Canada might be a great place to live, that is – if you can afford it. The infamous Canadian housing bubble made real estate prices surge 10x times higher than one’s average annual income, while mortgage payments may take about 97% of the household earnings.

You’ve probably come across many memes revolving around a common theme: buying a house is much harder for younger generations than it was for their parents. And if you’re a Millennial, the jokes about it aren’t that funny. Sad, but true – Millennials make up the biggest age group for whom affordability is one of the key issues preventing them from buying a home. It is even harder if you’re a Millennial living in Canada since this country is home to the biggest and greatest of all housing bubbles that ever existed.

What Is a Housing Bubble?

A housing bubble, also known as a real-estate bubble, is a continuous surge in housing prices that ultimately leads to ultra-low affordability of potential homes. The price boost may be fueled by demand, speculation, abnormal spending patterns, and many more factors. If the crisis isn’t timely and properly regulated, the real-estate segment gradually moves to the point of collapse.

One example is the housing and asset price bubble that took place in Japan in the 1990s. Then both real estate and stock prices were enormously inflated, largely due to the excessive monetary easing policy at the time. It caused so much damage that the housing market hasn’t fully recovered to date.

However, the Canadian housing bubble has surpassed all “rival” bubbles, growing almost unabated for over a decade.

Timeline and Stats of the Canadian Housing Bubble

- Early 1990s – average house prices declined, coupled with low commodity prices.

- The 2000s commodities boom (caused by rising demand from the US and China) strengthened the financial positions of the middle and upper classes in Canada. An influx of foreign investment and increased immigration created pressure on housing prices, while also causing a lot of speculative activity.

- After the 2008-2009 global economic crisis, the Bank of Canada adopted the record-low interest rate policy. That laid the foundation for an unprecedented bull run in the Canadian real-estate market.

- In early 2017, the cost of owning a home in the Greater Toronto Area had grown by a record 33% in a single year. That prompted the government to introduce some measures like foreign buyer tax in addition to property transfer tax, vacancy tax and non-resident speculation tax.

- 2019 – housing prices started showing slight signs of reversal.

- The Covid-19 pandemic of 2020 forced the national regulator to lower interest rates again, creating another surge in real-estate prices. Excess demand driven by low rates fully eroded housing affordability in Canada.

- 2022 – growing inflation was driving rates higher. Home sales plummeted by over 38% in a year.

- Bank of Canada returns to interest rate hikes. Its overnight rate was last raised to 5% in July 2023. At the same time, the uptick in housing demand caused by extended credit limits and unseen immigration rise doesn’t let the rate hikes directly translate to the price decline.

Despite the short positive momentum in spring 2023, the Aggregate Composite Multiple Listing Service (MLS) Home Price Index (HPI) created by the Canadian Real Estate Association (CREA) remains 4.5% below year-ago levels. It still represents the smallest decline since November 2022. Besides, the actual (not seasonally adjusted) national average home price in June 2023 was $709,218, reflecting a year-on-year increase of 6.7% compared to June 2022.

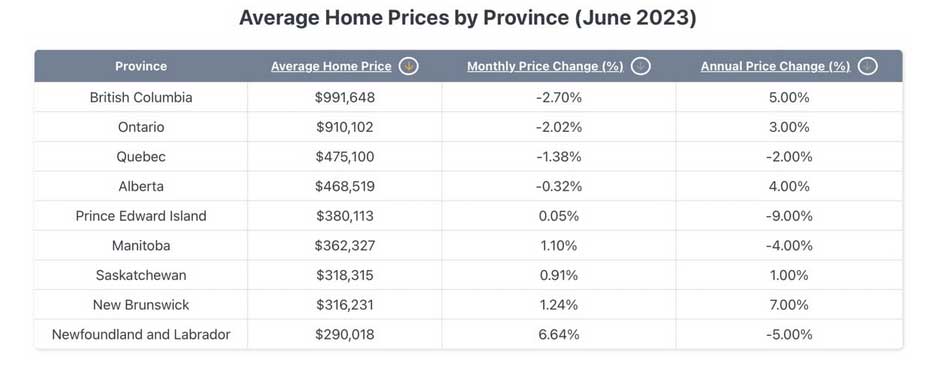

However, the Canadian housing bubble has not affected all of the country’s regions equally. In some provinces, homes are more affordable than in others, which is reflected in the home price range from $290K in Newfoundland and Labrador to over $290K in British Columbia.

Source: wowa.ca

Why Did the Great Canadian Housing Bubble Appear?

As with every socio-economic phenomenon, numbers and dates tell only half of the story. Understanding how a country with vast lands, able to house many more people than its current population, has ended up with a housing crisis is difficult. So here is a more detailed explanation of what’s happened to the Canadian housing market.

Demand/Supply Imbalance

The Canadian housing bubble started growing just when the country witnessed a boom in rural-to-urban domestic migration as well as greater inflows of immigrants. The latter came predominantly from Hong Kong and mainland China which faced some political turbulence at the time.

The country’s population continued to grow, adding 1 million people per year. However, local construction companies haven’t built nearly enough new homes for quite a while. In large part, that has happened due to specific local regulations. For instance, Canada has adopted restrictive zoning rules in its city planning policies. It means that there are limitations as to what can and can’t be built in certain places. Some residential areas are zoned strictly for single-detached or semi-detached homes, but not large apartment buildings that can house more people. Mid-rise and high-rise buildings are allowed only in select areas which are not that common on the country’s zoning map.

Another reason is that Canada has an acute shortage of skilled workers in the construction industry. According to Statistics Canada, about one-fifth of the people employed in construction were aged 55 or older in 2021. While such a large share of skilled workers is nearing retirement, the percentage of young people who get apprenticeship certificates in related fields is steadily declining. For the industry, it means a record of over 81,000 unfilled positions across the country as recorded in mid-2022.

Moreover, in 2022, the new wave of immigrants further aggravated the real-estate situation, widening the gap between available homes and all those wishing to get one. The country’s updated immigration policy along with the wider geopolitical situation brought 1 million new people to Canada. Similar numbers are expected in the next few years. Yet, that doesn’t automatically mean new housing is built for all the newcomers.

It is now officially estimated that the country needs to build an extra 3.5 million housing units by 2030 to restore affordability. At the same time, the real situation may be worse, since official data counts only permanent residents, while many more people need temporary rent.

Speculation

Investor sentiment is one of the most mysterious factors that greatly impact all types of markets. As soon as the demand for housing in Canada coincided with low interest rates, many people started buying real estate to resell, lease or rent. Houses were viewed as a stable and profitable type of long-term investment and passive income source.

Investors were not entirely wrong. Historically, the housing market has been one of the most stable ones. It has not suffered from the frequent price bubbles and extreme volatility of other investments. Hence, the demand only grew.

Even when the housing market offered clearly overpriced units, investors were extremely confident that the property would only grow in price over the years. Many people overbid well above the asking price just to get an attractive unit. Here we deal with something called FOMO – “fear of missing out.” It defined the bidders’ behaviour and prompted sellers to price up their properties.

Sadly, these practices created prices drastically exceeding the intrinsic value of any given home, while affordability was slowly vanishing.

Absence of Regulatory Correction

Perhaps, the Canadian housing bubble wouldn’t aggravate this much if the government intervened timely. Typically, to deal with the “bulls” running too fast, one needs a bear market. That can be achieved by an economic decline that kills demand (not the most desired scenario) or rising interest rates commonly leveraged by regulators across the globe.

And yet, Canada hasn’t applied interest rate hikes for years… until it was too late. It is estimated that to cope with the given real-estate bubble, one would need huge market intervention, never seen before.

At the same time, the local government hasn’t been ignorant of the problem. However, the measures taken were mostly aimed at expanding credit facilities or annihilating market speculation by foreign investors.

The Bank of Canada started to raise interest rates only in the spring of 2022. Although prices were falling until late 2022 and witnessed some decline in 2023, the average house price as of June 2023 is still 7% larger than in June 2022. The paradox is that even as prices sporadically fall on a monthly basis, the Canadian housing bubble still sees an annual price increase.

Moreover, the Canadian Federal Budget 2023 relaxed Canada’s previous strict ban on foreign home buying and allowed more foreign stakes in developing commercial real estate. The budget also relaxed home-buying requirements for temporary work-permit holders and international students.

In the last two years, tax credits for first-time homebuyers increased. Many banks introduced extensions of mortgage amortisation terms. The Tax-Free First Home Savings Account now allows Canadians under 40 to save $40,000 for a downpayment in a tax-free way. Besides, millions of Canadian citizens received monetary benefits from the Canadian Housing Benefit program.

All these regulatory efforts only help buyers to deal with rising prices but do not moderate the prices themselves.

Consequences of the Canadian Housing Bubble

As a result, many Canadians now handle larger amounts of credit. The amount of national household debt is astonishing. As of January 2023, residential mortgage debt was $2.08 trillion, an increase of 6% compared to January 2022. Overall Canada’s level of household debt is the highest in the G7 – 107% of national GDP as of 2021 and 101.4% as of December 2022. Around three-quarters of that huge household debt comes from mortgages.

Canada Mortgage and Housing Corporation (CMHC) notes that mortgage consumers are changing their borrowing habits to adapt to higher interest rates and high inflation.

Firstly, borrowers are increasingly choosing shorter-term fixed-rate mortgages. They expect that the policy interest rate will decrease in the next few years. That will not necessarily be the case, considering the size of the necessary correction, though.

Considering the available mortgage amortisation extensions, households end up paying their debts for much longer periods of time, being under constant financial pressure and mostly devoid of extra savings opportunities.

CMHC research indicates that some households are struggling to repay their debts while refinancing dropped by 32% last year. The situation created by the ongoing Canadian housing bubble makes local citizens vulnerable in the face of major negative external economic events, global crises that lead to job losses, or a national economic crisis.

More borrowers are renewing high-interest mortgages at alternative lenders, which might ultimately put them in a dangerous financial position. Besides, the non-bank mortgage market is gradually becoming a more significant part of the housing finance system.

In addition, many Canadians are anxious about home-buying in such unpredictable market conditions. Almost half (45%) of first-time home buyers in Canada choose brokers for their mortgage. Mortgage brokers are intermediaries between borrowers and lenders who can improve home buyers’ chances of scoring a mortgage that fits their budget, lifestyle and financial goals.

Another interesting consequence of the uneven housing market throughout the country is that many young people choose the periphery of the country instead of the central regions where the prices are exorbitant.

Forecasts

A recent report from Desjardins argues that although higher interest rates are limiting the buying power of many households, many Canadians have deeper-than-usual savings reserves built up during the pandemic. Besides, the country overall is witnessing strong income growth. Therefore, the demand side of the housing market will remain stable at least for a while.

At the same time, sellers are not that eager to list properties during a price decline, so supply is still too scarce. It is not likely that the Canadian housing bubble will fully burst anytime soon.

On the bright side, since many people are drawn to Prairie provinces by better housing affordability, less populated country regions will be benefitting from solid economic growth in the near term.

Speaking about the shortage of construction workers which prevents adequate housing levels, immigrants may eventually fill the gap. However, to make it true, the country should attract more working-class skilled employees than white-collar professionals who now make up the majority of Canadian immigrants.