![]()

Bader Al Hussain

PaySpace Magazine Analyst

Norway is one of the richest nations of Europe. Having a high standard of living, the country has a unique and strongly integrated welfare system in order to protect the lower strata of society. The country funds these welfare programs largely by relying on the financial reserve produced by exploiting its natural resources, particularly North Sea Oil. Here it is pertinent to note that Norway is one of the largest producers and exporters of oil in the world, but the country is not a member of OPEC.

The character of the country’s economy is more of a mixed rather than a free-market economy. This is because the strategic industries are owned by the government. Further, the services sector contributes approximately 63.5% to the total economic output, whereas industry and agriculture contributes 34.7% and 2.1% respectively.

Norway’s economic forecast 2021: what’s coming next? Source: pixabay.com

Economy at glance

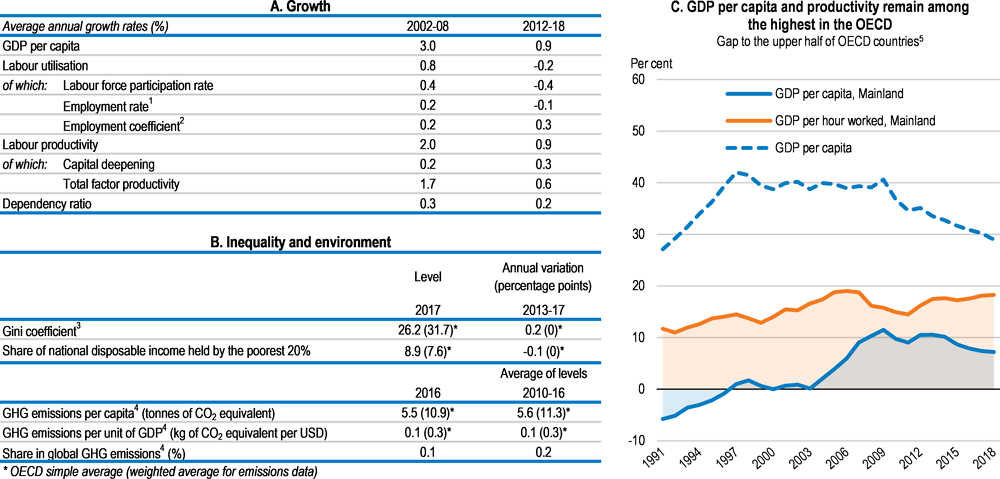

Norway is one of the highly developed economies of the world with a nominal GDP of approximately USD 366 billion and GDP per capita of USD 67,989. However, recently owing to lower labor utilisation the country’s growth in GDP per capita has slowed. It remains one of the two Nordic countries that has not joined European Union.

The total exports and imports of Norway are approximately USD 102.8 billion and USD 95.06 billion respectively. The major trading partners of the country are the United States, Germany, China and the Netherlands. The main exports of the country are petroleum and petroleum products, machinery and equipment, metals, chemicals, ships, and fish. Whereas the main imports are machinery and equipment, chemicals, metals, and food products.

Further as mentioned above, the country is a welfare state whereby the rich are taxed at a very high rate and the tax proceeds are spent on public welfare projects. In this context, advanced economies generally have an average tax to GDP of 35% whereas Norway has a tax to GDP of 45%.

Economy in COVID-19

During the COVID-19 pandemic, the Norwegian economy shrank by 2.5 per cent. Now, according to the analysts, the economy is expected to recover at a slower pace than anticipated. Nevertheless, the finance ministry is of the view that the recovery is largely dependent on the success and speed of vaccination campaigns.

“How fast the economy will grow depends to a large degree on the speed of vaccine rollouts and how quickly restrictions can be lifted,” the ministry said in a statement ahead of a two-day cabinet meeting.

Norway capital markets

Founded in 1819, the Oslo Stock Exchange is the only regulated stock exchange in Norway. The bourse offers a range of financial products that include equities, derivatives, and fixed income instruments. Oslo Børs Benchmark index is the benchmark index of the Oslo Stock Exchange. The Oslo Stock Exchange also became part of Euronext consortium of European stock exchanges in 2019.

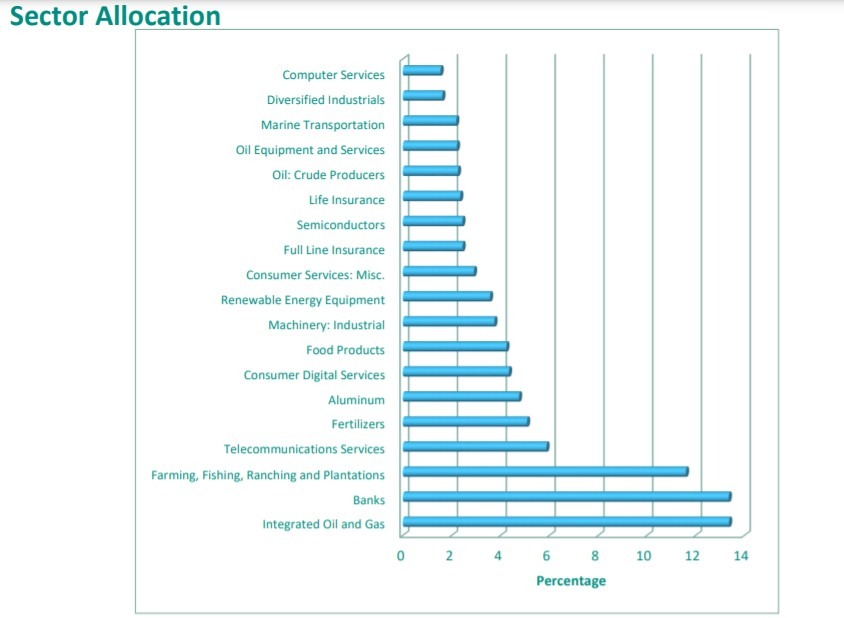

As far as the performance of the Oslo Stock Exchange Equity Index is concerned, the index gave a return of 33.73% over the span of one year and 16.19% Year-to-Date (YTD) return. Given the index is heavily tilted towards energy and financial sectors, the current performance is largely on the back of higher international oil prices. The following graph depicts the sectoral allocation of all-share equity index.

Economy outlook

However, there are concerns related to the current Norwegian economic policy where the independence on oil revenues and production has increased. Further, most of the human capital has also been concentrated in the petroleum-related industries. This makes the economic growth of the country to be highly susceptible to the fluctuations in the international oil prices.

Further, home prices have reached record-high levels in five years. “In essence, it is only rate hikes that can dampen house price growth now,” Swedbank analysts Oystein Borsum and Marlene Skjellet Granerud, said in a report, adding that they expect the first increase in the second half of 2021. The central bank’s next monetary policy meeting is on March 18.

Norway’s government has an ambitious policy agenda in order to boost its economic output. The salient features of those measures are as follows:

- Measures have included lowering of the corporate-tax rate from 24% to 23% in 2018 (with a parallel cut in the ordinary rate of personal income tax). The lowest value-added tax rate was further increased, from 10% to 12% in 2018.

- Curriculum overhaul is underway in primary and secondary schooling and a programme to improve the status and quality of teachers continues. In higher education, a series of mergers was completed in 2017 and a three-phase performance agreement process is underway.

- Following a stakeholder agreement in March 2018, a public-sector pension reform is underway that will reduce incentives for early retirement. Other reforms include new guidance for doctors on sick leave (2017) and new rules on eligibility for the Work Assessment Allowance (2018).

- Protective clauses for forestry-based farms and small farms have been removed in 2017. More ambitious proposals to free-up price setting and permit corporate ownership did not pass through parliament.

Nevertheless, economic experts contend that the country’s economy is expected to expand in 2021 and 2022 by 3.7 per cent and 3.6 per cent respectively. Further, Norwegian unemployment rate is forecasted to decline, but will still be higher than pre-pandemic levels in 2022.

Recommendations

The government needs to undertake the following measures for sustained growth of the country’s economy.

- Hold the current policy rate and remain wary of the changing global and regional economic developments.

- Renew macroprudential mortgage regulations and when they expire, consider removing time limitations.

- Mitigate tax concessions on home ownership.

- Keep the fiscal deficit below 3% of GDP so that structural deficits are tamed over the period.

- Increase and strengthen the value for money in government spending.

- Tighten medical assessment systems as a substantial share of the population is on disability benefit as compared to other developed economies.

- Investment in skills building and education is required. Further, concentrated incentives need to be given to the youth in order to complete upper secondary education. It is to be noted that (as the graph below depicts) Norway has a high share of youth who do not complete upper secondary education.

Conclusion

Risks related to higher inflation rates have raised concerns related to the impending rise in the policy rates by the central banks. Therefore, cautiousness is warranted for the investors who want to bet on the prospects of the Norwegian economy.

The government and the experts need to keenly observe the key global developments and domestic risks emanating from the property markets. From an equity market investment perspective, we foresee lacklustre and range-bound activity in the Oslo Stock Exchange all-share index for the remaining part of this year.

SEE ALSO: