Changpeng Zhao, the now ex-CEO of Binance, pleaded guilty to breaking sanctions and money laundering. Binance is set to pay $4.3 billion to settle the criminal charges, one of the largest penalties ever obtained by the US from a corporate defendant. Will Binance, US and otherwise, survive the courthouse trashing of its reputation? Will other cryptocurrency exchanges tighten their reins on customers to prevent suffering similar fate? How will the crypto market respond, if it will respond at all?

CZ Pleads Guilty

November 21, 2023 — Changpeng Zhao (CZ), founder and CEO of Binance, the world’s largest cryptocurrency exchange, has resigned from the company and pleaded guilty to money laundering charges.

As part of his plea deal, Zhao agreed to pay a $50 million fine and is barred from any involvement in the business.

Binance itself also pleaded guilty and agreed to appoint a monitor, paying a criminal fine of nearly $1.81 billion and a $2.51 billion order of forfeiture to settle three criminal charges, including conducting an unlicensed money transmitting business, conspiracy, and violating the International Emergency Economic Powers Act.

The US Justice Department accused Binance of enabling illicit transactions, including those involving users in sanctioned countries and terrorist groups. This settlement is one of the largest penalties the department has ever obtained from a criminal case, totaling $4.3 billion in fines.

Following these developments, Richard Teng was named the new CEO of Binance. Previously, Teng was Binance’s head of all regional markets outside the US.

The newly appointed CEO has already made clear that distancing Binance from Zhao will not be a part of the company’s reputation-rebuilding strategy.

Teng tweeted, “With CZ, and our leadership team’s support, I have accepted this role so that we can continue to meet and exceed the expectations of stakeholders while achieving our core mission, the freedom of money.”

A shifting of blame to CZ never seemed in the cards for Binance, adamant on maintaining a front strong in its unity, despite the former CEO’s step down from the very high profile and public position. What exactly is the largest crypto exchange planning to do about the charges against it, and how will its guilt affect other cryptocurrency exchanges and the market as a whole?

A Laundry List of Criminal Charges

In its press release on November 21, 2023, the US Department of the Treasury stressed the extent of crime facilitated by the indifference of Binance to its customers’ doings.

“Binance turned a blind eye to its legal obligations in the pursuit of profit. Its willful failures allowed money to flow to terrorists, cybercriminals, and child abusers through its platform,” said Secretary of the Treasury Janet Yellen, referring to criminal cases including Michael Mohammed’s, who was able to use Binance for transactions of child sexual abuse materials for eight years prior to getting caught by Dutch authorities.

Having accumulated too many ties to a long list of enabled crimes, Binance seems to be getting off with just a pricey slap on the wrist. After all the allegations against Binance and Zhao are severe, including:

Unlicensed Money Service Business (MSB)

The U.S. Department of Justice alleges that Binance, along with CZ and other executives, knowingly and willfully operated as an unlicensed money services business from August 2017 until October 2022. Binance failed to register with the U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) as an MSB, partly to avoid U.S. regulators discovering that it facilitated cryptocurrency trades without proper user checks. This allowed Binance to attract a substantial number of U.S. users to its platform.

Money Laundering Checks

Binance is accused of facilitating billions of dollars in cryptocurrency transactions for its customers, including those in the US, without implementing “know your customer” (KYC) checks. Binance’s compliance personnel recognized that its anti-money laundering controls were inadequate and could attract criminals to the platform. The exchange processed transactions associated with illicit activities, such as obfuscating the source of crypto funds and laundering proceeds from darknet market transactions, hacks, ransomware, and scams.

Sanctions Violations

Binance had a significant customer base in sanctioned jurisdictions, primarily Iran, and was aware that it allowed transactions between U.S. users and those subject to U.S. sanctions, which violated U.S. law. Between January 2018 and May 2022, Binance processed 1.1 million crypto transactions worth at least $898.6 million between U.S. customers and Iranians.

Further, Binance is accused of facilitating transactions for the sanctioned russia, specifically for illicit goods and fraudulent services via the Hydra darknet marketplace. Between August 2017 and April 2022, $106 million was sent in Bitcoin between Binance.com wallets and Hydra, a popular russian darknet marketplace that is frequently used by criminals for the sale of illegal goods and services.

‘Terrorism’ Financing

Binance failed to report suspicious transactions associated with terrorist groups, including the Palestinian militant group Hamas. Crypto wallets at Binance were found to interact with bitcoin wallets associated with various proscribed terrorist organisations, including Islamic State, Hamas’ armed wing, al Qaeda, and the Palestine Islamic Jihad (PIJ).

These allegations are part of the $4.3 billion settlement to resolve criminal charges against Binance and CZ related to operating an unlicensed money transmitter business, conspiracy, and violating sanctions regulations.

The company doesn’t seem to be going under. So, what exactly does Binance plan to do to deal with the concerns regarding the legal situation of Binance in the US?

Binance: Undoing or Ignoring a Tarnished Reputation

Within a 24-hour period, Binance experienced substantial withdrawals, totaling over $1 billion. Additionally, the exchange recorded net outflows of $703.1 million over seven days. Notably, a substantial portion of these outflows, amounting to $605.9 million, occurred across various blockchain networks, including Ethereum, Avalanche, Fantom, and Polygon.

These outflows indicate that investors and users are more than concerned about the legal developments and leadership change at Binance, prompting them to withdraw their assets from the exchange.

Teng responded to doubts of the exchange’s liquidity, “The fundamentals of our business are VERY strong. Binance continues to operate the world’s largest crypto exchange by volume, our capital structure is debt-free, expenses are modest, and, despite the low fees we charge our users, we have robust revenues and profits.”

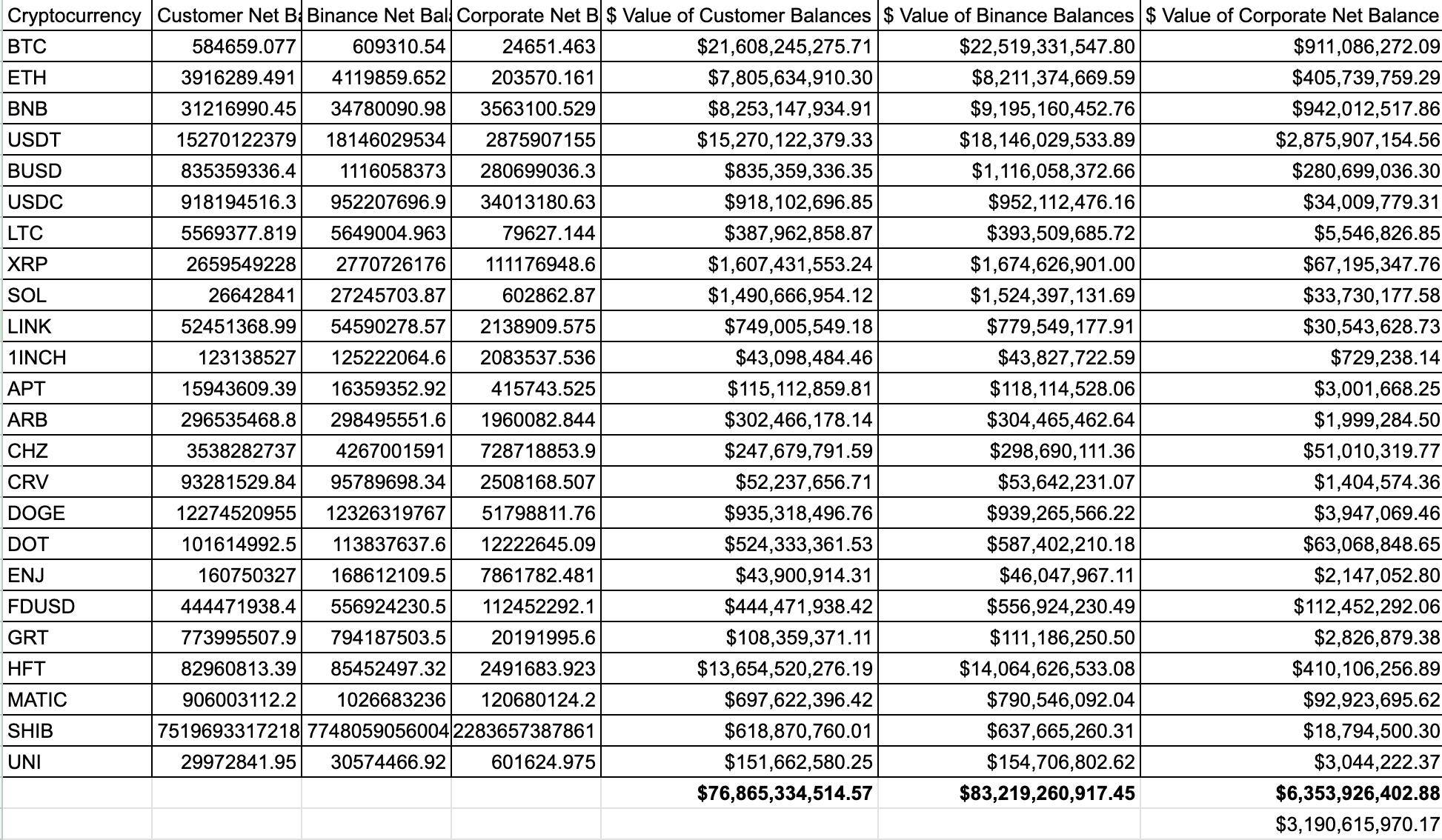

The new Binance CEO was backed by Coinbase exec Conor Grogan, who analysed Binance’s balance sheet to prove necessary liquidity of assets.

Proof of Reserves data provided by @jconorgrogan via Twitter.

“I backed out Binance Corporate’s crypto holdings from their Proof of Reserves: $6.35B total assets, $3.19B in stablecoins,” tweeted Grogan, “Doesn’t include off-chain cash balances or funds held in wallets not in PoR. Most likely [Binance is] able to pay full $4.3B DoJ fine with 0 crypto asset sales.”

Beyond, Binance is taking several steps to regain a good reputation following the criminal charges brought against it, including:

Settling with US Authorities

Binance has agreed to pay a substantial $4.3 billion fine to resolve the federal criminal charges in the US. This demonstrates a willingness to cooperate with regulators and address all legal concerns.

Change in Leadership

CZ has stepped down and will pay a $50 million fine, with Teng appointed as the new CEO. This leadership change signals a commitment to accountability and a fresh start for the company.

Outside Compliance Monitor

As part of the settlement, Binance has agreed to have an outside compliance monitor for three years. This independent entity will oversee Binance’s compliance programs and report back to the US government, ensuring transparency and accountability.

Industry Support

Industry leaders and financial institutions have expressed positive views about the settlement, indicating that it may help address concerns and systemic risks associated with Binance. This positive response can contribute to rebuilding trust in the company.

Binance is taking significant steps to address the legal issues it faces and regain a good reputation, accepting financial penalties, leadership changes, enhanced compliance measures, and external oversight to demonstrate a commitment to operating within the bounds of the law and fostering a more secure environment for the crypto industry.

A Mixed Response From the Crypto Market

The crypto market’s reaction to the news of Binance’s criminal charges was mixed, with several notable developments in the cryptocurrency industry:

Bitcoin’s Price

Bitcoin (BTC) and several other cryptocurrencies experienced a drop on November 21 when news of the impending crypto enforcement action by the US Department of Justice (DOJ) broke. BTC’s price fell from above $37,000 to approximately $35,800 within the day.

Bitcoin’s November 2023 price chart, indicating the brief drop following news of the Binance settlement.

Bitcoin recovered and exceeded its November 21st price the very next day, sitting at $38,700 at the time of writing. During the month of November, the price of Bitcoin has increased 12% since October.

Industry Leaders’ Views

Some industry leaders and financial institutions viewed the settlement positively. JP Morgan, for example, saw it as eliminating “potential systemic risk emanating from a hypothetical Binance collapse.” Ripple’s Chief Legal Officer, Stuart Alderoty, drew comparisons between enforcements of compliance which “all big banks had to undergo” and current efforts to bring safeguards to big cryptocurrency companies.

Regulatory Actions

Besides the Binance settlement, regulatory actions have been taken against other major players in the crypto industry. The US Securities and Exchange Commission (SEC) sued Kraken, a US-based crypto exchange, alleging that it operated as an unregistered securities exchange and commingled customer crypto deposits with its own assets.

Tether’s Involvement

Tether, issuer of the largest stablecoin, USDT, voluntarily froze $225 million worth of USDT following a DOJ investigation into an international human trafficking ring based in Southeast Asia. “The frozen wallets are on the secondary market and are not associated with Tether’s customers,” said the press release, “To the extent lawful wallets were captured by this operation, Tether will work quickly with law enforcement and the owners of those wallets to unfreeze them, as appropriate.”

A Certain Future For Binance

In the end, there was no mass crypto market exodus. Given that the charges have not been suddenly sprung up on Binance, detrimental effects on the market were likely highly (and successfully) mitigated.

“After the momentary shock of the agreement with the announcement, there is no significant impact on most assets,” said Grzegorz Drozdz, a market analyst at investment firm Conotoxia, referring to news of the settlement and a mild market reaction. With the anticipated approval of the Spot Bitcoin ETF, the crypto market looks more promising than negatively affected.

For Binance, however, recovery will largely depend on how effectively the exchange addresses its regulatory challenges, rebuilds its reputation, and demonstrates a commitment to operating within the bounds of the law. Adapting to evolving regulatory landscapes and fostering a culture of compliance will be critical for the exchange’s long-term success.