Do you consider paying with a wearable innovative? What about a glance of an eye, a fingerprint or a voice command? What I’m talking about is not a sci-fi movie, but a world of phygital payments that promises unprecedented convenience but also raises critical questions about privacy, security, and how much of ourselves we’re willing to digitize.

Imagine paying for a snack by simply looking at a smart glass display, or completing a back-to-school shopping purchase with nothing but the press of your fingertip or wave of a hand. How is that even possible?

While some payment providers still grapple with accepting ubiquitous digital wallets, others experiment with phygital payments, where our bodies and IoT devices might merge seamlessly with digital payment tools.

However, phygital payments are a broader term that is not limited to futuristic biometric purchases, but also encompasses other seamless ways to blend physical payment methods (like cards or cash) with digital technologies (like mobile wallets, QR code scanning, contactless payments, and augmented reality).

For example, a supermarket allows customers to scan selected goods as they go in the app, which creates a single QR code for the whole grocery cart. At the physical checkout, the shopper only has to scan the QR code and pay with whatever payment method they choose (cash, card, mobile wallet, etc.).

The Rise of Biometric Payments

The biometric payment market was valued at $8.6 billion in 2023 and is anticipated to grow to $34.8 billion by 2032, with a CAGR of 16.84% from 2024 to 2032.

Being a subset of phygital payment experiences, biometric payments are, perhaps, the most fascinating but also unnerving innovation. Biometric authentication has long begun reshaping the way we pay and authorize daily transactions. From fingerprint scanners on smartphones with embedded mobile wallets to facial recognition at ATMs or points of sale, businesses and banks are leveraging unique physical traits of their customers to streamline transactions.

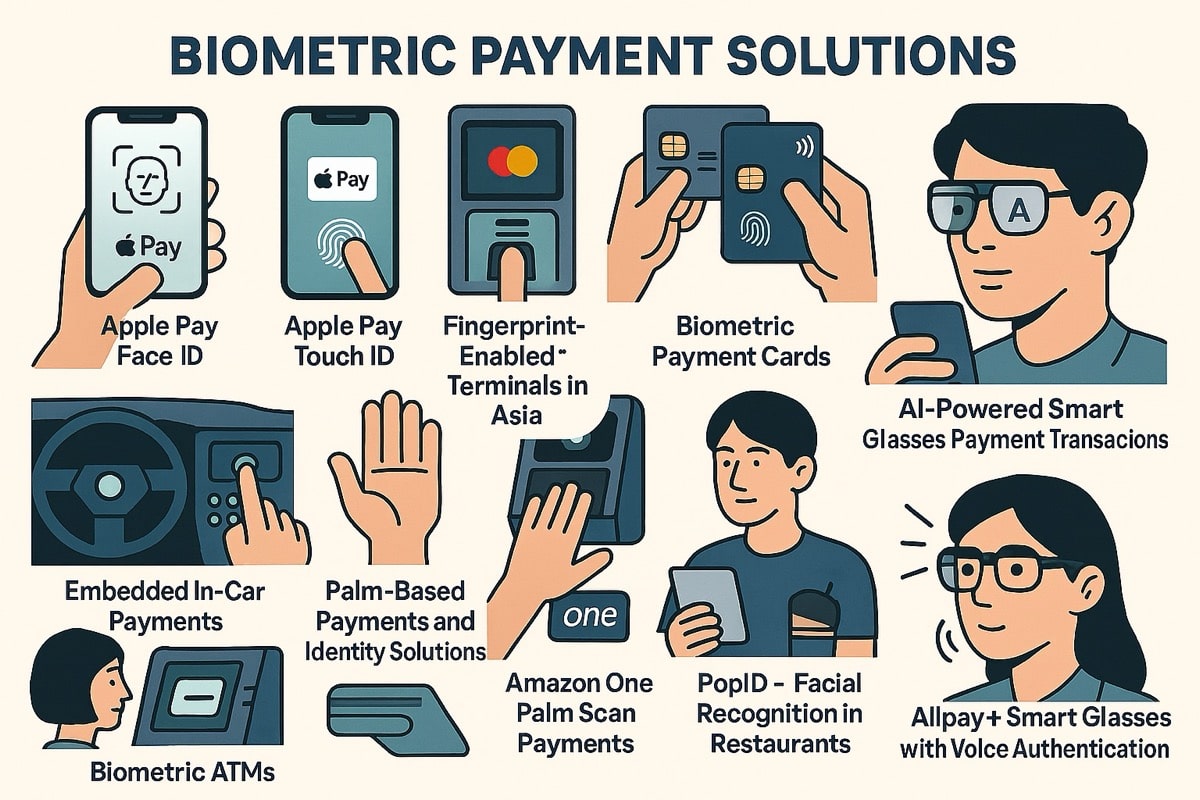

Apple Pay’s Face ID and Touch ID, Mastercard’s fingerprint-enabled terminals in Asia, various biometric payment cards, embedded in-car payments via fingerprint sensor, emerging palm-based payments and identity solutions, pilot AI-powered smart glasses payment transactions, PopID face recognition in restaurants, and biometric ATMs in several countries demonstrate that the technology is gradually moving from novelty to mainstream.

These solutions seem to be a win-win for all ecosystem participants. Shoppers don’t need to remember PINs and passwords, or even carry physical cards, and merchants benefit from faster or even invisible checkout and reduced fraud, as biometrics are harder to replicate than traditional credentials. However, these advances are not without challenges. Biometric data is highly sensitive, and unlike a password, it cannot be changed if compromised. Organizations must navigate a complex regulatory landscape, ranging from GDPR in Europe to local privacy laws in Asia, to enable biometric payments while ensuring data is securely stored and processed.

Phygital Payments Are Much More Than Biometrics

Biometric payments are just one form of phygital payment experiences, where physical and digital payment solutions integrate to create a seamless, convenient, and personalized transaction flow.

A phygital payment experience recognizes that customers desire the tactile engagement of physical interactions alongside the convenience and efficiency of digital solutions. How can they get this all-in-one experience without infringing either?

In retail, shoppers can use mobile apps to scan QR codes in-store, accessing detailed product information, recipes, digital coupons and exclusive offers, and complete purchases directly from their devices, using smartphone wallets linked to physical payment cards, with digital receipts sent instantly to their email or e-commerce app.

Meanwhile, restaurants, hotels, gas stations, and other public venues enable guests to check in, order, and pay using mobile devices or biometrics, enhancing convenience and reducing wait times.

For instance, KFC employed AI-powered digital self-service kiosks, which, combined with the use of Smile to Pay facial recognition payment technology, enabled customers to order and pay digitally while being physically present to eat at the restaurant. This innovative system also uses AI to personalize menu recommendations and robots for food preparation, fully integrating physical operations with digital smart technology.

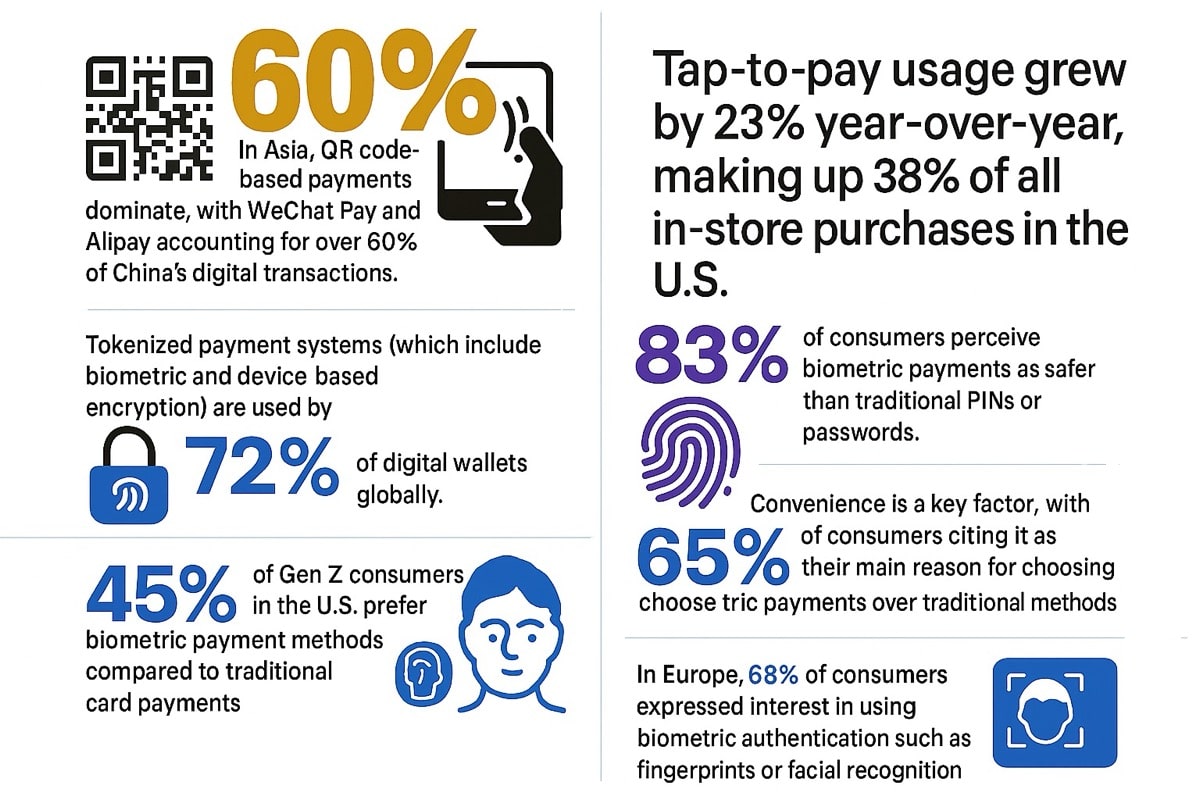

These key statistics illustrate the mass adoption of phygital payment technologies worldwide.

Phygital Devices and IoT Integration

Incorporating some forms of phygital payments into the retail ecosystem requires relevant infrastructure. Here we speak of embedding physical devices, wearables, and IoT seamlessly into the payment flow. Certain devices like smart glasses, rings, wristbands, or even connected cars can initiate transactions seamlessly, but payment providers and merchants need tools to accept and process such payments.

For instance, voice-activated payments in smart glasses allow users to confirm purchases with a spoken command while walking down the street or browsing in a store. Wristbands and rings linked to digital wallets enable tap-to-pay experiences, similar to contactless cards but integrated directly into wearable devices. Connected cars can automatically pay tolls, parking, or drive-through orders, all without manual input.

These devices offer truly frictionless transactions. But phygital integration may stress out some merchants or payment players as they require device-compatible payment terminals or point-of-sale (POS) systems that can accept contactless/NFC, QR code, or tokenized payments from various smart devices. Some devices may also require Bluetooth Low Energy (BLE) or IoT-enabled POS terminals.

Next to the proper terminals, phygital transactions need real-time transaction processing to keep the “seamless” promise. Fast authorization and settlement ensure a smooth user experience, while slow processing kills all the fun in the blended payment experience. Additionally, payment providers must offer relevant developer tools so merchants can integrate device-initiated payments into their POS or online systems.

The phygital payment device markets are growing rapidly. Thus, the global wearable payment device market was valued at $71.5 billion in 2024 and is projected to reach $407.5 billion by 2034, growing at a CAGR of 19.0% from 2025 to 2034. The voice-based payments market is estimated to reach over $20.5 billion by 2033, while global IoT payments market size is expected to grow from $428.5 billion in 2023 to $41 trillion by 2032, at a CAGR of 66%.

At the same time, as payments increasingly require our biometric data, the balance between convenience and privacy, security, and trust becomes a central challenge for both consumers and businesses.

Privacy and Security Risks

As biometric and phygital payments gain traction, the convenience they offer comes with significant privacy and security considerations. Biometric identifiers like fingerprints, facial scans, voice patterns are harder or impossible to steal or imitate but cannot be changed if compromised. A breach could therefore have permanent consequences for users’ identities.

Meanwhile, today we have advanced AI tools that can potentially copy and spoof some biometric identifiers, e.g. create synthetic fingerprints, highly realistic deepfake faces or even animated 3D models that could trick some facial recognition systems, replicate a person’s voice from a short sample, etc.

To avoid this risk, authorization systems should combine two or more biometric factors, use liveness detection (checking micro-movements, blinking, 3D depth sensing, infrared heat patterns) and multi-point verification, making it much harder to bypass for fraudsters. Voice recognition systems may analyze not only voice itself but also intonation, background noise, and vocal tract signatures, plus implement challenge-response methods.

IoT integration adds another layer of complexity. Smart glasses, wearables, and connected devices may lack robust security protocols, making them potential entry points for hackers. Unauthorized access could lead not only to financial theft but also to behavioral profiling, tracking of user habits, and exposure of sensitive personal information.

While regulatory frameworks are still catching up to emerging threats and challenges, many phygital payment implementations operate in uncharted territory or must navigate cross-border compliance.

Many users also do not fully understand how their data is collected, stored, or used, which could erode trust if privacy policies are unclear or violated. Ensuring transparency and control over data is, therefore, critical for widespread adoption of phygital payments.

Opportunities and Advantages of Phygital Payments

Despite any arising privacy and security challenges, biometric and phygital payments offer compelling benefits for consumers, merchants, and the broader financial ecosystem:

- Frictionless experiences enable users to complete transactions instantly and seamlessly, whether with a fingerprint, a glance at smart glasses, or a tap of a wearable device.

- Reduced checkout friction helps increase conversion rates in retail and e-commerce.

- Biometric authentication provides stronger fraud protection than traditional PINs or passwords. Combined with tokenization and on-device encryption, phygital payments can minimize the risk of data breaches.

- Phygital solutions can boost financial inclusion among population segments without traditional IDs or banking infrastructure, enabling broader access to digital payments.

- Biometric and wearable data can support personalized offers and rewards while maintaining privacy through anonymized analytics.

- For businesses, automated verification and customer empowerment in self-service processes reduce employee intervention, saving time and operational costs.

Future Outlook

The trajectory of phygital and biometric payments points toward an increasingly integrated and immersive financial ecosystem. Here are some of the emerging phygital trends that might sound futuristic but are already there in niche use cases.

AI-Enabled Biometric Verification

The next-generation biometric authentication market, incorporating AI and advanced technologies, is growing very fast. Advanced machine learning and deep learning models can better detect anomalies in user behavior or out-of-place authentication attempts based on wider context, adding dynamic security layers and making fraud prevention proactive, while also not triggering extra false positives. Increasingly, such systems enhance multi-modal biometric recognition by combining fingerprints, facial, iris, and voice data in one solution.

Gesture- and Motion-Based Payments

Beyond fingerprints and voice, future devices may recognize hand gestures or subtle movements to authorize transactions. Gesture- and motion-based biometric payment systems are already emerging and being tested in real-world applications in 2025, along with palm vein scanning. Adoption is still relatively early stage, but consumer willingness to test such solutions is high — about 86% of consumers are ready to use biometrics for payments, including newer methods like palm scanning and gesture recognition. Potentially, this type of payment authentication can blend seamlessly with voice recognition technology. Experts envision combining voice commands to initiate payments with gestures to confirm transactions.

Implantable and Wearable Tech

This segment of biometric and phygital payments is both trickier and riskier. At the same time, some firms are already considering experiments with technologies embedded directly into the human body. These could allow payments with just a touch or proximity signal, blending physical presence with digital identity. However, customer willingness to pay with body implants is not sky high, so wearable payment technology development is much more promising at this point. Here we see a gradual expansion from watches to wearable tech-driven jewellery, garments, accessories, and more.

Cross-Device and Cross-Channel Integration

Expectedly, phygital experiences will soon seamlessly blend not just physical and digital payments but also become multi-modal. Thus, phygital payments will increasingly work seamlessly across smart glasses, wearables, mobile devices, and in-store terminals, creating a fully connected commerce experience.

Conclusion

Biometric and phygital payments represent the next frontier of frictionless commerce, offering speed, convenience, personalization, and enhanced security. Yet, these advantages come with complex privacy, ethical, and security challenges that must be addressed.

In this respect, regulation and ethics will play a pivotal role. Balancing innovation with consumer privacy, data protection, and ethical considerations will determine how widely and safely these technologies are adopted.