Even though cash remains the most preferred mode of consumer payment currently in Portugal, electronic payments are set to surpass it by 2020

Electronic payments to overtake cash in Portugal by 2020. Source: unsplash.com

Even though cash remains the most preferred mode of consumer payment currently in Portugal, electronic payments are set to surpass it by 2020, supported by government initiatives and improved payment infrastructure, according to GlobalData.

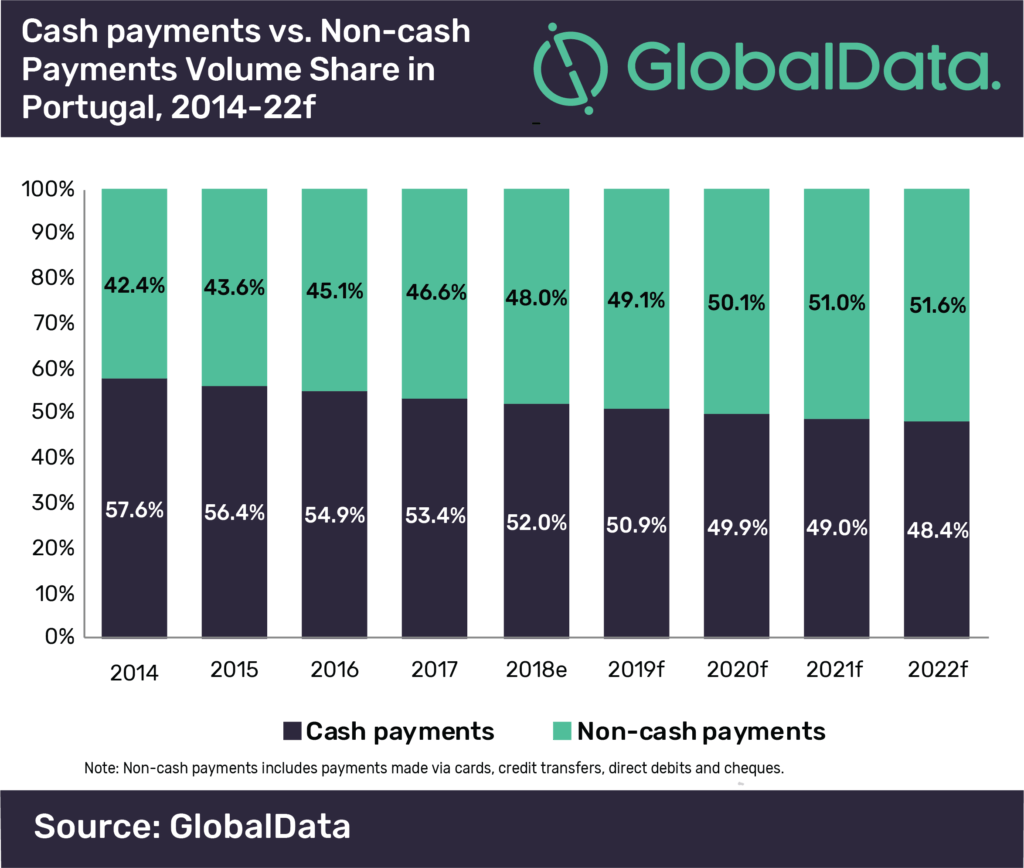

The report reveals that the share of cash in total payment volume decreased from 57.6% in 2014 to 52.0% in 2018 and is expected to drop further to 48.4% by 2022.

The introduction of SCT Inst – a pan-European instant payment scheme – in Portugal in September 2018 was a positive move in this direction. It enables peer-to-peer electronic fund transfers of up to €15,000 ($17,183.22) in real-time within 10 seconds and is available 24/7.

To reduce the dependence on cash and promote electronic payments, the government capped the amount of cash per transaction for residents and non-residents to €3,000 ($3,436.64) and €10,000 ($11,455.48), respectively in August 2017. The government also mandated income tax payments over €1,000 ($1,145.55) to be made through bank transfer, cheque or direct debit.

One month prior to this, the central bank–Banco de Portugal–had enacted a regulation enabling the financial institutions in the country to allow their customers to open bank accounts online. With this, several banks such as Novo Banco, Millennium BCP and Santander allowed consumers to open bank accounts through digital channels.

SEE ALSO: Cashless economy: pros & cons