Thailand is among the worst affected Southeast Asian countries by the coronacrisis

Here’s when card payments in Thailand are set to rebound. Source: pixabay.com

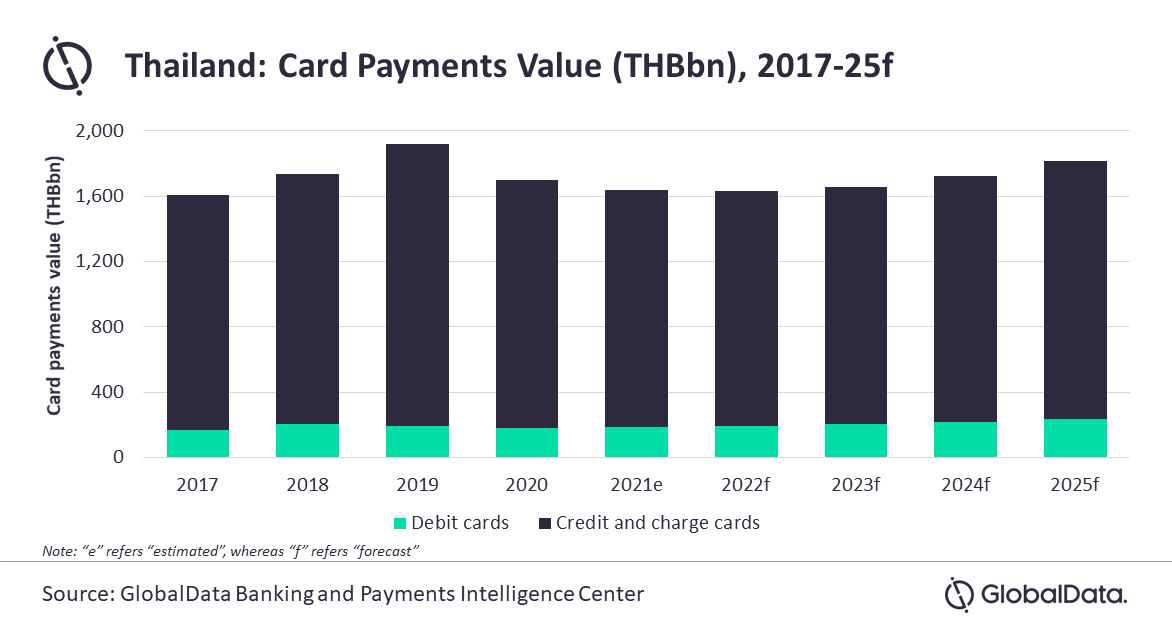

According to GlobalData, Thailand’s payment card transactions value, which registered robust growth in the last few years, declined by 11.7% in 2020, as consumer spending declined. As a result, the payment cards market is expected to rebound from 2023.

The report has found that reduced income levels and uncertain economic conditions are pushing consumers to cut down on spending, resulting in reduced card usage. Consequently, card payments value in Thailand is estimated to decline by 3.5% to reach $54.6 billion in 2021.

Along with that, due to the resurgence in new cases, the central bank of Thailand has revised downward its GDP forecast for 2021, from 1.8% released in July 2021 to 0.7% in its August 2021 estimates.

Credit and charge cards are the most preferred card types for payments in Thailand primarily due to the reward benefits such as discounts and cashback, and installment payment facilities offered on these cards. These cards account for 88.7% of all card payments by value in 2021. Debit cards account for the remaining 11.3% share.

We’ve reported that RBC Ventures rolled out money management app and Smart Card for kids.

SEE ALSO: