What does Worldpay, one of the largest payment services companies worldwide, offer?

Throwback Thursday: Worldpay’s ecosystem. Source: facebook.com

Most internet users today know at least one payment system – in most cases, PayPal comes to mind. However, it should be noted that this is not the only payment system operating worldwide.

PaySpace Magazine has considered the brief history and special features of Worldpay processing company.

History

There is an alternative payment system Worldpay, which was founded in 1993. Actually, it was founded in 1989 as a subsidiary of National Westminster Bank, and it was an electronic payment system. Nevertheless, it became the first electronic payment system operating in Europe. In 1994, Worldpay opened its own online store, which accepted several different currencies. Since 1997, Worldpay has begun its strong expansion due to the rapid development of the internet infrastructure and an increasing number of users connecting to the internet. It has opened many branches in various countries of the world and has become a truly global money transfer system.

In 2002, Worldpay was acquired by Royal Bank of Scotland Group, which was the 5th largest banking group in the world. In July 2019, it was acquired by FIS for $43 billion. Now Worldpay, unlike PayPal, provides full support for multi-currency services, transfers of funds from one currency to another and cross-border payments.

However, servicing a personal account in Worldpay is not cheap. Clients, in addition to the standard percentage (4.5%), will be charged an annual maintenance fee from each transaction on the account. As a result, this payment system can be positioned rather as a bank, operating online transactions, than a conventional electronic payment system.

Worldpay Merchant Services

Products & Services

Small- to Medium-Sized Businesses (SMEs) Services

Face to Face

- Card machines

- Payment via cell phones

- Integrated card payment services

Online

- Online payment gateway

- Online payment methods

- Online merchant account

By Phone

- Virtual terminal

Servicing a personal account in Worldpay is not cheap. Source: twitter.com

Larger Business Services

E-commerce expertise

- Airlines

- Digital content

- Gambling

- Travel

- Video games

- Retail

Online Solutions

- Partnership Opportunities

- Card Payments

- Alternatives

- Fraud & Risk Management

- Treasury services

- Gateway services

Multichannel & Face to Face

- Payment methods

- Tailored service

- Integrated Card Payments

Merchant account services

Worldpay is a direct processor, thus it carries out all clients’ transactions in-house. Consequently, no single operation is outsourced. And this feature is a really huge advantage, compared to its competitors. Working with Worldpay, there will be no need for you to deal with any third-party merchant account provider to authorize/process transactions.

Talking about technical issues, this feature also simplifies many points. For example, if a company is a direct processor, it handles all technical problems by itself (if there are any problems). Moreover, in this case, you’ll have only one single merchant ID, and you’ll be able to use it for all your payments and other transactions.

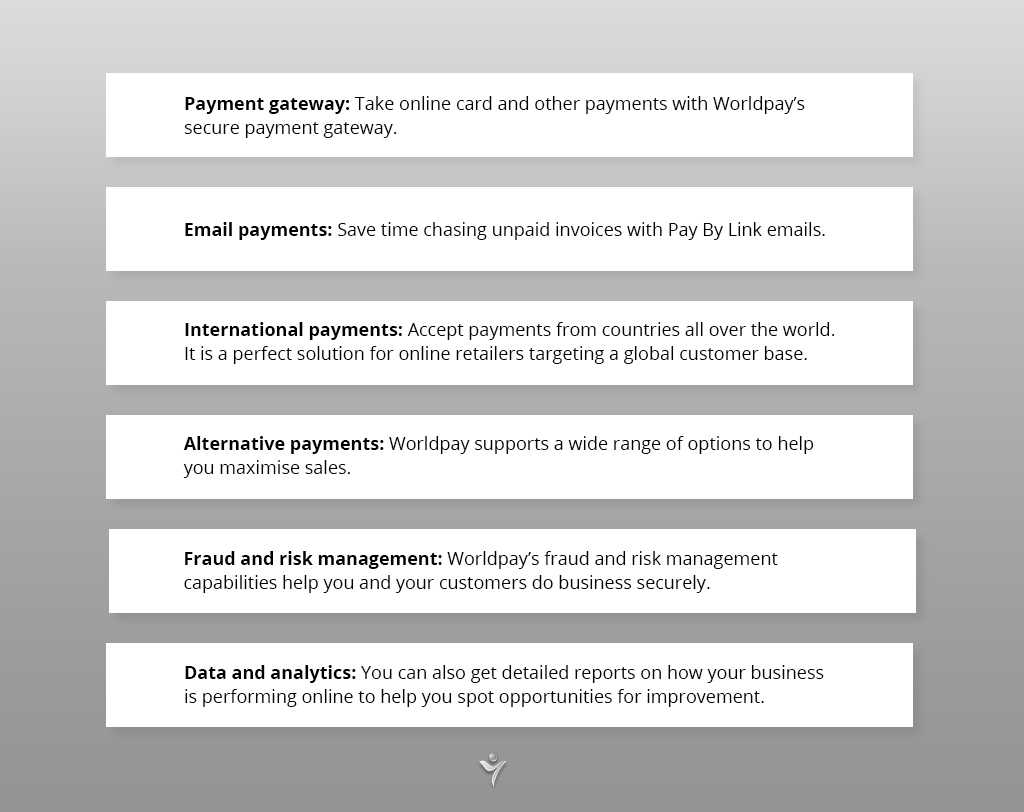

Online Payments

When it comes to online payments, Worldpay has a broad range of services. Furthermore, it covers the needs of businesses of all sizes, from the smallest to the largest. What is more, it doesn’t matter whether you need to set up a new solution or add an online payment option to the existing business, Worldpay will handle any issue related to online payments.

Here is what Worldpay offers:

Virtual terminal

In the case when you need to accept a payment through the phone or by mail, Worldpay can offer its virtual terminals. Basically, it gives you a secure payment point, which allows you to enter your clients’ card details whenever you want.

If you desire to use a conventional card machine, Worldpay will charge you £9.95 per month for its virtual terminal.

Bottom line

Pros

- Large international processor

- Interchange-plus pricing available

- 24/7 customer support

Cons

- Early termination fee of up to $295

- Three-year contract

- Misleading “free” terminal offer

FIS deal

American Fidelity National Information Services (FIS), a technology provider in the financial services industry, has signed an agreement to purchase the British payment operator Worldpay. Worldpay shareholders received 0.9287 FIS shares and $11 for each share.

Accordingly, the value of Worldpay is estimated at $43 billion, including debt that FIS intends to refinance. After completion of the transaction, FIS shareholders own approximately 53% of the company, while Worldpay shareholders own 47%.

SEE ALSO: