Today, AI powers pretty much everything in payments and banking. From fraud mitigation to offering personalization, artificial intelligence makes fintech services faster, simpler, and more efficient. Transaction routing is not an exception. AI-driven routing is a powerful tool to improve payment efficiency and success rates. Are there any pitfalls here? For sure. So let’s explore both opportunities and risks of AI payment routing in this article.

Basics of Transaction Routing

When a customer initiates a payment, a lot of fintech “magic” happens behind the scenes. When a payment gateway or processor receives a request for a transaction, it needs to evaluate multiple available acquirers and payment networks to figure out which route a particular transaction should take to reach its destination most efficiently.

Transaction routing takes into account multiple factors such as cost, speed, success rate, currency, geography, and payment method to select the optimal way to process the payment. While some purchase environments are simpler (e.g. transaction processing within one country, with both sender and recipient sharing a payment network), many e-commerce settings are much more complex, especially when it comes to cross-border transactions.

Why Transaction Routing Is Important

Evaluating all the nuances for hundreds of transactions per second is no job for a human. Therefore, the decision-making process is automated. Traditionally, transaction routing is facilitated by rules-based engines, but with the rise of AI, that process also gets “smarter”. The integration of AI into payment routing is no longer optional but a necessity for future-ready infrastructure, as transaction volumes grow along with available payment rails.

Is it a basic requirement for payment processing? Not imperatively. Even without routing, merchants and payment providers might send every transaction through a fixed path.

However, it won’t always be advantageous. Using a single path for every transaction can result in:

- extra costs, making transactions unsustainable;

- lower success rates for particular types of payments;

- slower settlement;

- poorer scalability of a payment system as the business expands and has to deal with varying customer preferences or local regulations;

- customer dissatisfaction with high failure rates;

- payment processing delays, etc.

AI-Powered Routing Vs Rules-Based Engines: What’s the Difference?

If a rule-based engine were a car navigation system, it would be static, rigid, like the one that uses offline maps and doesn’t allow for alternative driving routes. Meanwhile, the AI-driven routing system is flexible. It updates in real-time, takes into account unexpected changes or obstacles to the planned path, and helps one adapt to the altering conditions.

At the same time, a rules-based engine is more predictable and transparent in its logic, which might be advantageous for many business applications. For instance, rules-based engines might follow predefined, static instructions like “If the transaction occurs in India, use Acquirer A; if it happens in Europe, use Acquirer B”. The rules are created for locations, transaction amounts, and other factors, but they cannot change automatically when a situation changes (e.g. costs rise, speed falters, regulations get stricter).

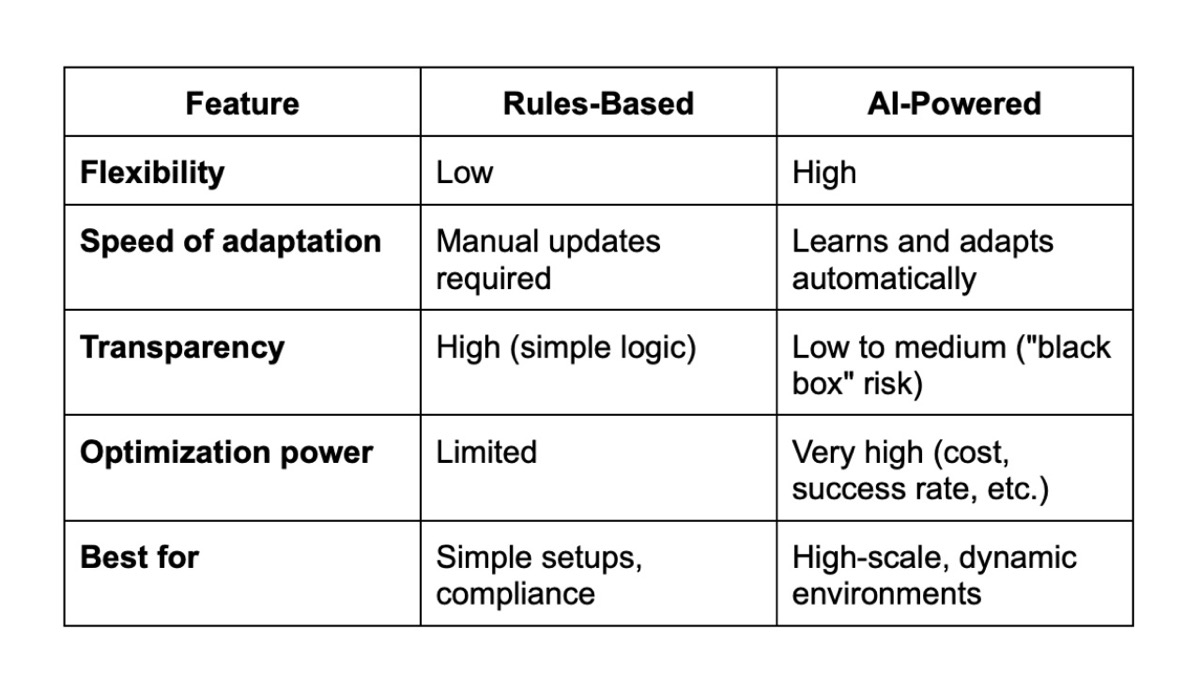

Here is a simple comparison of both routing types.

Benefits of AI-Driven Routing

The use of artificial intelligence for transaction routing purposes is rightfully seen as the next step in automated payment processing. Machine learning helps AI-driven systems navigate the transaction route maps much more efficiently, continuously optimizing their decisions for better cost, speed, and success.

Their advantages are best seen in numbers. Thus, on average, AI-driven routing can achieve:

- 10-15% increase in approval rates, directing transactions to the most effective acquirers based on a combination of real-time data and historical approval patterns;

- 20-25% recovery of soft declines (e.g., insufficient funds, temporary restrictions) via dynamic retrying with optimized timing and alternative routes;

- 4-6% improvement in success rates across all payment methods compared to random or static routing;

- 20-25% improvement in success rates for cross-border transactions due to better processor selection and continuous adaptation to complex regional payment regulations;

- 30-40% transaction cost reduction by avoiding expensive or unreliable routes and minimizing failed transaction attempts;

- up to 50% reduction of transaction latency, boosting both customer experience and business liquidity with faster payment processing.

Downsides of Using AI for Routing Optimization

As it happens with every emerging technology, AI-driven payment routing comes not just with numerous benefits but also with a set of downsides and risks to consider.

Tech Complexity

To begin with, AI routing isn’t the most technically simple solution. Its implementation and maintenance involve integrating with multiple acquirers, constant access to fresh, high-quality data, advanced payment infrastructure and tech stack, and periodical retraining of machine learning models.

Data Protection and Privacy Concerns

As their precision requires leveraging plenty of financial data, both local regulators and customers may have privacy and data protection concerns. Questions often arise regarding how to ensure that only necessary data is used or how to check if the data you consented to provide for payment processing is leveraged for this purpose only.

While certain legal and technical mechanisms to protect against misuse do exist, their effectiveness varies depending on implementation, regulation, and enforcement. Therefore, there’s still an ongoing risk that sensitive private payment data may be reused for profiling, marketing, or fraud modeling outside of routing, often unintentionally or by third parties.

Black-Box Considerations

The decision-making process in AI systems may be much faster and smarter than the one used by rules-based engines. However, it’s also quite opaque. AI systems operate with such complex algorithms that even their own developers cannot explain what exactly guided them in a particular routing decision.

This opacity makes auditing harder. It is also challenging to hold AI systems accountable for sub-optimal decisions as their rules are not as simply described as those for plainer engines. Payment providers must also be careful about possible bias that might occur in AI-driven routing patterns. Black-box AI models can even lead to legal trouble if they produce decisions that cannot be audited or justified, such as unexplained transaction denials or discriminatory outcomes.

Limitations Come From Acquirer Capabilities and Over-Reliance on AI

Although AI handles routine decisions, human employees should still regularly monitor the payment processing flows and intervene when they spot too many errors or unintended consequences. While AI enables dynamic, real-time adjustment of routing rules, over-reliance on automated mechanisms may lead to unintended consequences that may be treated as bias or discrimination and negatively affect the company’s reputation. For instance, transactions from certain countries or regions might be routed through higher‑cost or lower‑priority acquirers, or else, customers using bank cards from smaller or local banks may get routed through less reliable or more expensive paths compared to BINs from large global issuers or major networks.

As intelligent routing is enabled by multiple acquirer support, not all the acquirers support AI-driven dynamic routing equally. Many legacy infrastructures may not properly sustain these advanced capabilities. Thus, less advanced acquirers may only allow static routing or delayed responses, reducing the AI’s ability to adapt in real time. Besides, legacy acquirers may need additional manual checks or have slower fraud detection engines, adding to overall transaction latency.

Mitigating Concerns for AI-Powered Payment Routing Systems

Despite all the concerns and issues listed above, payment providers and merchants realize that AI payment routing is well worth the effort, as its efficiency far outweighs existing concerns. Though not to be overlooked, AI-linked risks can and should be mitigated.

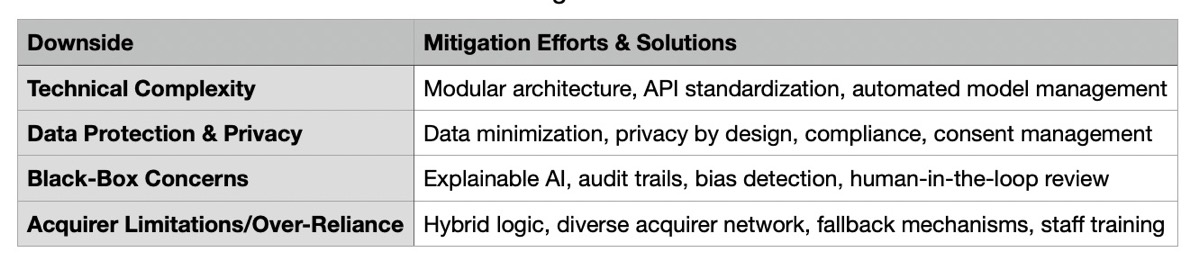

Here’s what the payment industry is doing so far to address black-box and other concerns in using AI-powered payment routing engines:

Let’s dive into some of these points in more detail.

Modular, Microservices‑Based Architecture Simplifies AI Implementation

When each payment service (e.g., routing logic, fraud detection, settlement, reporting) has infrastructure boundaries and is not interdependent with other components of the payment processing engine, you can develop, test, and deploy the AI routing service without heavily impacting the rest of the stack.

With microservices, you can give each service the exact amount of resources it needs, roll out and roll back new components seamlessly. Besides, updating your AI model or feature flags doesn’t require rebuilding or retesting unrelated components.

The given architecture benefits are supplemented with other handy technologies. Thus, standardized APIs and SDKs simplify connections to multiple acquirers, while automated pipelines ensure regular retraining and validation of AI models without extra fuss.

Automated Consent Management & Privacy by Design Help Control Proper Data Use

Automated consent management platforms give users clear, granular control over what part of transaction data they share and for what purposes. By capturing and enforcing consent preferences in real time, these systems ensure that AI‑routing engines only access data fields the customer has explicitly approved. Whenever a routing model needs new or different information, the platform prompts for updated consent and logs every grant or revocation, creating an auditable trail that prevents unauthorized data use. For even better transparency, emerging projects focus explicitly on decentralized blockchain‑backed consent registries tailored to fintech and payments compliance.

Privacy by design embeds strong data‑protection measures directly into every stage of the routing system’s lifecycle. From the outset, dedicated AI models are built to collect only the minimal data necessary and to process it solely for routing optimization, not additional purposes. Techniques like pseudonymization, role‑based access controls, and encrypted data stores are architecturally enforced, so even developers and AI engineers can’t inadvertently misuse sensitive information.

Explainable AI (XAI) Coupled With Audit Trails Makes AI Decisions Understandable

Explainable AI (XAI) uses tools like SHAP values or decision-tree models to “peek inside” the AI logic and figure out which inputs influenced the decision most. It helps make AI routing systems easier to understand, turning them from “black boxes” into more transparent structures. Instead of just showing the final result (like why a transaction was routed or flagged), XAI tools break down what influenced that decision most, e.g. card type, location, or amount. If banks and payment providers can clearly explain their AI’s behavior, they not only meet legal requirements but also build trust with users and auditors, making AI systems fair and accountable.

As an addition to XAI, audit trails maintain detailed, immutable logs of all AI-driven decisions and the data inputs involved. That enables post-event analysis and thorough auditing of the AI system’s exact rationale, further ensuring accountability and traceability. This capability is critical for legal defense, regulatory examinations, and continuous improvement of AI models. Together, these two tools can form a robust framework that mitigates the risks associated with black-box AI systems, fostering transparency, fairness, and trust in AI-powered payment routing.

Hybrid Routing and Diverse Acquirer Network Help Payment Systems Stay Flexible

Hybrid routing is a good choice for those payment providers who want to avoid over-reliance on AI. It combines rules‑based logic with AI‑driven optimization. This dual approach lets the payment engine switch tactics in real time depending on the situation. For instance, when data is predictable, fixed rules keep costs low and compliance clear. However, when patterns shift, the AI model takes over, testing multiple paths and learning which acquirer gives the best approval rate, latency, or fee structure. A smart interchange between rule sets and machine learning keeps the system responsive without downtime.

A diverse acquirer network adds another layer of resilience to the payment system. By connecting to local, regional, and global acquirers, the platform can reroute traffic if one partner faces an outage, regulatory restriction, or pricing change. This geographic and functional spread reduces single‑point risk and allows merchants to tailor routing to each market’s card preferences, fraud profile, and cost structure. Together, hybrid logic and acquirer diversity create a flexible payment stack that adapts smoothly to volume spikes, new regulations, and evolving customer behavior.

Regulators Increasingly Address Black-Box and Privacy Concerns Linked to AI Systems

AI risks and potential bias don’t go unnoticed by the global regulators. Many countries, like the U.S., Canada, the UK, and Brazil, have introduced some kind of legislative proposals to address the existing concerns.

The EU has gone further in these efforts, having officially adopted a comprehensive AI Act in 2024. The legal framework is gradually entering into force throughout 2025–2026. It classifies AI systems based on their risk and sets specific obligations for each category. Payment decision-making systems, like AI-powered routing and fraud detection, fall under the “high-risk” category, meaning they face stricter rules, including:

- Risk assessments before deployment (like a Data Protection Impact Assessment, but AI-focused);

- Transparency and explainability;

- Human oversight to prevent full automation without fallback options;

- High data quality standards to avoid biased or discriminatory outcomes;

- Robust documentation and auditability for regulators;

- CE marking and registration in a public EU database of high-risk AI systems.

Therefore, as AI-based payment routing systems evolve, so does the relevant regulation. In the nearest future, these systems will need to align with not just data privacy laws (like GDPR or CCPA), but also AI-specific risk, transparency, and oversight rules, which might vary across destinations.

Bottom Line

AI-powered transaction routing is a game-changer for payment efficiency, but it’s not without its risks. While it delivers smarter decisions, higher approval rates, and lower costs, it also introduces technical complexity, data privacy concerns, and regulatory pressure. To stay competitive and compliant, payment providers must balance automation with transparency, flexibility with control, and innovation with responsibility. The future of payments depends on doing AI right.