While global financial regulators are torn between which form of digital money – CBDCs or private stablecoins – fits better into their monetary systems, payment gateways and digital wallet platforms may decide which digital currencies will stick.

CBDCs vs Stablecoins

A recent U.S. legislation brought stablecoins into the spotlight. Clarity in regulation has shifted the stablecoin market from speculative hype toward utility and adoption. In particular, institutions and market makers were finally encouraged to put more capital and product support behind regulated stablecoins.

At the same time, other countries are still monitoring private stablecoins or restricting their use in favour of central bank digital currencies (CBDCs). A vivid example is China, which has pushed its e-CNY CBDC actively while keeping harsh limits on private crypto activity, including private stablecoin trading.

Now, what’s the difference between these two types of digital assets? On one hand, they’re very similar in function, non-speculative, and pegged to a fiat asset value. However, the distinction between CBDCs and stablecoins is essential. It’s about who owns the currency and related infrastructure.

As comes from their name, CBDCs are sovereign liabilities backed by the central bank’s balance sheet, running on a centralized blockchain network, and basically controlled by the government.

Meanwhile, stablecoins are typically privately owned. Their value is backed by corporate reserves or just maintained by smart algorithms. Stablecoins operate on public blockchains and face different AML/KYC requirements.

Many countries, like the EU nations, are already regulating stablecoin activities while also exploring CBDC potential. Therefore, payment gateway providers must also adapt to the existing and prospective digital money initiatives.

Should Payment Gateways Adopt CBDCs, Stablecoins, or Both?

CBDCs and stablecoins will largely compete for use cases at the margins. Both digital currency tools are considered for cross-border retail, programmable payments, and settlement convenience. In some jurisdictions, the payment provider choice will be limited by regulations.

Nevertheless, in many countries, CBDCs and stablecoins are also likely to coexist and interoperate. In this case, gateways and wallets become the neutral financial tool that routes, converts, and enforces compliance between private stablecoins, card rails, and central bank e-money.

Should they adopt both digital currency types or focus on the one most in demand? Well, without payment gateway infrastructure, none of the crypto assets technically allowed by the law to function will reach mass adoption.

Gateways and other fintech institutions, card networks, and acquirers deal with the APIs, tokenization, integrations, and merchant relationships. It depends on payment infrastructure whether a new asset becomes easy to use at checkout, in wallets, or in apps. With no practical utility or convenience, customer adoption simply won’t take off.

Boosting demand and availability of both programmable money types powered by smart contracts and blockchain technology brings payment gateways a number of benefits, while targeting just CBDC or stablecoin settlements limits those opportunities.

As both CBDCs and stablecoins offer near-instant 24/7 settlement and lower fees, more merchants will be able to participate in the ecosystem, where gateways can earn fees on token on-/off-ramp services, custody, settlement routing, FX and conversion, and other value-added services.

Hence, a practical way would be to discover a way to implement both digital money types into a gateway architecture. It works well with hybrid or modular structures that enable providers build token adapters and compliance modules that plug into existing rails so the gateway can switch on stablecoin/CBDC support incrementally without massive rewrites.

Obstacles and Challenges Payment Gateways Face While Dealing With CBDCs and Stablecoins

Now, it may all sound good in practice, but reality is a bit more complicated. Obviously, cross-border settlements are the one area where either CBDCs or stablecoins would be most useful. However, even establishing an interoperability between existing fiat payment systems on the international scale is harsh. When digital money is involved, even more challenges arise.

- CBDCs and stablecoins have different settings when it comes to risk, legal treatment, and who guarantees redemptions;

- The two assets have different tech and security demands, so a payment gateway may deal with several different blockchain integrations;

- As novel assets perceived as ‘risky’, stablecoins and CBDCs bring heavy KYC/AML, reserve/audit and licensing requirements in many jurisdictions, making non-compliance risk both high and costly;

- Supporting multiple token types requires liquidity management, intraday settlement mechanisms and possibly central-bank or custodian relationships — much more than trivial operational work;

- In CBDC access implementation, central banks control the technical access model (who can connect, how settlement happens) and policy tradeoffs (privacy vs. traceability, offline use, financial-stability safeguards), significantly limiting what private fintech firms can build on top;

- Payment gateway providers deal with patched, fragmented legislative frameworks when it comes to cross-border digital asset payments.

CBDC & Stablecoin Snapshot Across Global Economies

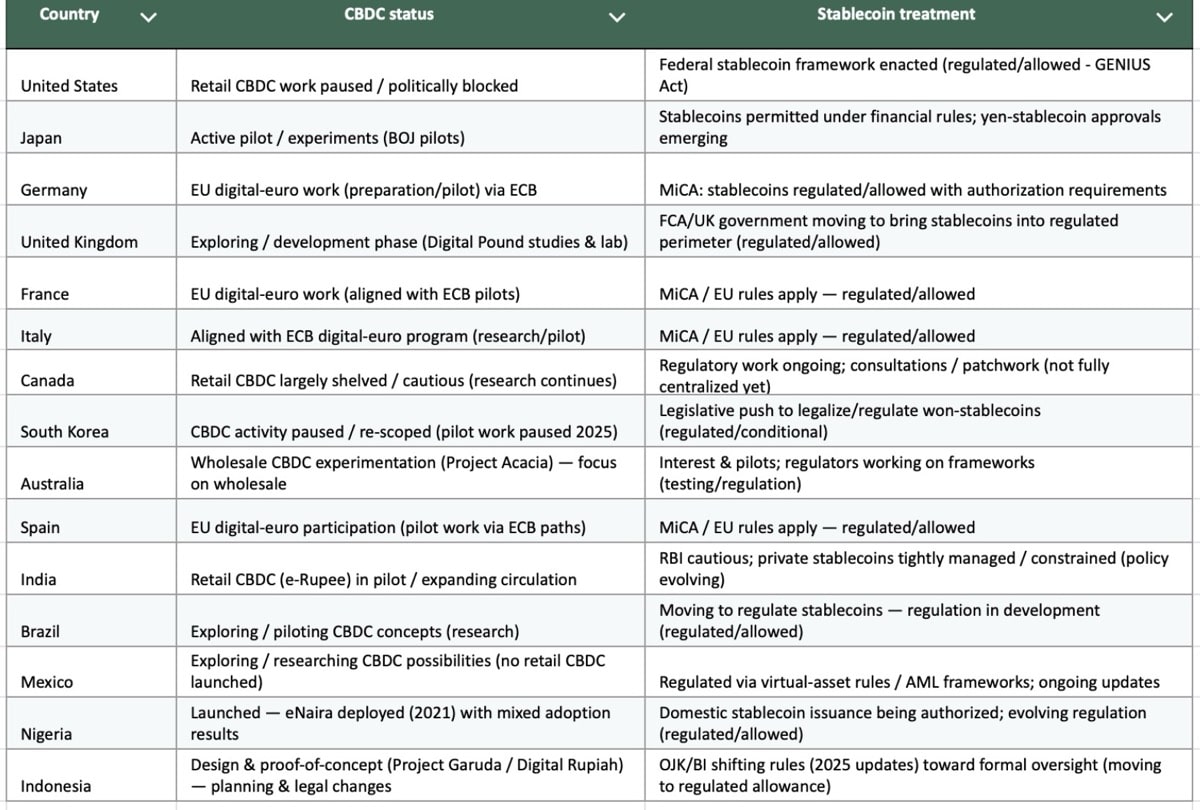

As of 2025, over 130 countries in the world explore CBDC opportunities, with 44 conducting CBDC pilots. However, only three economies (The Bahamas, Jamaica, and Nigeria) have rolled out CBDCs nationwide.

Meanwhile, specific laws and frameworks regarding stablecoins exist in approximately 10-12 countries and regions globally; however, one of them – the EU – has 27 member states with regulation implemented via MiCA.

Here is a quick overview of where selected economies stand on the matters of CBDC and stablecoin regulations.

Summary

The future of digital money may hinge less on regulators and more on payment gateways. While some countries push CBDCs and others opt for stablecoins, the real test is whether gateways make them usable at scale. These platforms decide if either asset works seamlessly at checkout, in wallets, and across borders. Adoption brings clear benefits, like instant settlement, lower fees, and broader merchant participation, but also faces tough challenges, from compliance burdens to fragmented laws and technical integrations. With both CBDCs and stablecoins advancing, gateways that can bridge them flexibly will play a decisive role in shaping global digital payment adoption.