Payment gateways are a necessary part of any online business. Their main role lies in making the transaction fast and safe so the customer does not have to worry about data failure or other risks. Now more and more companies are realizing the importance of choosing the right payment gateway, as it affects the speed of payment processing, security, availability of different payment methods, and even international coverage.

To better understand how to set up a payment gateway, we’ll take a closer look at its components, as well as find out which option is cheaper and faster – create a payment gateway software or lease one from a trustworthy provider such as Akurateco.

What is a payment gateway?

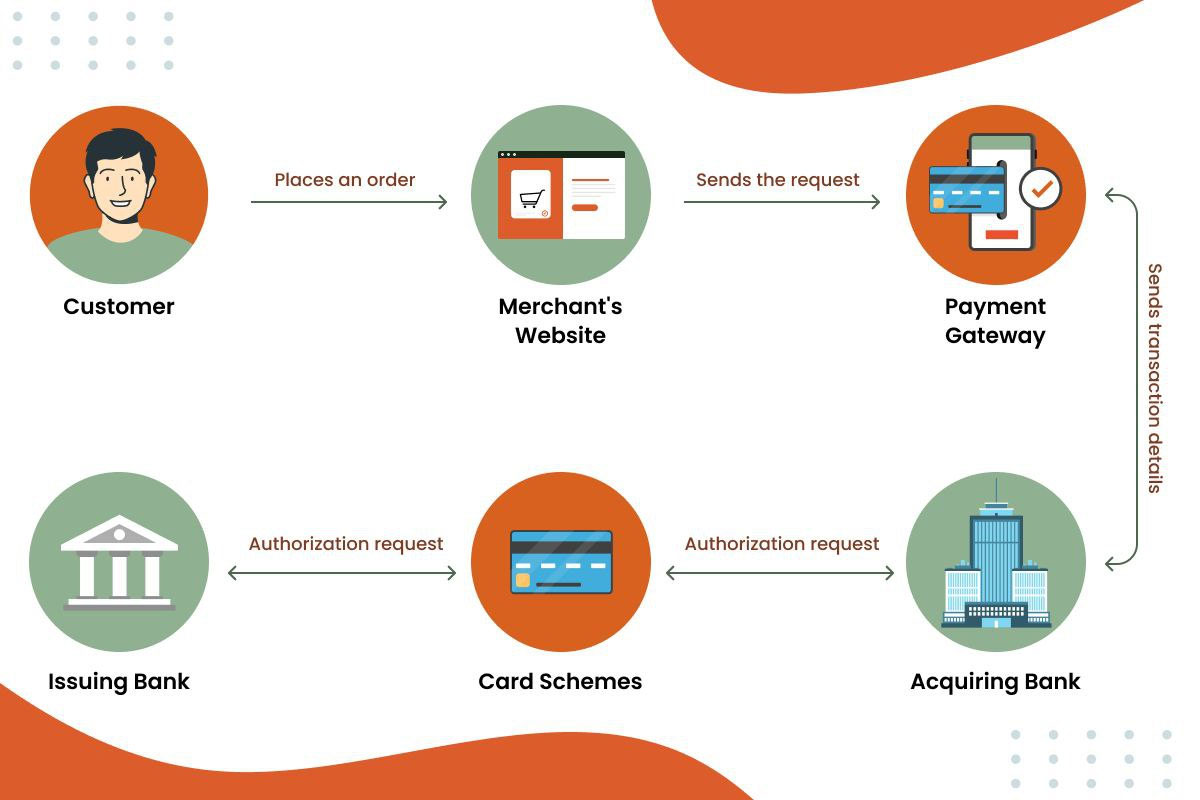

A payment gateway is a technical solution that allows a website owner to securely accept online transactions from customers. Its main function is to receive payments from buyers and transfer the relevant data to the acquirer. The payments are made automatically in seconds. The payment gateway connects the various parties involved in the payment process (the acquirer, the issuer, and the card scheme).

What’s more, the technology bridges the gap between the customer, the online shop, and the relevant financial institutions, allowing to:

- Securely provide their credit or debit card information;

- See whether a debit or credit card payment has been approved or declined;

- Transfer funds to the merchant’s account for settlement.

Payment gateways provide well-documented Application Programming Interfaces (APIs) and (Software Development Kits) SDKs, making it easier for payment software providers (PSPs) to integrate payment processing functionalities. By leveraging pre-built integration solutions, they can save time and effort, accelerating the development process.

How does a payment gateway work?

A payment gateway works in the following way:

1. The customer makes a purchase

After the clients enter information about their payment methods, the payment gateway encrypts and transmits it to the payment processor. For example, with card payments, the customers enter their credit or debit card details on the payment page. Usually, this includes the cardholder’s name, card number, card expiration date, and card verification number (CVV code).

The payment page can either be hosted on a payment gateway or have encrypted input fields that then securely transmit the information to the payment gateway. Payment gateways also inform about the transaction status – whether the financial transaction is authorized or denied.

2. Information is encrypted and sent to the acquirer

The payment gateway encrypts the card information, performs fraud checks, and transmits the cardholder information and transaction data to the acquirer.

3. Card schemes perform fraud checks

The acquirer securely transmits the information to the card system (e.g., Visa, Mastercard, Amex), where additional fraud checks are made. The payment data is then sent from the card system to the issuer.

4. The issuer authorizes the transactions

The issuer conducts further fraud checks, such as verifying the transaction information, checking that the cardholder has adequate funds, and confirming the validity of the bank account. Depending on the results, the payment is either authorized or refused.

5. Customers and merchants receive notifications

The issuer sends the payment gateway a confirmation or denial of the payment, which is notified to the customer and the merchant.

6. Payment is approved

If the payment is confirmed, the customer is then redirected to the payment confirmation page. In case of a payment decline, the customer will be offered to try another method.

7. The calculation begins

After the payment is approved, the acquirer receives the funds from the issuing bank and blocks them on the merchant’s account.

Although it seems like a lot of information is transferred between the different parties, all the steps we described above take place within a few seconds.

Basic components of a payment gateway

Before starting a payment gateway creation, it’s essential to know its functionality. Here’s a comprehensive list of the basic components to take into account:

Scalable infrastructure

Design the payment gateway to handle high transaction volumes, especially during peak periods like holidays or promotions. Think about using cloud-based infrastructure and load-balancing techniques to ensure the high availability and performance of your payment gateway.

Robust fraud protection

Implement advanced fraud detection and prevention tools to keep your customer’s data safe and maintain their trust. For example, you can utilize machine learning algorithms and real-time risk assessment to identify suspicious activities. Also, consider integrating with third-party fraud prevention services for additional security.

Tokenization and dynamic data masking

Employ tokenization to replace sensitive card data with unique tokens, reducing the risk of data breaches. At the same time, data masking will protect cardholder information during transmission and storage.

Flexible recurring payments

Offer your clients a variety of recurring payment options. These include subscriptions, memberships, and installment plans. Your customers would also value easy management and cancellation features.

Seamless software integration

Ensure seamless integration with your existing business systems through APIs, SDKs, or custom integrations. Using middleware solutions will also simplify the integration process.

Comprehensive dispute resolution

Provide your customers and merchants with a clear and efficient dispute resolution process, such as tools for chargebacks and refunds. You can also integrate with dispute resolution networks to streamline the process.

Payment methods support

To cater to diverse customer preferences, a robust payment gateway supports a wide range of traditional and alternative payment methods (credit and debit cards, PayPal, Apple Pay, and Google Pay). By offering multiple payment options, businesses can enhance customer convenience, increase conversion rates, and expand their potential customer base.

PCI DSS adherence

Payment Card Industry Data Security Standards (PCI DSS) compliance protects sensitive cardholder data, including credit card numbers and expiration dates. By complying with PCI DSS, payment gateways demonstrate their commitment to safeguarding customer information, building trust, and mitigating the risk of data breaches.

Innovative technologies

Efficient routing involves directing transactions to the appropriate payment processor or acquiring bank, ensuring optimal processing times, and minimizing transaction failures. To ensure uninterrupted service, payment gateways employ cascading. This involves having multiple backup options for failed transactions, such as additional payment processors or acquiring banks. A payment gateway also incorporates powerful analytics tools to provide valuable insights into transaction data, including sales trends, customer behavior, and fraud patterns, as well as multiple other features.

Step-by-step guide to payment gateway software development

The first thing you need to do is define your goals: for whom and for what purpose this payment gateway will be created. Then visualize what it looks like, what technologies and integrations you need to develop.

Building a payment gateway also means considering expansion and planning for growth through the use of load balancing, cloud infrastructure, and effective monitoring tools to improve performance and optimization.

Regular updates, maintenance, customer feedback, and successful marketing of your payment gateway are key to keeping it running smoothly, attracting new merchants and users, and building trust and credibility.

Now that you have an idea of how to create a payment gateway, let’s take a look at its advantages and disadvantages.

Costs and timeline for payment gateway development

After knowing how to develop a custom payment gateway, it is still important to understand the pros and cons. Although payment gateways provide competitive advantages, there are high development costs, security risks, technical expertise, limited payment options, and regulatory concerns. Payment gateway development costs range from 150,000$ to 700,000$ and higher.

Consider the following factors that may impact your budget:

- The experience and skill level of the development team will impact project speed and quality.

- Utilizing efficient project management tools can streamline workflows and improve productivity.

- The type and complexity of the software, including integrations and customizations, will affect payment gateway development time.

- The number and complexity of features will influence the project’s scope and timeline.

The timeframe for building a payment gateway is from 6 months to 1 year or more and depends on such factors:

- Hiring individual freelancers is cost-effective but may require more management and coordination.

- Building an internal development team offers you control but is time-consuming and expensive.

- Partnering with an experienced outsourcing payment gateway software development company provides expertise and efficiency but requires careful selection and communication.

Common challenges in payment gateway development

Developing a custom payment gateway for your website or program involves significant challenges and considerations you need to be aware of.

Regulatory compliance

Following strict regulations, such as PCI DSS, is a must for keeping credit card information secure. Talking about compliance, you need to conduct comprehensive security measures, regular audits, and continuous updates to address evolving standards and maintain your business’s reputation.

Robust security

Protecting sensitive customer data from fraud and data breaches is also crucial. Implement a multi-layered security approach, including encryption, tokenization, and intrusion detection systems. Also, don’t forget to regularly update security measures.

Deep technical expertise

Building a payment gateway demands a team with deep and strong technical knowledge in payment processing, software development, and integration with various banking APIs and e-commerce platforms. Consider hiring experienced developers or partnering with a specialized payment gateway software development company to obtain the best payment processing solution.

Ongoing maintenance and support

A custom payment gateway requires ongoing maintenance, troubleshooting, and customer support. Allocate resources for regular software updates and security patches, addressing technical issues promptly. Consider offering 24/7 support to ensure customer satisfaction.

Complex financial partnerships

Establishing relationships with banks and credit card companies is often necessary for payment gateway development. Collaboration with a payment gateway development company can be challenging, especially for smaller businesses.

While building a custom payment gateway offers potential advantages, such as greater control and customization, you need to carefully weigh all the challenges.

Payment gateway software development vs. leasing: pros and cons

When evaluating their options, businesses often choose between developing their own software or leasing a pre-developed one from a trusted vendor. Let’s take a look at both options in detail.

In case you have time and enough budget, you can consider developing a custom payment gateway that offers the following advantages:

- Greater control over features and functionality.

- Tailored integration with existing systems.

- Potential for competitive differentiation.

While bringing a lot to the table, custom payment gateway development also has major disadvantages. They include:

- Higher costs on payment solution software development.

- Long time-to-market.

- Requires significant technical expertise and resources.

- Increased complexity of maintenance and updates.

- It takes extensive features and integration development to gain a competitive edge.

Leasing a payment gateway, on the other hand, is a cost-effective and fast time-to-market option for those who don’t want to spend their resources on development. Experienced vendors like Akurateco offer pre-developed white-label payment software. It is fully equipped with advanced technologies and multiple integrations and is ready to be launched under your brand.

Among the key advantages are:

- Faster time-to-market: Launch within the first month.

- No development costs: Save significant resources.

- Comprehensive security: Built-in anti-fraud tools and PCI DSS compliance.

- Innovative features: Intelligent routing, retries, payment analytics, automated merchant onboarding, and more.

- Diverse integrations: Access multiple payment methods and providers pre-integrated into the platform.

- Expert support: Ongoing technical assistance from an experienced payment team.

Yet, payment gateway leasing also has its cons. They include:

- Limited customization options.

- Potential for vendor lock-in.

- Not always aligned with specific business needs.

Conclusion

In conclusion, there is no right or wrong answer when choosing between developing a custom payment gateway or leasing a pre-built solution. It is a decision that depends on your business’s unique needs, budget, and timeline. Custom development offers unparalleled control and customization. Yet, it demands significant resources and technical expertise. On the other hand, leasing a solution from a trusted provider like Akurateco provides a faster, cost-effective, and feature-rich alternative. However, it will not be equal to independent development in terms of customization.

By carefully weighing the pros and cons of each option, businesses can select the path that aligns with their goals. If you are looking for a cutting-edge white-label payment software provider, don’t hesitate to book a free demo of the Akurateco system to discover its benefits and capabilities.

FAQ

Who would benefit the most from payment gateway development?

A lot of companies may benefit from having a customized payment gateway, but the most common ones include payment service providers, other fintech solution providers, and big merchants.

How long does it take to develop a payment gateway?

The payment gateway development varies depending on complexity, team size, technology, and integrations. It can range from six months to a year or more.

How much does it cost to develop a payment gateway?

The cost depends on project scope, team, technology, integrations, and ongoing maintenance. It can range from 250,000 of dollars and more.

Are there alternatives for payment gateway software development?

Yes, alternatives include leasing a white-label payment infrastructure from an established vendor. The best choice depends on your specific needs, budget, and technical capabilities.