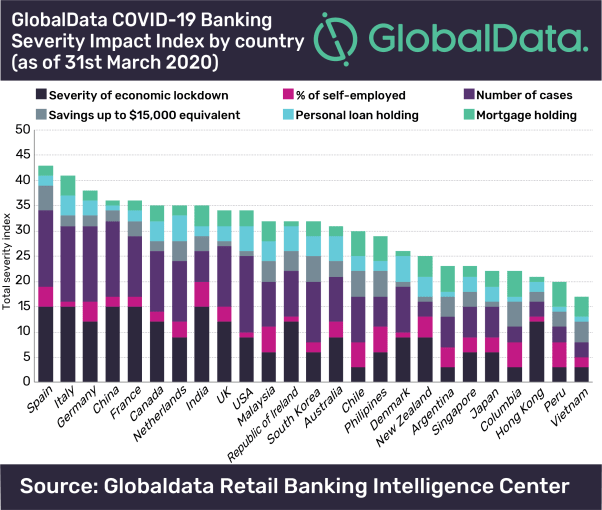

GlobalData’s COVID-19 Banking Severity Impact Index examines the level of secured and unsecured debt and emergency savings that self-employers possess

Which countries will suffer most from coronacrisis. Source: pixabay.com

The level of COVID-19 lockdown and number of cases shifts Spain and Italy to the top of GlobalData’s COVID-19 Banking Severity Impact Index.

Besides, the percentage of the self-employed population and those having savings of up to $15,000 make Spain score the highest, followed by Italy and Germany.

According to the report, banks will stay open during even the most severe lockdowns. Although, they should use this as a chance to push through digital transformation to stay in touch with customers.

At the same time, many banks won’t be able to handle higher numbers of telephone banking customers, thus leading to long waiting times for customers.

The report highlighted there will be a significantly high number of vulnerable personal and business banking customers worldwide during the next few months. Since they will need to contact their banks, only the banks with a strong digital presence will be best-placed to help and support their customers amid the crisis.

We’ve reported that changes in consumer behavior might lead to e-payments boom. This way, online, cashless, and mobile transactions would see long-term growth since people change their spending behavior to avoid contact with the disease.

SEE ALSO: