In an effort to boost sales, merchants strive to provide excellent customer experience and utmost payment flexibility. But does the variety of payment methods available on the e-commerce platform account for bigger revenues or scare customers away? We’re here to analyse a possible connection and decide whether the focus on payment variety is worth the effort.

The days when available payment methods were limited to credit and debit cards now seem something of a distant past, though the early forms of mobile banking came into existence only a couple of decades ago. The first digital wallets launched only in the 2010s, about the same time as P2P payment apps.

As the number of local and international payment methods skyrocketed within the last decade, so did the desire of retailers to offer as many alternatives as possible. At the same time, a 2022 research showed that, on average, mid-market and large enterprises offered 4.5 to 5 means of payment to their clients, while smaller businesses provided even fewer choices – about 4.2 payment methods. Not too many, right?

Here confusion may start creeping into your mind. Different studies have shown that customers prioritise the availability of their preferred payment methods as the most important condition to finalise their checkout. In fact, as many as 60% of e-commerce shoppers will abandon their carts if they don’t see their preferred payment method among the payment choices. And yet, out of all the variety, most businesses limit the payment options to 4-5 alternatives.

What looks like a paradox, is truly a logical solution. Now, let’s find out why more payment options do not always translate to more money or sales.

Why Multiple Payment Methods Are a Must?

To begin with, let’s clarify. Not too many payment solutions are the same as a single one. There are rare customers who use only one payment method for all their daily transactions, and there are rare merchants who limit their payment choices to one. It’s not a coincidence. The bigger the scale of the business, the more payment alternatives they are ready to provide. Why do we find multiple payment options to be a norm of modern e-commerce?

Increased Conversion Rates

Merchants offering multiple payment methods and, more importantly, choosing the ones their target audience prefers can increase conversion rates up to 30%. The logic is simple – the easier it is for someone to pay in their preferred way, the less likely they are to abandon their purchase. On the contrary, if a customer proceeds to the checkout and finds no familiar ways of payment, they face a tough choice – register for a mobile wallet or other service they don’t normally use or find another seller offering the preferred payment method. In most cases, buyers would choose the second option.

Customer Base Expansion

A diverse range of payment options enables merchants to reach wider audiences both at home and abroad. Different regions may have various popular preferred payment methods, so the variety of options is a must for businesses looking for a global reach. International shipping is an important growth area for many businesses. It unlocks more profit opportunities and greater customer base growth than local sales only. According to 2022 statistics, the average order value of an international sale is $9 more than the average domestic sale.

Increased Product Affordability and Accessibility

Besides, if a business adds some flexible payment options, like buy now pay later (BNPL) payment methods, it may attract more customers who would find the purchases unaffordable in other ways. Such payment alternatives are particularly popular among Gen Z and Millennials. Over 45% of consumers out of these age cohorts use BNPL, and nearly 60% of consumers across all generations prefer BNPL over credit cards due to the ease of payments, the simple approval process and lack of interest charges.

Cash Flow Optimisation

Some instant payment methods enable quicker transaction processing. This gives businesses greater liquidity, improving cash flow and the firm’s financial stability. Besides, customers are more likely to pay on time when they have flexible and convenient payment options. Fewer delays mean businesses receive money sooner and can use it for more investments or inventory transactions.

Increased Convenience

The availability of multiple payment options (credit/debit cards, digital wallets, bank transfers, etc.), helps businesses cater to the diverse preferences of customers and save their precious time. The easiest way to finalise a purchase is for someone to pay in their preferred way. Therefore, customers who don’t find their regular payment methods may find the checkout process too complicated and leave a site abandoning the cart altogether. In fact, over 50% of customers abandon their carts if the checkout process takes longer than 30 seconds.

Fewer Abandoned Carts

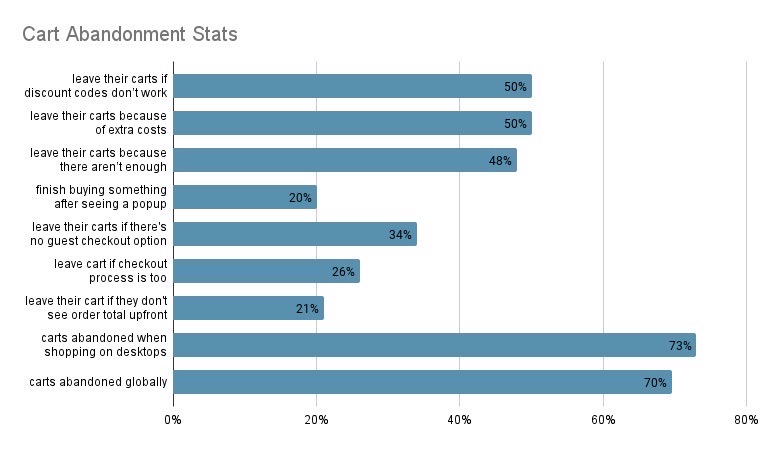

Cart abandonment is a real problem for e-commerce sellers. The estimated amount of money online retailers lose annually due to abandoned shopping carts is $18 billion. About 70% of carts are abandoned globally and nearly half (48%) of business buyers leave their carts because there aren’t enough payment options.

Adding Numerous Payment Methods Is Not Always Advantageous

Notwithstanding all those welcome bonuses, simply adding all possible payment methods to your checkout is not a healthy solution. Moreover, the presence of too many payment types may have an adverse effect and scare prospective buyers away. Why is it happening?

Checkout Distraction and Disappointment

The correlation between more payment methods and more sales is not always direct. Sometimes, the variety is overwhelming to a customer. Imagine proceeding to the checkout and seeing a cluttered web page with dozens of different logos and options. It looks chaotic and distracts online store visitors.

In addition, customers may face an issue of choice overload. This term describes a phenomenon when people have a harder time deciding from more options to choose from. They also end up less satisfied with their choice, and are more likely to experience regret. Clients who experience choice overload are not likely to return to the purchases at the place they were not happy to shop at in the first place.

Managing Multiple Payment Methods May Be Costly

Although many payment gateway providers offer plans with multiple payment options included, not all of your targeted alternatives may fit into a single solution. Merchants who need integrations with various payment processors, gateways, and systems may experience higher instalment and maintenance costs.

On average, payment gateways charge merchants 2-3% of the transaction value plus an additional flat fee per transaction. Multiple credit card processing fees alone may add up to form a hefty sum and lead to increased service fees for the end customers, which is highly undesirable.

Increased Operational Complexity

Managing a great variety of payment options can increase the administrative burden for the company, complicate accounting processes, lead to reconciliation errors, etc. Businesses with multiple payment gateways must handle many technical integration processes, reconcile different payment reports, and maintain relationships with numerous payment providers on a constant basis. It requires more working capital and working hours or even additional personnel.

Not all payment methods will be equally popular among customers. However, offering lesser-used or even rarely-used options still requires the business to manage their costs, technical updates and other complexities. If few customers are using a specific method, the cost of offering it might completely outweigh the perceived benefits, making it inefficient.

Security and Compliance Risks

Managing multiple payment methods also increases the exposure to security vulnerabilities. Each payment option comes with its own compliance standards (e.g., PCI DSS for card payments, GDPR for certain European methods). The more payment options you offer, the more standards you have to comply with, and the more difficult it becomes to ensure that all security and regulatory requirements are met. That could potentially increase the risk of data breaches or non-compliance penalties.

What Does the Correlation Between Additional Payment Methods and Sales Look Like in Real Life?

Different studies have shown that a merchant does not have to offer all the possible payment methods to be successful. However, businesses should ensure that they always offer at least the top three payment methods in a given market. Providing the top three alternatives instead of only the one which is most popular, can increase conversions by up to 30%.

To understand current payment trends and local payment preferences, one needs to operate up-to-date transaction analysis and survey data. At the same time, lack of visibility of payments/customer data is a problem for nearly half of all businesses in Europe, becoming a specifically pressing issue in the UK, Spain and Lithuania. Lack of data visibility is one of the reasons why so few merchants in the region currently offer multi-currency options or fail to deliver a properly customised checkout experience.

There is currently no comprehensive data that would clearly show a correlation between offering multiple payment methods and sales boost in the same location. Perhaps, some future research would shed a light on it. At the same time, when we compare regional data, there is no striking difference in sales or revenues between the countries with few payment methods typically offered and those with greater variety.

UK vs France Case

For example, in the UK, 97% of merchants offer their clients to pay with card schemes, with mobile wallets the only other method offered by three-fourths of all merchants (75%). However, the UK used to have Europe’s biggest B2C e-commerce market in 2021. UK consumers spent over 250 billion euros on online purchases, roughly twice as much as the citizens of France, who ranked second.

These two countries have approximately the same population number, so can be easily compared in the respect of market size. Meanwhile, the average number of payment options offered in France was between 2.9 and 3.3. back in 2015 and has surely grown since.

The UK also has comparably low cart abandonment rates (36% vs 63% in Germany, for instance). We may conclude that local consumers in the UK don’t really need a wider variety of payment options and are quite satisfied with offered choices. However, in France, between 80% and 89% of online shopping baskets created by users in different shopping modes (mobile, desktop, etc) did not result in a completed order in the first quarter of 2023. The reasons may vary, but dissatisfaction with payment variety is typically also one of them. Thus, as we can see, the desired payment methods versatility depends on the market and is not universal.

Conclusion

There is currently no comprehensive data that would clearly show a correlation between offering multiple payment methods and sales boost in the same location. Perhaps, some future research would shed a light on it. Meanwhile, we can see that simply offering a larger number of payment alternatives is not enough to make consumers feel comfortable.

Firstly, merchants should choose a correct payment method mix for each location, and almost half of them lack proper data to make informed decisions. Secondly, when you go overboard with the variety, it can also lead to a high cart abandonment rate, as user experience suffers from overwhelming choices. Besides, too many options come with extra maintenance costs.

As with many concepts, payment variety needs a golden middle to bring you some benefits. Surely, there is no need to focus on a single payment method available, customers do love flexibility. Choose a few additional alternatives based on your target audience preferences and make sure to not make the selection static, as customer tastes and choices change with time. Once you’ve narrowed down your options, it’s essential to look into the costs and potential risks. Such a thorough analysis will help you ultimately create the best checkout experience and build customer loyalty.