UK retailers set to reap benefits if they can keep pace with the rapid rise in customer experience expectations

One bad experience would stop shoppers returning to a brand. Source: shutterstock.com

New research conducted by Klarna across 2,000 UK consumers and over 250 retail decision-makers, reveals that retailers are struggling to retain their customers as consumers today increasingly have zero tolerance for a poor retail experience.

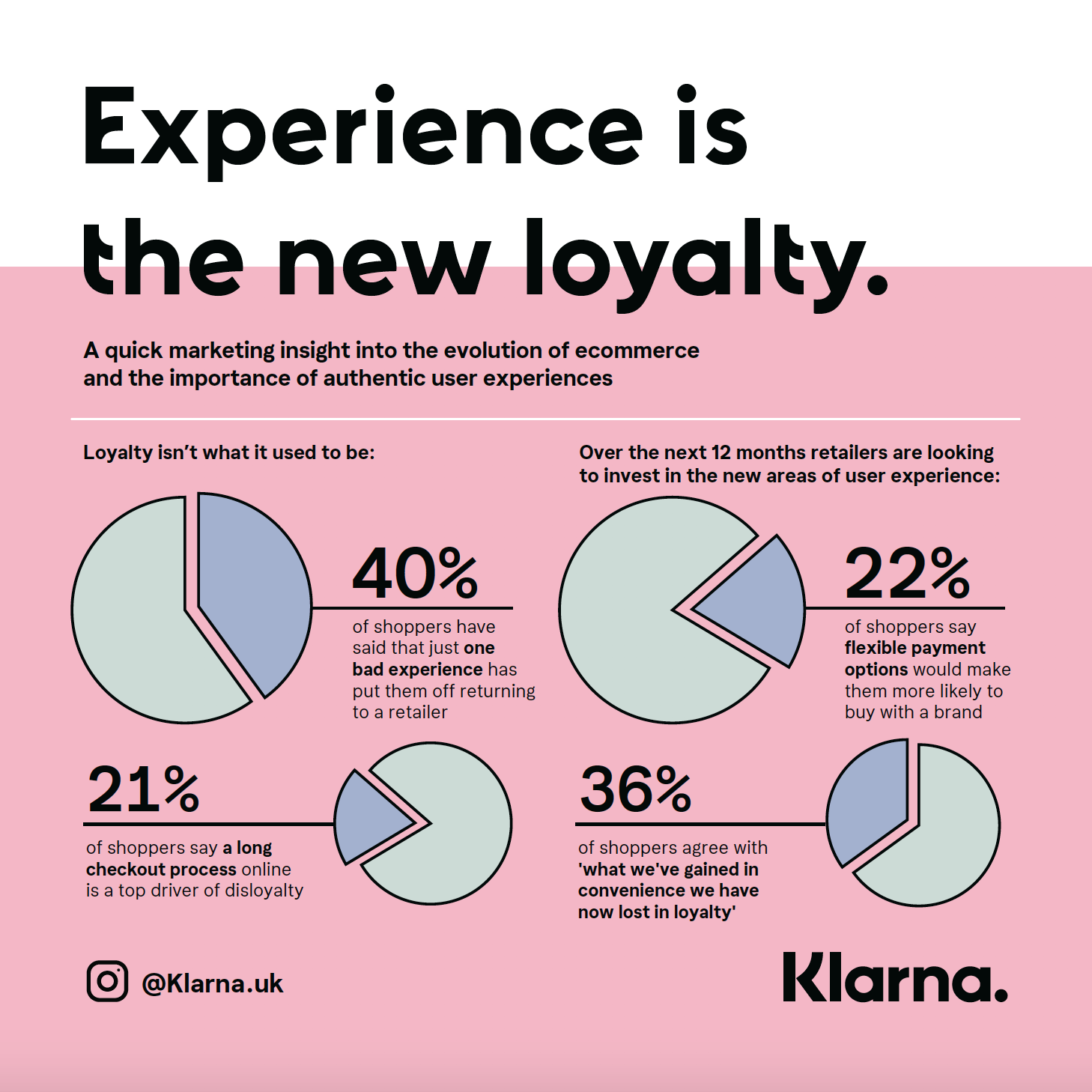

40% of shoppers say just one bad experience would stop them returning to a brand. A third (32%) say shopping isn’t as fun as it used to be, with 36% feeling that what shoppers today have gained in convenience, they’ve lost in experience.

Where brands used to think of loyalty in terms of reward schemes or points, the findings show that for today’s shopper, the drivers of loyalty run much deeper than a transaction or offer. And when it comes to what drives disloyalty, a bad returns process (30%), and a drawn-out online checkout without payment options (21%) rank much higher for shoppers than retailers perceive them to be.

Retailers are recognizing this shift and starting to evolve the way they think about loyalty. 41% of retailers agree that loyalty is no longer solely driven by rewards and 76% say they have to work harder than ever to retain customers. But, many (33%) are struggling to keep pace with changing consumer expectations around experience and are being held back by outdated tech (33%) and a short-term focus on sales (30%).

Shoppers today want more – craving things like brand values they can align with (40%), human engagement (35%) and flexible payment options (26%). This is especially true of millennial and Gen Z shoppers who care less about value for money, and more about the brand image (20%, compared to 13% of over 45-year-olds) and flexible payments (30%, compared to 25% of over 35-year-olds).

These insights demonstrate how important it is for retailers to focus on these broader concepts of experience to win back loyalty. It’s encouraging to see forward-thinking retailers are already starting to invest in these ‘newer’ elements of experience. The top areas for investment over the next 12 months are a smooth online UX (39%), additional payment options (38%), a curated experience (37%) and brand content (34%).