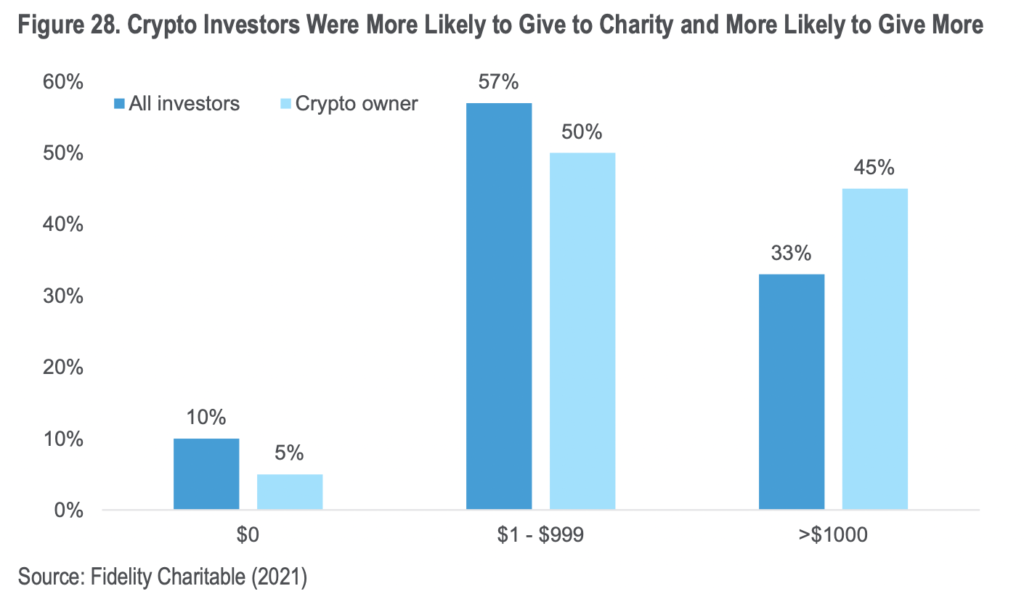

Besides, it would attract a completely novel donor base, who are not only more generous than their cash-giving counterparts but also more secure about their donations due to the transparent blockchain mechanisms.

However, many charities still lose out on these opportunities. One of the reasons is the inherent risk of crypto transactions and the lack of legal clarity. One way around the volatility and theft risks is for charities to accept donations in crypto and immediately convert it to fiat, according to Citi. In addition, charities must take precautions according to the existing rules around AML, sanctions rules, and any kind of KYC procedures applied to traditional assets.

The bank uses examples of humanitarian crises caused by the wars in Ukraine and South Sudan to illustrate how refugees could benefit from blockchain technology and crypto donations.

SEE ALSO:

CBA launches digital donations app

PaySpace Magazine accepts PayPal donations to help Ukrainians affected by Russia’s invasion