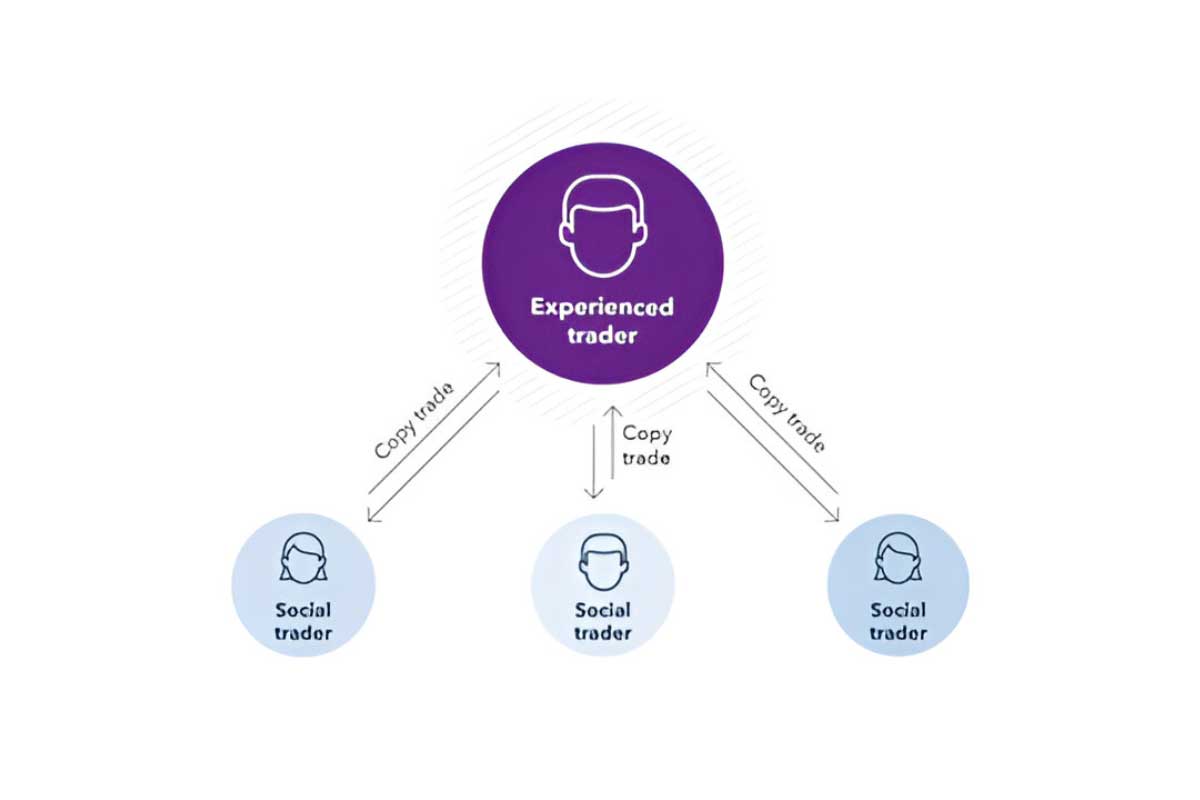

Copy trading has become incredibly popular recently. Platforms such as eToro, Bidsbee, Investmate, NAGA, and Bybit have opened up the opportunity for investors to automatically copy the trades of successful traders, allowing even those without sufficient knowledge and experience in the field to earn profits. In fact, copy trading can be quite profitable if you know how to use this tool correctly, including the need for analysis and monitoring of successful traders, risk minimization options, and capital protection strategies.

Is copy trading a viable option for income?

When you visit Bidsbee Social Trading or any other platform, you can find both those earning passive income through this method and traders actively trying to learn and adopt the strategies of successful professionals. In any case, you can always expect a certain profit level from copy trading.

Is there a risk of losing money?

Copying the trades of others does not guarantee success, as financial markets are inherently unpredictable. Market fluctuations, sudden economic changes, and unforeseen events can lead to losses even when following successful traders. However, potential losses can be mitigated through diversification and by setting stop-loss and take-profit levels.

Can someone make a living from day trading?

Any form of trading can be profitable and meet your financial needs. However, like other forms, day trading needs to align with your strategies and be in sync with market dynamics. It requires dedication and significant time investment, as day traders typically spend long hours monitoring markets, analyzing data, and executing trades. So, while you can expect excellent profits, understand that it won’t be an easy path.

How many hours do day traders work?

The working hours of a day trader align with market hours. Day traders often start early and remain active throughout the trading day.

How much money do I need to start copy trading?

The initial capital required for copy trading depends on the platform and individual factors. Some platforms may have minimum deposit requirements, while others allow traders to start with smaller sums. Additionally, the required capital amount can depend on the trader’s risk tolerance, trading goals, and desired level of diversification.

How to start day trading with $500 or even $100?

Focus on selecting affordable trading instruments such as low-cost stocks or derivatives. Consider options like micro-investments and fractional shares. Exercise caution if using leverage. Also, set realistic profit expectations and never overlook the opportunity to use risk management tools.

Challenges and considerations in copy trading

The main challenge you will face is carefully selecting traders, as not all traders can consistently perform well. You will have to conduct your own research rather than relying solely on the rankings of top specialists provided by the platform you intend to work with. This also requires continuous monitoring and evaluation to ensure that the performance of selected traders aligns with your trading goals.

Is it legal in the United States?

In the United States, this industry is regulated, so the platform you choose for trading should be licensed, confirming its operation within the legal framework. Working on such a platform, in this case, would be legal.

What issues can arise?

There are two main issues: choosing a reliable platform and selecting traders to follow. If you address these points successfully, the next steps involve asset diversification and risk minimization.

Pros and cons of copy trading

Advantages:

- Access to professional strategies;

- Opportunities for portfolio diversification;

- Potential for passive income;

- Speed and efficiency of operation;

- Opportunity to learn new approaches and strategies used by professionals.

Disadvantages:

- High dependence on the success of selected traders;

- Inability to influence trade execution even if you see the trader making the wrong decision;

- Requires monitoring and adjustments and does not eliminate the need for risk management.

Conclusion about Make a Living From Copy Trading

Despite being able to start your trading journey with minimal assets, you should also be aware of the Pattern Day Trading (PDT) rule that applies in the United States. This rule requires traders to maintain a minimum equity of $25,000 in their trading accounts. Such an approach helps protect inexperienced traders from excessive risk and potential losses. It also ensures that traders have sufficient capital to meet margin requirements and cover potential losses.

However, that’s not the only challenge, as you also need to find resources for emotional control, develop skills, acquire new knowledge, and cultivate discipline within yourself. Only with such an approach can you effectively manage risks, cope with the psychological pressures of trading, and achieve the profits you expect.