Choosing the right white-label payment gateway can be a crucial decision for any business looking to offer payment processing services to its customers. The right payment gateway helps businesses streamline their payment processes and enhance customer experience, while the wrong choice leads to numerous issues, from payment delays to lost revenue. With so many white-label payment gateways on the market, it can be challenging to determine which one is right for your business.

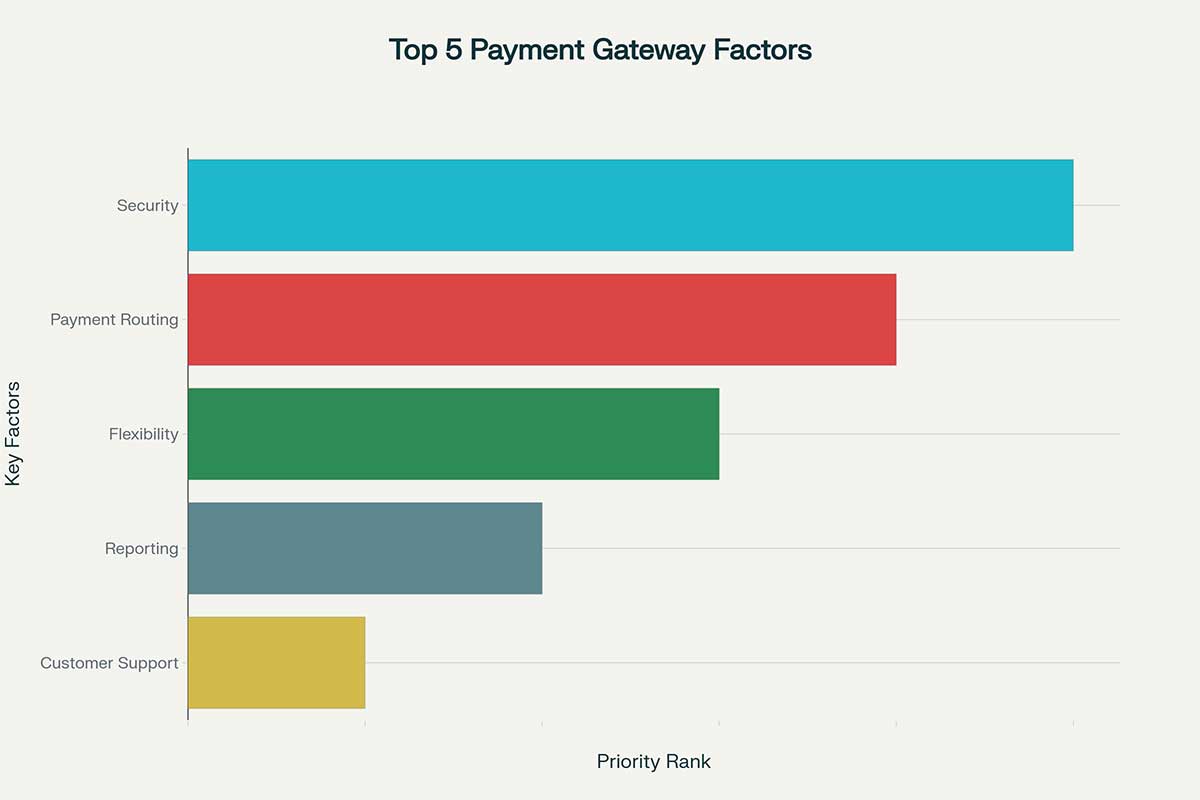

This article addresses payment service providers and similar businesses offering payment processing to merchants. We’ll explore the top 5 things to consider when choosing a white-label payment gateway.

Security Features

Security should be a top priority, as payment-related fraud is getting more sophisticated each day. Therefore, you should look for a payment gateway that offers advanced security features like tokenization, which replaces sensitive card data with a unique token, reducing the risk of data breaches. Additionally, choose a white-label payment gateway that is PCI DSS compliant, ensuring that it meets the latest security standards.

By the way, did you know that the majority of payment providers keep users’ tokens in their database, which means that if you want to switch to another payment provider, your tokens will be lost, causing broken subscriptions? If a customer is asked to put in their payment details again to prolong the subscription, how many of them will actually stay? This undoubtedly leads to reduced revenue for merchants. But when using some white-label payment software like Akurateco, users’ tokens are stored on your cloud, which means you can keep them even if you decide to switch to another payment provider or just add a few more.

Payment Routing and Cascading Capabilities

A payment gateway that offers a smart routing feature can help optimize payment processing by directing payments through the most effective payment methods based on the user’s location, currency, etc. This can result in faster processing times, increased transaction success rates, and ultimately, higher revenue.

In addition to smart routing, a white-label payment gateway with cascading capabilities can be a valuable tool for businesses. Cascading payments refer to the process of distributing declined transactions between multiple payment channels so that the payment can be completed. This feature can be especially useful in cases where a transaction is declined due to soft reasons, such as bank limits. Instead of outright rejecting the transaction, the gateway can automatically route the payment through another payment channel, such as a different bank or payment provider, to increase the chances of a successful transaction. The ability to cascade payments can ultimately result in higher transaction success rates and improved customer satisfaction.

Flexibility and Customization

Look for a white-label payment gateway that allows for easy integration with your existing systems and software and offers customizable features, like a pay-by-link option or the ability to customize billing for each individual payment operation. Remember that a big established company will not necessarily be happy to customize solutions for you. There are more chances to get this done through a more innovative payment hub.

In addition to easy integration and customizable features, an ideal white-label payment gateway should also prioritize a seamless merchant onboarding process. This means offering efficient and user-friendly tools to streamline the onboarding experience for merchants. A user-friendly merchant onboarding portal allows merchants to easily sign up, provide necessary documentation, and configure their payment settings. Subsequently, a well-designed onboarding process can significantly reduce the time and effort required for merchants to start accepting payments, enhancing their overall experience with your payment processing services.

Reporting and Analytics

A good white-label payment gateway should provide businesses with detailed reporting and analytics capabilities. These features can provide insights into payment processing performance, transaction volume, and more. Look for a payment gateway that offers real-time reporting and instant alerts for greater control and awareness. To achieve the best results, they should be integrating artificial intelligence (AI) and machine learning (ML) technologies. Akurateco’s reporting system is accurate and thorough, providing businesses with in-depth insights into their payment processes. It also utilizes AI to classify chargebacks and generate issuer-specific responses.

Customer Support

Finally, when choosing a white-label payment gateway, it’s essential to consider the level of customer support that will be available to you. Look for a payment technology solution that offers decent support and easy access to technical assistance. Additionally, consider the level of support you’ll receive during the onboarding process and ongoing support as your business grows.

Final thoughts

In conclusion, choosing the right white-label payment gateway is crucial to the success of your business. Look for a payment gateway that offers robust security features, payment routing capabilities, flexibility and customization, detailed reporting and analytics, and excellent customer support. Akurateco is a software solution for PSPs that offers smart routing and cascading, as well as smart billing features, has proper support, and is flexible and enthusiastic when it comes to implementing new features.