To ensure compliance and risk minimization, KYC/AML processes need to be both flexible and automated. How can payment gateways and fintech companies achieve that and keep pace with legal requirements without stifling innovation? Here’s how AI technology can help.

An average bank spends about $50 million each year to boost its resilience against financial crime. Some banks are splurging as much as $500 million annually to improve and manage their Know-Your-Customer (KYC) and Anti-Money Laundering (AML) processes. The global amounts of financial crime compliance spending far surpass $200 billion a year. Impressive, isn’t it? And it’s not nearly the end limit.

In 2025, financial service providers of different kinds face heightened financial crime risks due to the fast pace of technological advancement, the increasing capabilities of malicious actors, the rising volume and complexity of cyber threats, and the intricate web of interconnected financial systems and dependencies across institutions.

Therefore, KYC and AML are not just regulatory checkboxes to tick for payment gateways. They’re essential components of user trust and operational integrity. With proper KYC/AML policies and technologies in place, payment providers can scale safely across borders, onboard users quickly, and prevent financial crime in real time. At the same time, the path towards seamless compliance is not always smooth.

Why We Need AML and KYC Procedures

Know-Your-Customer (KYC) is a legal requirement for a financial institution, fintech company, payment provider, and other regulated entities to verify the identity of users leveraging their products and services. It is important to know whether your customers are who they say they are and whether they have a criminal record or high-risk profiles to prevent criminal activities, identity theft, money laundering, and other types of illicit activities.

Anti-Money Laundering (AML) procedures are designed to prevent criminals from disguising illegally obtained funds as legitimate income and protect financial systems from being exploited for criminal purposes such as drug trafficking, terrorism financing, tax evasion, or corruption. To do that, financial institutions and other regulated entities must report suspicious transactions to authorities. Identifying a suspicious activity, in turn, requires continuous monitoring and analyzing financial transactions.

How Fintech Entities Deal With KYC/AML Requirements

When onboarding for a selected financial service, customers must go through a brief registration process which includes identity and address verification. There are various mechanisms for that, starting from uploading an ID scan or taking a live online photo to using biometric authentication.

Today, KYC checks increasingly happen behind the scenes with minimal user effort. Frictionless KYC is especially popular in digital-first environments like fintech apps, payment gateways, and neobanks. The info required for a verification process can be obtained on the back end from trusted databases (e.g. credit bureaus, mobile networks, government APIs). This way, the necessary data can be pre-filled. Countries that have verified digital ID systems (like BankID or Aadhaar) allow users to prove identity with a single click or biometric scan.

At the same time, many jurisdictions still require explicit consent or manual document capture, especially for high-risk users or transactions, which adds friction to the onboarding process.

Fintech entities constantly need to balance compliance with KYC and AML requirements with user experience and scalability, leveraging a combination of technology, risk-based strategies, and partnerships to achieve that fragile golden mean.

Typically, fintech companies streamline KYC by automating user verification through:

- eKYC tools: use AI to scan and validate government IDs, selfies, and biometric data.

- Database checks: cross-reference customer data with public records, credit bureaus, or telecom databases.

- Liveness detection: prevents AI and social media-powered fraud by verifying that users are real people, not stolen photos or deepfakes.

- To reduce friction and costs of KYC checks, fintechs often use a tiered verification system, where low-risk users (e.g., small account balances, domestic use) go through minimal examinations, while high-risk users (e.g., large transactions, crypto exposure) face more thorough due diligence, including enhanced KYC and source-of-funds verification.

After the onboarding stage, fintechs continue to monitor user activity to detect potential financial crime:

- Transaction monitoring: rule-based or AI-driven monitoring systems flag unusual patterns (unusual location or device, extra expensive purchase, uncommon shipping option, simultaneous multiple orders, delivery address different from the billing address, etc.)

- Customer risk profiles: a combination of automated systems and risk engines assigns risk scores based on user behavior, geography, business type, etc., some of the profiles are manually reviewed by compliance experts.

- Ongoing screening: customers are continuously checked against sanctions, PEP (Politically Exposed Persons) lists, and other watchlists.

If something looks suspicious, the company should file a Suspicious Activity Report (SAR) to regulators.

To confirm their regulatory compliance, fintechs must also:

- Maintain detailed audit trails and logs of all their KYC/AML activities.

- Store customer data securely, following GDPR or local data privacy laws.

- Train staff and implement compliance policies, even if they rely heavily on automation.

Many payment businesses partner with RegTech providers to manage KYC/AML processes via API-based plug-and-play solutions for ID verification, AML screening, and monitoring.

AML and KYC in Payment Gateway Tech Stack

When a merchant or a customer signs up to use a payment gateway, the platform collects necessary data, like name, address, company registration details, tax IDs, beneficial ownership structure, and other details required by local regulatory authorities.

Depending on the setup and eKYC infrastructure available, the business representative might need to upload some verification documents such as government-issued IDs, proof of address, and business licenses. In some cases, these documents are available in trusted databases so that the user only needs to go through biometric authentication or use an e-signature to complete the verification stage.

All the users undergo a screening process while onboarding to make sure they’re not under some kinds of sanctions or linked to terorism/criminal activities. Even after the initial verification, automated screening systems conduct periodic checks against updated sanctions lists to catch newly listed entities.

Once onboarding is complete, gateways monitor all the transactions processed on the platform. Each customer is dynamically assigned a risk score that adjusts with their activity changes. Sudden spikes in activity, inconsistent geographies, or odd timing patterns trigger risk alerts. In addition, enhanced due diligence (EDD) red flags appear when certain thresholds or rules are breached. In suspicious situations, the gateway might suspend payouts, block merchant funds, and request additional documents.

Payment gateways often use regtech solutions to ensure onboarding, verification, and monitoring compliance. Some of the popular tools are:

- Onfido (Entrust) – the API-driven tool is verifying government-issued IDs (passports, driver’s licenses, etc.) and matching them to a real-time selfie or video. It also enables payment gateways to orchestrate verification processes combining both document and biometric verification.

- Trulioo – has KYC, KYB and AML capabilities, verifying individuals and business entities in over 100 countries using public records, credit data, watchlists. The solution is suitable even for hard-to-verify jurisdictions.

- Jumio – AI-powered identity verification platform enabling real-time KYC onboarding with selfie-video, OCR ID checks, adaptive fraud detection, and risk scoring.

- Alloy – the tool creates automated decision workflows for onboarding, fraud scoring, and compliance triggers.

- Chainalysis – specializes in blockchain analysis and crypto transaction monitoring, which supports AML (Anti-Money Laundering) compliance for firms dealing with crypto wallets.

When KYC/AML Verification Becomes a Bottleneck for Payment Processing

Though necessary, KYC and AML checks can become significant obstacles for payment processing, if not automated and configured properly.

A merchant or customer can’t process or receive funds until their ID and documents are reviewed. Since manual KYC checks are slow, onboarding can take hours or even days, preventing users from transacting, and causing cart abandonment or user drop-offs.

In case when AML engines rely on static rules, they do not account for larger context or flexible transaction patterns. They may label legitimate transactions as fraudulent. In fact, about a half of all online orders flagged as suspicious prove to be legit. False declines lead to unnecessary investigations, wasted time and resources, reputational losses, not to mention customer dissatisfaction.

Many KYC systems fail to assess the client/transaction risk levels accurately due to the reliance on too little internal data rather than getting access to larger trusted databases. Besides, risk scoring may rely on overly rigid rules. Thus, inconsistent or too conservative risk scoring can label low-risk users as high risk, causing unnecessary friction.

Operating across multiple jurisdictions brings another major challenge – dealing with multiple regulations and compliance standards that might change over time.

Another problem is lack of real-time verification. When transaction monitoring systems batch process data or update risk scores only from time to time, suspicious transactions can go unnoticed or falsely trigger freezes too late.

Today, more and more traditional financial institutions partner with cryptocurrency service providers. In this case, KYC and AML processes face more obstacles like reactive fraud prevention techniques and user anonymity.

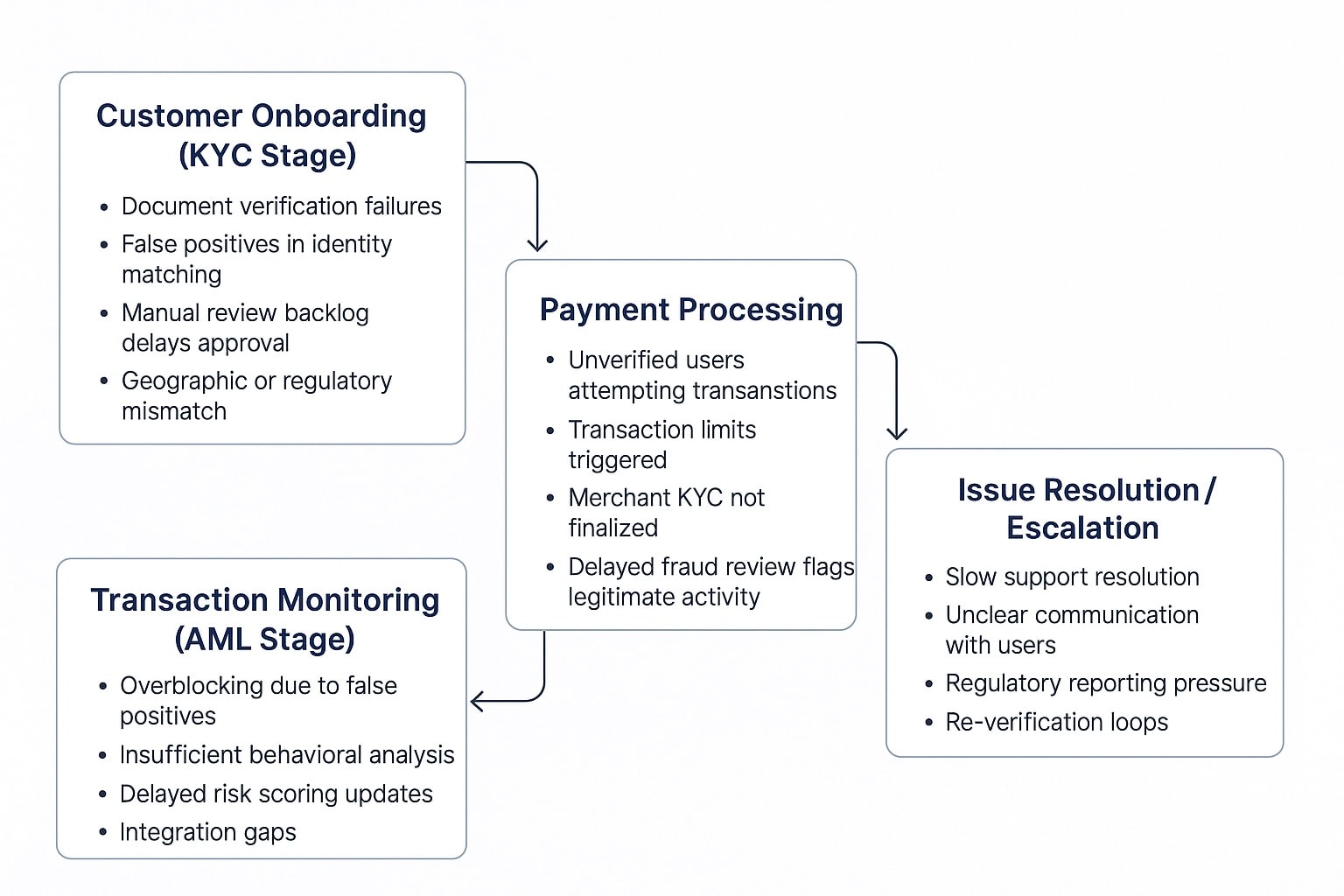

Here are some of the other most common issues appearing throughout the compliance journey:

How to Improve KYC/AML With the Help of AI and Advanced Blockchain Tech

Automating KYC and AML compliance is essential for payment gateways in 2025, as fraud threats evolve and regulatory pressure intensifies.

AI plays a central role in streamlining compliance, without adding too much complexity and friction to user experience. AI-based facial recognition and document verification can validate IDs in seconds, cross-checking global watchlists and public records in real time.

Facial recognition and liveness detection are now standard in payment gateway KYC. Most gateway platforms combine biometric face mapping with document digitization, aligning facial data with photo IDs and confirming the user is present, not a deepfake or still image.

The AI-powered analytics tools can also help extract, summarize, and categorize compliance data from unstructured sources like sanctions lists, regulatory texts, and news articles, easily expanding the scope of data screening systems rely on. Payment gateways deploy these AI systems to seamlessly scale across multiple geographies and regulatory regimes, rapidly adapting screening and reporting requirements for every market. therefore, using AI gives payment gateways the benefits of lower manual review rates, reduced onboarding times, and better scalability across regions.

AI models are also much more efficient than traditional rule-based systems. They enable dynamic risk scoring, adapting thresholds in real time based on user profiles, transaction history, and contextual data. Real-time transaction screening avoids blanket freezes typical for batch verification, enabling legitimate payments to flow uninterrupted. Some payment processors also use AI to automate chargeback and dispute responses, increasing win rates and reducing operational overhead.

However, as the fraudulent techniques get more sophisticated, using AI alone is not enough anymore to protect a financial system. The emerging trend is combination of AI with blockchain and decentralized databases.

It enables perpetual KYC, that reviews customer risk profiles in a continuous, event-driven manner. Such KYC systems record auto-update as new data appears, reducing costly manual refresh cycles and accelerating regulatory compliance. Due to the immutable nature of blockchain, these records remain open for future use at all times.

Powered by blockchain, Decentralized Identifier (DID) technology gives users control over their credentials while allowing gateways to verify authenticity from trusted sources. This new type of identity verification are made up of a string of letters and numbers that act like an identifying address on a blockchain and are independent of any organization.

Along with verifiable credentials (VCs), DIDs act as a privacy-friendly alternative to centralized and proprietary authentication services. Due to their emerging nature, these two tools are currently not sufficient for undoubtedly proving an identity, but can be helpful in combination with other ID verification methods.

As the technology develops, users might be able to present proofs on-demand via digital wallets using secure cryptographic verification instead of payment gateways collecting and storing personal data, which increases their liability. This could be a valuable addition to tokenization use, data vaulting, and federated VCs which are the most popular sensitive data sharing tools today.

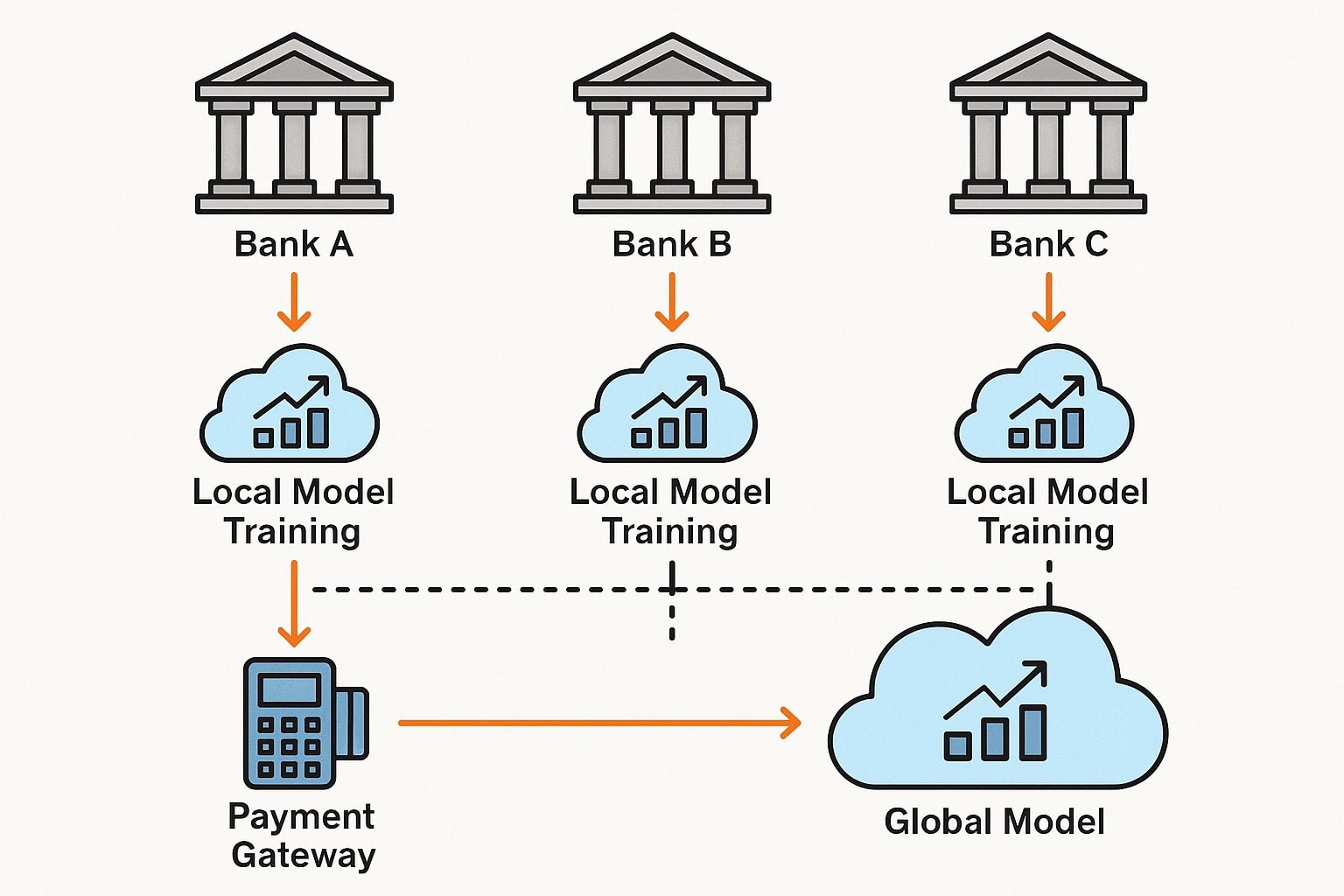

Federated machine learning technology is another promising approach to developing AI-powered compliance tools. It allows multiple parties like banks, fintechs, payment gateways, etc. to train a shared model collaboratively without exchanging or centralizing raw sensitive data. In this case, each party trains a model locally on their own internal data and shares only model updates, which the central server combines to improve a global model.

This way, fraudulent anomalies learned on one network can help others, even if they’ve never faced that particular fraud type before. It may help payment gateways avoid blind spots caused by too little data on fraud signals. Besides, gateways gain access to broader behavioural trends without sharing user identities.

Summary

KYC and AML checks are a must for payment gateways, but they often slow things down and frustrate users. Banks spend millions trying to get it right, but manual checks, clunky onboarding, and false flags still cause delays and missed opportunities. Luckily, AI is changing the game: speeding up ID verification, spotting risky behaviour in real time, and cutting down on human review. Add blockchain, decentralized IDs, and federated learning to the mix, and you get smarter, faster, and more private compliance systems that work across borders without exposing sensitive user data. It’s all about balancing trust, speed, and security in a world where fraudsters are getting smarter too.