“Faster, higher, stronger – together” is not just a new Olympic motto, but an enhanced operation model scenario for payment gateway providers that deliver faster payment processing, higher conversion rates, and stronger financial performance, all united into a single orchestration-driven ecosystem.

A payment orchestration platform is a system that helps businesses manage all parts of the payment process in one place. It connects to multiple payment service providers (PSPs), routes transactions efficiently, handles retries (cascading), and includes tools for fraud prevention, reconciliation, settlements, and compliance. It also securely stores payment data (vaulting and tokenization) and provides detailed reporting and analytics. By bringing these functions together, the platform makes payment operations more efficient and easier to control.

Recent industry research shows that more than half of merchants globally use payment orchestration platforms to manage multiple payment gateways more effectively and increase the success rate of transactions. Adoption is especially high among e-commerce and large enterprise merchants looking to improve payment performance and streamline operations.

By rough estimations, the number of businesses using payment orchestration is growing by 19-25% each year. The total payment orchestration platform market was valued at around $1.5 billion in 2023 and is expected to grow rapidly, surpassing $6.5 billion by 2030.

Payment Orchestration Vs Payment Gateway Technology

While payment gateways and orchestration platforms serve similar purposes, they have a number of differences too.

Payment gateways are simple, purpose-built tools that securely transmit customer payment data to processors. They’re well-suited for smaller businesses making localized or low-volume online sales.

Meanwhile, payment orchestration platforms serve as an overarching layer that connects multiple gateways and providers, offering advanced tools for routing, fraud prevention, reconciliation, and analytics. This architecture benefits high-volume operations and businesses with complex global payment needs.

Let’s compare some of their main functions and capabilities:

As we see, payment gateways alone won’t satisfy business needs of the companies that actively scale across regions and currencies. Therefore, most of the payment gateway providers globally are expanding their offering suites with more orchestration solutions.

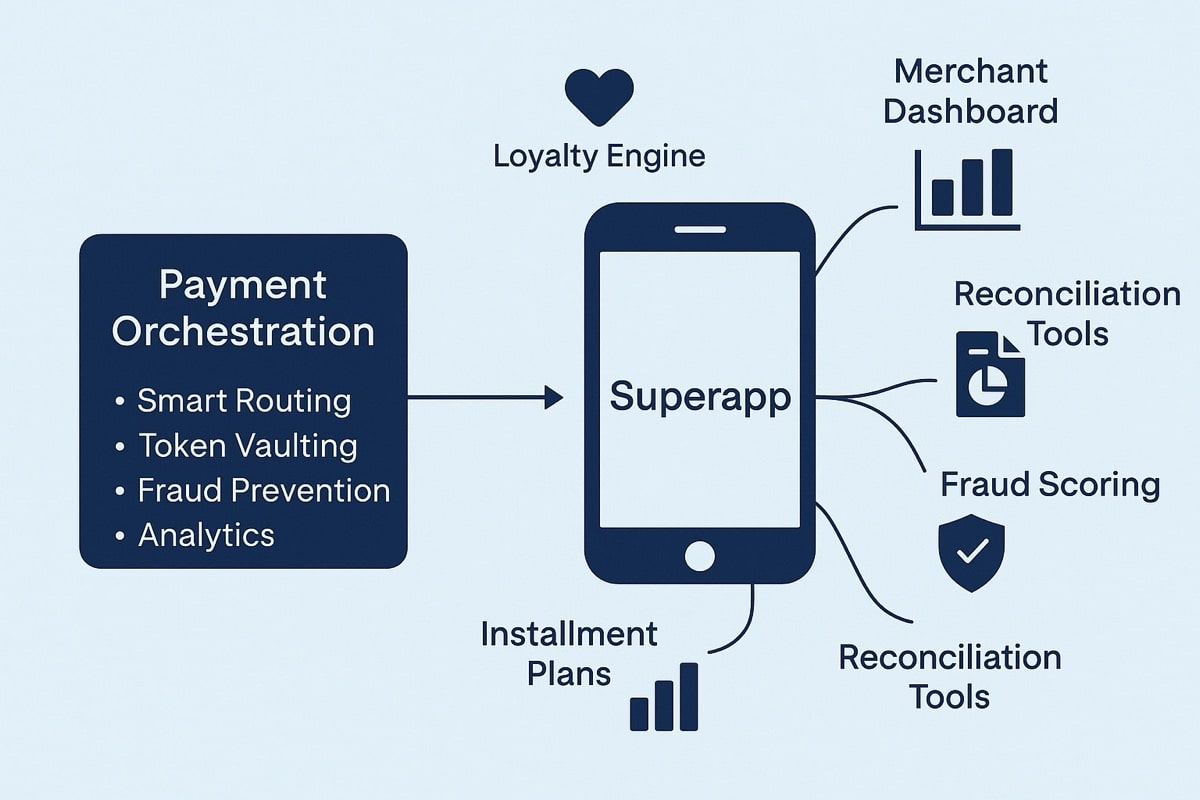

Furthermore, payment orchestration is the core enabler behind the transformation of traditional payment gateways into superapps that go beyond simple transaction processing to offer a wide array of integrated financial services.

How Payment Gateways Turn Into Orchestrated Superapps

Modern e-commerce environments have a modular structure. The platforms unite multiple functions, enabling merchants to provide all types of financial services beyond simple purchases in one place. Payment orchestration allows gateways to add:

- Loyalty engines;

- Merchant dashboards;

- Installment plans;

- Instant payouts;

- Fraud scoring;

- Reconciliation tools, and more, on top of payment processing integration.

These modular services are what allows gateways to evolve from a single-function payment tool to a flexible, intelligent superapp — a central platform where businesses and users interact with multiple financial functions, from e-commerce to embedded banking, under one login or API.

Superapps rely on delivering smooth, consistent, and fast checkout experiences. Although they plug into many backend providers, all these complexities are managed in the background, while user interface stays simple and powerful.

In this scenario, payment orchestration tools support:

- Smart routing to reduce transaction failures;

- Token vaulting for seamless one-click or even zero-click checkout;

- Analytics and personalization for dynamic pricing or promotional offers;

- Consent management for regulation and user trust.

When payment gateways gain the orchestration layer, they can become one-stop platforms, supporting multiple local and global PSP integrations, alternative payment methods (such as digital wallets, BNPL, or crypto), integrated risk engines, and other embedded finance tools. With the help of orchestration, gateways can seamlessly deliver complex services like in-app payments, lending, loyalty programs, and dynamic checkout.

Payment Superapps Use Surges Globally

Payment superapps with integrated gateway technology today serve over 4 billion of users globally and operate in a multibillion-dollar market with vast potential. In 2024, mobile commerce via super apps reached $2.8 trillion GMV, with 70% of global e-commerce transactions running through super apps and their integrated gateways.

The Asia-Pacific region leads in superapp use for digital payments, but other countries increasingly follow the lead. Asian providers set the user convenience and multi-functionality standard: 80% of super apps in the region now support extra financial services (loans, insurance, investments), powered by modular gateway and orchestration technology that routes transactions and enables regulatory compliance.

Gateway Providers That Evolved Into Payment Superapps

Super apps typically begin with a single core service, such as messaging, ride-hailing, or food delivery. However, embedded payment gateway and orchestration technologies allow them to quickly add and scale new features like loans, insurance, ticketing, and international payments. This flexible setup makes it easier for businesses to expand and diversify, which is key to how super apps grow around the world. Here are some of the most successful examples of evolution from single-function payment processing service to a financial service powerhouse.

WeChat Pay & Alipay

Both omnipresent Chinese superapps, WeChat Pay and Alipay, began with a single core function, and later expanded into superapp status by layering on additional services.

WeChat Pay function was added to a messaging service WeChat after two years of operations. From that point, it gradually expanded with e-commerce, ride-hailing, food delivery, utility payments, and various mini-programs (third-party apps inside WeChat) functionalities.

In turn, Alipay started as a simple online escrow service to support transactions on Alibaba’s platforms over twenty years ago. As payment technology evolved, the solution became the default digital wallet for the company’s marketplaces, and eventually added bill payments, wealth management, insurance, lending, mini-apps, and third-party services.

Today, Alipay has around 1.4 billion monthly active users globally, while WeChat Pay user number is nearing 1 billion. In China, Alipay covers more than half of the mobile payment market, and WeChat Pay is the second most popular payment platform with a 42% local market share.

Stripe

Originally focused on developer‑friendly card processing APIs, Stripe now offers Stripe Issuing services for both physical and virtual cards, Stripe Treasury tool for banking services, Stripe Capital lending solution, fraud protection, localized payout tools, payment orchestration, in‑dashboard analytics, and reporting within a single offering suite.

Stripe now serves over 4 million websites worldwide, across e-commerce, SaaS, nonprofit, and other segments. Last year, the company processed approximately $1.4 trillion in total payment volume. In 2025 so far, the volume processed is already around $1.05 trillion, reflecting continued strong growth at double-digit rates.

Adyen

Once founded as a global payment gateway focused on unified commerce, Adyen evolved into an end-to-end platform with smart transaction routing, tokenization, vaulting, and reconciliation functions. Beyond omnichannel payment authorization and settlement, the fintech company provides an integrated risk‑management suite, loyalty engines, data insights, and unified commerce tools that let merchants seamlessly manage in‑store, online and in‑app payments.

Adyen supports a diversified customer base across many verticals. In 2024, the payment technology provider processed a total payment volume of over $1.35 trillion, representing a 33% year-over-year increase.

Checkout.com

Over a decade ago, Checkout focused solely on helping merchants accept online payments. Today, the fintech’s orchestration API lets merchants plug into multiple acquirers, embed tokenized card vaults, apply dynamic routing rules, and layer in customizable fraud tools via a single integration.

Over the last few years, Checkout.com has demonstrated strong growth and improved operational scale, including an 80% payment volume increase in the US and expanded direct acquiring integrations in key markets like Japan, Saudi Arabia, with plans for Canada and Brazil in 2025.

The company’s vault now stores over 2.5 billion payment cards, while its AI-driven “Intelligent Acceptance” product optimizes around 26,000 payment transactions per minute, unlocking about $9 billion in additional merchant revenue with accelerated acceptance rates.

Rapyd

Rapyd’s global fintech network combines payments, payouts, virtual accounts, wallets, card issuing, fraud protection, foreign exchange, and compliance capabilities in one platform, acting both as a gateway and an orchestration layer for cross‑border commerce. The company operates in over 100 jurisdictions globally, offering an API-driven fintech-as-a-service solution.

The platform was once launched as a payment tool for cross-border transactions, but always had a focus on the embedded finance future. Today, only 60% of Rapyd’s processing flows, about $70 billion a year, involve cross-border collections and disbursements.

PayPal (with Braintree & Venmo integrations)

Braintree began as a payment gateway for mobile and web in 2007 and got acquired by PayPal in 2013, now being an integral part of the acquirer’s broader stack. PayPal’s Braintree integration and Venmo wallet are helping the company to evolve into a broader financial hub, combining wallets, buy‑now‑pay‑later (BNPL) functionality, peer‑to‑peer payments, and merchant promotions under a unified PayPal identity.

At the same time, PayPal’s journey towards an orchestration-driven superapp is still very limited. Thus, Braintree operates mostly within PayPal’s closed-loop ecosystem today. It’s not designed to manage multiple third-party PSPs or offer agnostic routing across competitors like Adyen or Stripe.

PayPal processed about $1.7 trillion in transaction volume in 2024, serving approximately 430 million active users and merchants globally. So far, the company has a stronger emphasis on consumer and merchant payments rather than purely enterprise payment infrastructure. It has also recently become one of the early enablers of agentic AI commerce payments.

Block (ex-Square)

Block launched in 2009 under the brand name Square with a POS device and software to process card payments as its core offering. Over the years, the company has not only rebranded, but also extended into banking, BNPL lending, payroll, and analytics solutions, aiming to be the go‑to platform for small businesses’ entire financial stack.

One of its notable advancements is crypto support integrated into a broader ecosystem of financial and commercial tools. Block already has a dedicated Cash App for crypto purchases and investments. Additionally, the paytech provider has tested merchant-level crypto payments through its seller tools and modular developer APIs that merchants use to build, customize, and orchestrate their own payments experience.

For 2024, Block processed almost $230 billion in payments. The company has also recently begun gradually rolling out its Bitcoin payment capability to merchants, using the Bitcoin Lightning Network for fast, low-cost transactions. It aims to reach all 4 million Block merchants by 2026.

What Does It Mean for Payment Gateway Providers?

The evolution of payment gateways into orchestration platforms marks a major shift in the digital commerce infrastructure. As I see it, transmitting transaction data between customers and payment processors is not enough anymore in the age when global commerce becomes more complex and both consumer and merchant expectations are more sophisticated.

Smart transaction routing, cascading retries, tokenization, fraud management, and embedded reporting are the norm rather than a rare exception today. Moreover, payment orchestration becomes a foundation for payment gateways’ broader evolution into end-to-end platforms supercharged with embedded financial services, from lending to insurance.

As demand for seamless, one-stop financial experiences grows globally, especially in e-commerce and mobile-first markets, orchestration capabilities give gateways the flexibility and modularity to scale offerings without overhauling infrastructure. In essence, orchestration is no longer a backend utility. It’s gradually becoming the strategic core of future-proof payment platforms, enabling providers like Stripe, Adyen, Rapyd, and Checkout.com to compete not only as payment processors but as end-to-end commerce ecosystems.