Estimates of a global satellite bus market vary from one intelligence analytics company to another, yet most sources in 2023 agree on a $14.5 billion figure. Since 2020, this industry has been showing significant compound annual growth rates, varying from 9% to almost 17% a year. A modest satellite bus market forecast for 2028 expects to see segment value increase up to $22 billion, even though some agencies already predict $39 billion by 2029 and $54 billion by 2030. But how realistic are those estimates? Probably quite realistic.

The most important thing to understand about the satellite bus market is that buses are fundamental components of any spacecraft that include a variety of mission-specific equipment, including mechanics, electronics and communication systems, attitude and thermal control, propulsion, power, guidance and navigation, even life support for crewed missions. So, for as long as we keep launching satellites, we will rely on satellite bus tech.

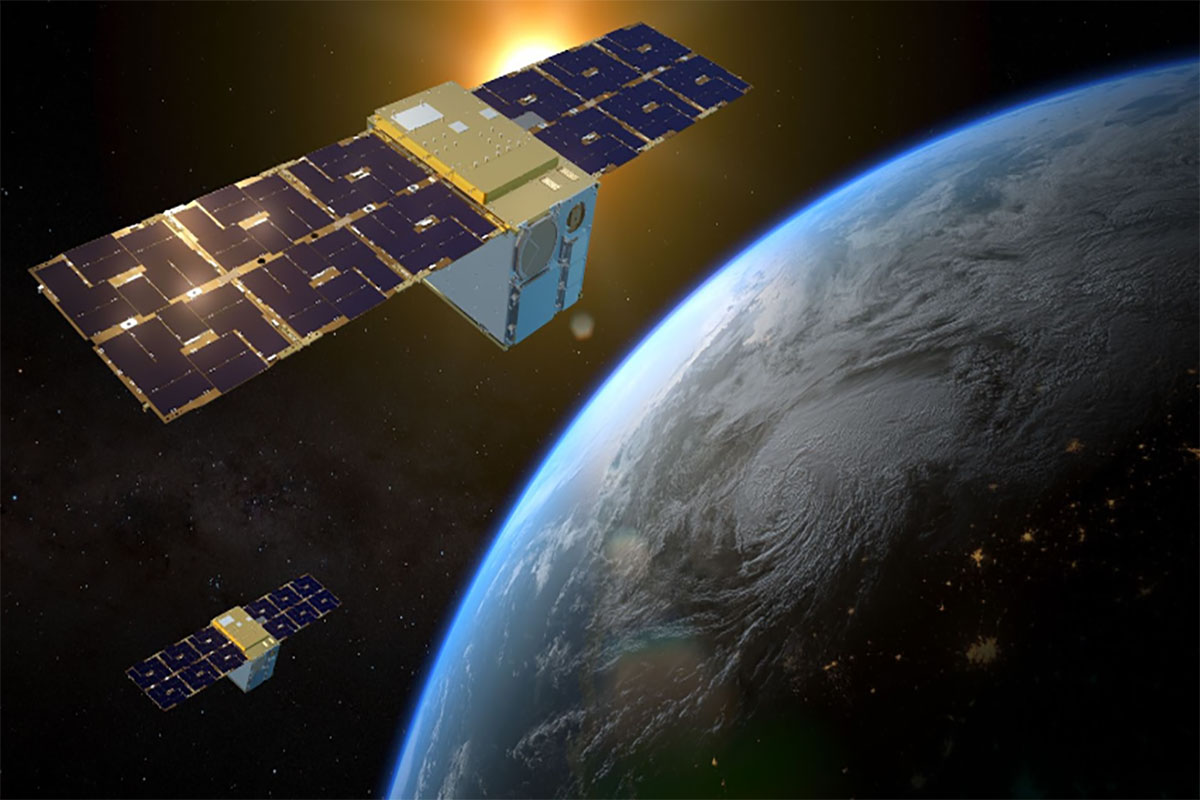

Even though satellite bus technology is essential for all spacecraft types, the rapid growth of the bus market is directly related to the growing share of small satellites. Today, small satellites hold the largest share of the global satellite market, while satellite buses are the largest segment in the small satellite market — which, by the way, is also growing steadily. This development results in the miniaturization of satellite buses — a trend that will define the industry’s future. So, what is the satellite market forecast? And what major developments should we expect to see before the end of this decade?

Constellations Will Rely on Enhanced Communication Segment

The growing number of satellite constellations in orbit will require new advances in the communication segment. The focus should be on eliminating delays and increasing communication speed between space and user segments. Also, with the increase in private launches and non-profit educational research missions, satellite buses should become more adaptable to support remote reprogramming and mission adjustment.

Artificial Intelligence Will Result in More Spacecraft Autonomy

Artificial intelligence should spread beyond our planet’s borders, allowing space tech more autonomy and local decision-making. Machine learning and AI, when used in small satellite bus technology, can ‘help’ spacecraft predict solar storms or possible collisions with space debris. This, in turn, should minimize reliance on human control.

Growing Need for Eco-Friendly Propulsion Systems

Our fight for sustainable fuel and propulsion tech should continue in space. Besides sustainability, this development should cause a huge rise in satellite manoeuvrability, ensuring longer mission durations and reduced space debris accumulation. Based on this satellite bus market forecast, bus manufacturers will have to find a proper balance between tech size, cost, and functionality.

Spacecraft & Satellite Buses Will Keep Getting Smaller

SmallSat’s market share is expected to keep growing, making spacecraft launches evermore affordable for private companies as well as non-profit research organizations. Space tech miniaturization will obviously affect satellite bus manufacturers, who will have to adjust spacecraft bus functionality to suit several different space missions or ensure that a bus can be reprogrammed remotely.

Scalability & Modular Design Will Grow in Demand

The massive popularity of CubeSats and their vertically scalable functionality is a trend that keeps affecting space tech in general and satellite buses in particular. New-generation spacecraft buses will have to accommodate different payloads from different manufacturers. So, adjustable solutions that could easily integrate with different commercial-off-the-shelf payloads will have to be adopted.

Share of Commercial Satellites Will Grow

The smaller and the more affordable spacecraft becomes, the more private satellites will be launched into our orbit. So far, how big is the satellite industry? Over seven thousand satellites are already active in orbit — and five thousand of those are commercial space tech. This tendency should only become more apparent in the coming years, affecting the bus industry, too.

Military Spacecraft Will Require Enhanced Surveillance Capability

Military satellite launches should increase as well — especially considering that commercial satellites are already performing traditional military tasks such as intelligence and surveillance. The government agencies are expected to react to a growing political uncertainty by introducing more military spacecraft.

North America Should Remain Launch Market Leader

North America should retain its leadership in satellite bus manufacture and space launches. However, the European market is already growing and may even show even higher growth rates than the US market. This does not mean that the number of already launched space tech will even out any time soon.

LEO Will Persist as Top Launch Destination

However, launches to MEO and GEO will also take place. Still, it looks like LEO will remain an undisputed leader as far as commercial launches go — especially in the space Internet niche. GEO, however, will remain the second-favourite spot for telecommunications providers.

These are almost certain developments as far as the forecast period until 2028 goes. In fact, most of them are already happening — some smallsat constellations are already functional, and spacecraft numbers on LEO keep growing as we speak. With this in mind, space agencies will have to come up with new bus propulsion solutions for de-orbiting used space tech because our nearest orbits promise to become quite crowded soon.