The beta product now available to 100,000 users on US waitlist

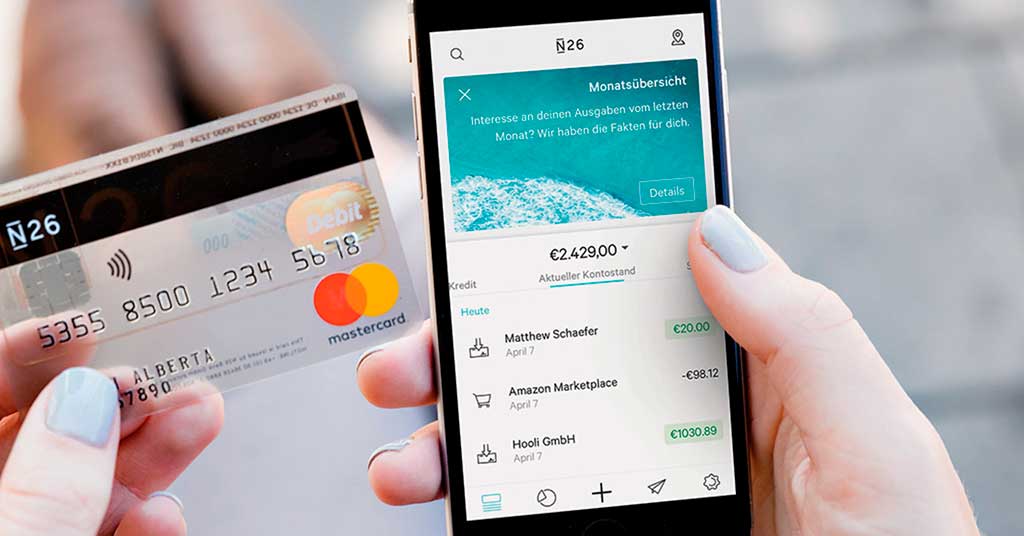

N26 launches in the US. Source: n26.com

N26 is launching its banking app in the US. Starting in a staged rollout, the 100,000 customers on the US waitlist will be invited to sign up and have full access to the product. A full public launch will follow later this summer.

N26 already has a strong presence in the market, where it operates via its wholly-owned subsidiary, N26 Inc., based in New York. Since opening its office in New York, the company has been able to gain insights on the US market and consumers, which is reflected in the development and rollout of the US product behavior, the bank says.

The US team already consists of over 50 employees. The initial US product includes an N26 account via Axos Bank, a federally regulated and FDIC-insured bank, and a Visa debit card.

Account activity is displayed in the app in real time and each transaction is automatically categorized. Customers can also set daily spending limits and lock and unlock their cards with a simple swipe in the app.

Since the initial European product launch in 2015, N26 has reached 3.5 million customers in 24 European markets. The bank attracts over 10,000 new customers every day in Europe primarily through word of mouth. With its widespread success in Europe, N26 is currently focused on overseas expansion, first in the US, followed by Brazil.

SEE ALSO: TOP-10 mobile-only banks