The payment industry is eagerly embracing artificial intelligence (AI) technology, implementing its unique capabilities into almost every aspect of external and internal processes to boost efficiency. Yet, some of the fintech players are more reluctant to introduce AI than others. In particular, the lack of interest and adoption is striking with remittance companies.

Artificial Intelligence in Payments

The payment landscape’s evolution is propelled by the development of innovative technologies such as AI and machine learning. As for what the customers see, AI may be mostly leveraged for mobile banking applications in the role of conversational chatbots. However, a lot of data analysing, optimising and generative activities are happening on the back end of the payment process.

AI and Payments Safety

To begin with, AI can better identify potentially fraudulent transactions in real time, which helps to solve one of the biggest concerns with contactless payments – initiating purchases without detection or using a lost credit card or stolen device to access one’s banking account. AI models are trained on large datasets of the historical transaction data to recognise patterns of legitimate and fraudulent behaviour and flag any deviations or anomalies that could indicate fraud.

AI-based fraud detection solutions are used by the biggest payment infrastructure providers like Visa and Mastercard. Besides, artificial intelligence is one of the most effective ways to reduce financial fraud false positive rate which appears as a drawback of many automated fraud detection systems.

Advanced AI systems using NLP can analyse unstructured data from customer interactions, emails, and communications to detect social engineering attacks or phishing attempts that often precede fraudulent payments. None of the typical rules-based detection systems have such functionality.

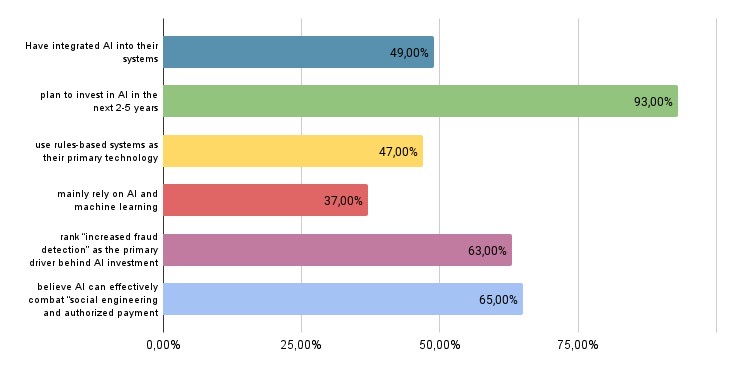

According to the Mastercard recent survey, nearly half of financial institutions of different kinds employ AI to boost fraud detection, with 93% planning to invest in AI in the next few years.

Those firms who do leverage AI to improve their fraudulent transaction detection already see significant benefits. Thus, Mastercard’s “Decision Intelligence Pro” solution with its AI-driven insights is able to boost fraud detection rates on average by 20% and reduce the number of false positives by more than 85%. Meanwhile, Visa has used GenAI to expand its fraud detection expertise from cards into account-to-account (A2A) payments, and Global Payments fintech claims that its GenAI-enabled fraud detection solution has driven a 50% reduction in fraud losses for customers.

AI Facilitates Transactions

AI is also transforming the way transactions are made by improving their speed, security, and overall efficiency of payment processes.

For example, AI systems can optimise transaction routing and timing through intelligent algorithms to reduce transaction time, minimise applicable fees, and avoid payment delays during peak periods. Besides, AI and ML enable faster risk identification in payables, receivables, and reporting, thus, streamlining payment processes.

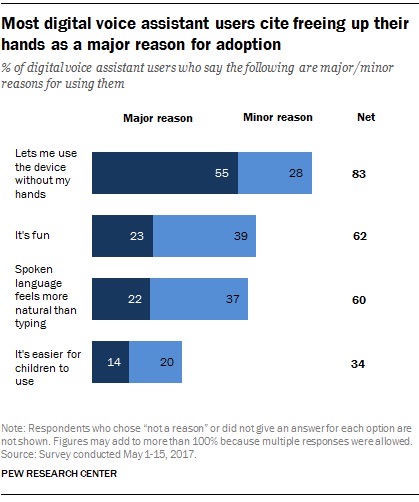

AI-driven virtual assistants can help users manage transactions, set up payments, and answer queries about account balances. In addition, natural language processing (NLP), which is a subset of artificial intelligence, can be used for initiating transactions with one’s voice either by a merchant/cashier or a customer. After all, nearly half of U.S. adults (46%) already use voice-controlled digital assistants for a wide range of consumer activities.

Some of the innovative uses for AI agents are autonomous payments on behalf of the user. Companies like Skyfire are experimenting not just with AI scheduling regular payments to vendors, suppliers, or service providers, but also with autonomous initiation of one-time or repeated transactions according to the general task assigned to the bot.

Finally, AI automates a large share of the backend work involved in payment processing, such as data entry, reconciliation, and compliance checks. It reduces the need for manual operations and lowers overall transaction costs, enabling affordable transaction fees and boosting financial inclusion.

AI Forecast Helps Banks Manage Cash Flows

Moreover, AI can not only facilitate separate transactions, but also aid financial institutions in a larger context of cash management. For instance, Deutsche Bank employs AI/ML in its cash management operations, which include day-to-day administration of managing cash inflows and outflows. Smart tools help bank employees to forecast cash flows. The bank can then amend transaction due dates to expected payment dates in real time depending on the changing circumstances and incoming data. The main purpose of cash flow forecasting is to assist with managing liquidity. Thus, the more accurate it is, the better is debt planning and the smoother are the bank’s daily operations.

Another successful example is ING Bank, which utilises AI to optimise its cash logistics, predicting how much cash is needed in each ATM to meet changing customer demand without holding excess cash. Having excess cash in ATMs ties up bank capital and increases the risk of theft, so AI minimises these risks. The AI-driven approach also helps ING Bank enhance operational efficiency, lowers costs associated with cash transportation, labour, and ATM maintenance, and ensures a consistent and reliable service for its customers. AI predictions can be pretty accurate, as they integrate multiple data sources in the analysis, e.g. withdrawal history, regional economic activity, weather conditions, or upcoming local events that may impact cash demand.

AI Is the Backbone of Modern Customer Service

Like most other service companies, payment providers leverage AI to increase response efficiency, reduce operational costs, and provide fast and personalised support at scale.

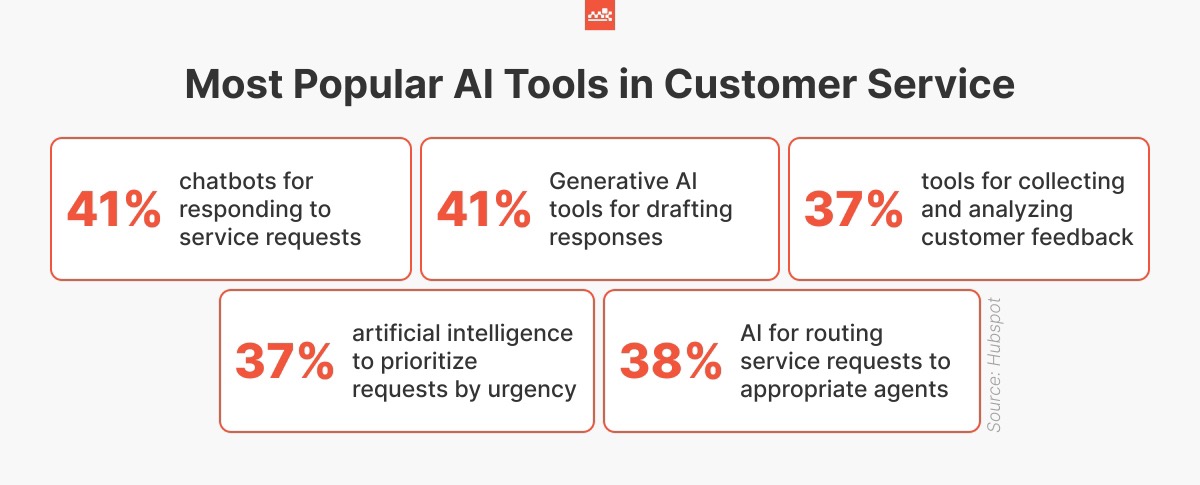

According to Master of Code curated statistics, nearly half (45%) of global customer support teams are already using AI in various forms:

Source: Master of Code

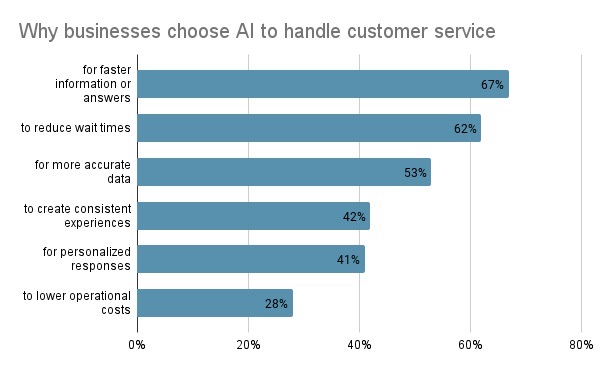

Companies choose artificial intelligence as a customer service solution for multiple reasons:

There are numerous examples of how fintechs and banks are using generative AI chatbots to personalise their offerings and help customers with their daily queries and complaints. Let’s take a look at the most prominent examples:

- Bank of America has its virtual financial assistant Erica integrated into the bank’s mobile app, to assist customers with their banking needs, provide personalised banking insights, reminders, and recommendations.

- JPMorgan Chase implemented machine learning algorithms to personalise financial advice and product recommendations for customers.

- Wealthsimple, a Canadian fintech company, uses generative AI to automate support conversations. Its chatbot answers FAQs, allows customers to quickly access their financial information, and gives relevant guidance on money management.

- ING Bank has different chatbots for different markets on Meta’s Messenger. However, they all use NLP to understand their customers’ needs better. Furthermore, the bank implemented voice technology in some of its customer service processes, allowing customers to use their voice to log in and access certain functionalities

- Axis Bank lets its customers use their Alexa devices for a number of requests which are traditionally handled by human agents, e.g. blocking credit cards, reviewing transaction history or ordering chequebooks.

- BBVA uses AI and ML to transform its customer service and offer personalised banking experiences through customer segmentation. AI-driven insights enable the bank to dynamically personalise its banking app’s user interface for each customer segment.

- Esusu, a fintech platform, leverages automated workflows available through Zendesk to scale its support operations and summarise tickets for agents. With AI, the firm’s first reply time dropped 64%, the phone answer rate increased by 90%, while the team’s full resolution time decreased by 34%.

- Capital One developed Eno, a virtual assistant that interacts with customers through text messages, providing account insights, answering financial questions, and helping with credit card services.

Artificial Intelligence and Remittance Services

While the Internet is abundant with use cases for AI in mobile banking, financial fraud detection and backend process optimisation for banks and payment providers, little is known about AI adoption in the remittance segment.

It is not that remittance players shy away from AI use completely, but their efforts to innovate services with this novel technology are moderate. Besides, it seems that many remittance providers prefer to keep their plans for AI confidential. For instance,

- Western Union has been using an AI chatbot with a money transfer function integrated into the Facebook Messenger interface since 2018. Besides that, the company is partnering with some AI startups now and then and hosts AI bootcamps, but little is known about the impact of such partnerships on the popular remittance platform or any AI innovations taking place over the last six years.

- MoneyGram explores the potential of generative AI in creative ways like hosting a contest which involves AI-generated greetings cards. The firm has recently started using a chatbot and some AI tools to enhance its loyalty program and improve targeted marketing. Though the company’s executives speak little of AI solutions, mostly focusing on blockchain and crypto tech stack.

- Remitly rolled out a new AI-powered virtual support assistant and enhanced AI search capabilities for its updated help centre only a few months ago. The company also uses machine learning to combat fraud and reduce chargebacks. Unlike most remittance players, Remitly publicly shares its AI/ML journey and challenges with implementing the technology. In fact, the firm’s ML engineering manager Jake Weholt partly lifts the veil on why most remittance companies are careful with AI adoption.

Obstacles in AI Adoption in the Remittance Segment

When asked about the trade-off between risk management framework and advanced fraud detection and prevention systems, Jake Weholt carefully states: “I think we think about first model explainability and control when building our risk systems. And because we are a public financial company, it is tricky, I would say. I can’t go too much into that, but we think about model explainability and usability first because one of our primary goals is managing model stability so that we are not impacting the customer experience too much. We are, I would say, hesitant to use more complex tools if they add complexity but don’t add value for our customers. And the first thing for us is customer value.”

Now, the main question is what do customers value? How do they really feel about AI in payments? Some answers come from numerous surveys on the topic.

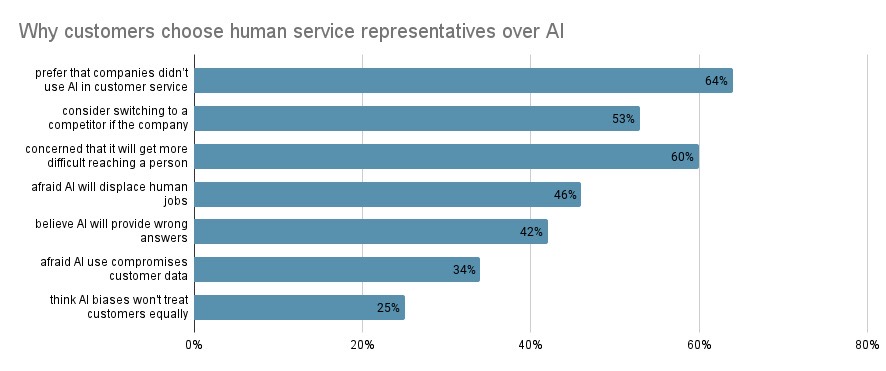

A December 2023 Gartner survey showed that many people prefer human customer support agents, with over 60% ready to switch to another service provider rather than deal with AI.

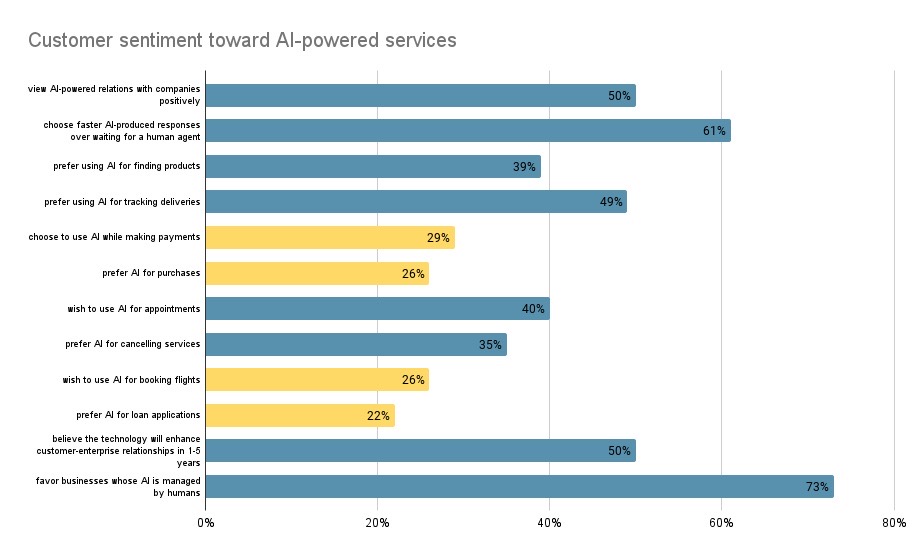

The research prepared by Master of Code also reveals controversial customer sentiment towards AI use. It seems people get especially sceptical when it comes to the payment segment.

As we can see, all of the use cases which deal with monetary transactions ignite significantly less enthusiasm than those which require routine consultation or checkup. In this case why would companies that focus on added customer value bother with a complex implementation process which might also create some friction? Besides, integrating AI deep into the firm’s operations requires solid investments, especially at the initial stage. That might result in increasing some customer fees. For the remittance segment, which already deals with FX exchange rates, it is critical to make services as affordable as possible. That might be another reason why remittance leaders are not very eager to tackle costly innovations.

At the same time, it is becoming clear that people are feeling more comfortable with AI use in payments with time and rising awareness. Thus, a Paysafe survey showed that only 10% of respondents are willing to use AI-driven payments in the next two years, while 35% of those surveyed lacked adequate knowledge about the technology to feel comfortable using it.

About one-third of respondents never knowingly used AI-assisted payment technologies — AI-powered checkouts, smart wallets, and payment chatbots. Most people (82-86%) aren’t even confident that they can tell whether a piece of content comes from a human mind or whether they are interacting with a chatbot. Therefore, they simply lack awareness of the concept, its mechanism and implications. As people get more familiar with AI and realise it’s safe and reliable, they may be way more comfortable with AI-powered cross-border transfers.

How Can AI Maximise Benefits for Remittance Players?

The time for widespread use of AI in payments will surely come sooner rather than later. It will need some educational activities and promotional campaigns from the industry, though.

“With the very immediate and significant impact of AI that we’ve seen in recent months, it’s understandable that consumers would have concerns about using such technology at the checkout. Payment service providers and merchants will need to educate users about the benefits of AI-driven payments, such as smoother experiences, convenience and security, in order to break down those barriers.”

Rob Gatto, chief revenue officer at Paysafe

Meanwhile, perhaps, remittance players who prefer to stay on the safe side with innovations should consider less controversial areas to implement AI in their operations. While customers are dubious about addressing AI chatbots for payments or customer service, they are perfectly willing to use AI in other functions.

Thus, SurveyMonkey revealed that there are many types of customer experience AI that consumers (especially the younger generations) are excited about.

- 52% of consumers are interested in AI that helps them through a product, website, feature experience.

- 47% of customers are interested in getting personalised deals.

- 42% of customers appreciate AI-driven product recommendations.

It can work well for the remittance segment that sees rising competition. Aggregator and comparison platforms may help users go shopping for favourable rates and transfer conditions while sending money abroad. Besides, a single remittance platform can use AI to differentiate its customers into meaningful segments and create personalised offerings for different sender and receiver categories.

Another area where AI can be most useful without disturbing the customers is legal compliance. It may be specifically challenging for remittance companies which deal with numerous jurisdictions which all have different laws and regulations. AI helps remittance companies comply with AML regulations by identifying and flagging suspicious transactions or entities. The technology may seamlessly automate both currency conversion and compliance checks in cross-border payments. Its use in the sphere is very promising. The global AI market for compliance and governance is projected to reach $1,016 million by 2026, growing at a CAGR of 65.5% from about $50 million in 2020.

AI algorithms can also monitor real-time exchange rate fluctuations and optimise currency conversions for both the company and its customers, helping maximise profit margins while providing competitive rates. It can even alert users when exchange rates are favourable for their usual remittance destinations. Besides, smart algorithms can handle repetitive and time-consuming tasks, such as data entry, transaction processing, and customer service. This reduces the need for manual intervention, lowers operational costs and allows employees to focus on more complex tasks such as handling tricky customer queries.

To Sum Up

The use cases for AI in payments ranges from fraud detection to smart wallets and customer-oriented chatbots. The technology is widely used in the industry. However, remittance processing already involves a lot of friction and complex fees, so payment providers avoid overcomplicating the process with additional AI-driven tools.

They take a cautionary approach considering that customers do not yet value AI chatbots and customer services too much. At the same time, many remittance players might be already using much of AI for internal processes, remaining discreet about it. The most efficiency in this segment can be achieved by AI automation for compliance and governance as well as documentation.

However, remittance companies should also strongly consider using AI for personalisation of their services, customised insights and recommendations, as well as rate comparison tools which might be welcomed by the public today without additional awareness-raising.