Humble beginnings fixing ACs in Florida, the world’s fastest Ferrari, the most expensive Rolexes, $27 million donated to charity, and a token better than Bitcoin. This is the supposed composition of Richard Heart — a force for good in every avenue of life.

The altruistic exhibitionist has put out solutions to addiction issues, excessive military spending, democracy, the failed school system, starting a business, proper apologies, and living a better life. He’s also supplied one of the most comprehensive examples of what a cryptocurrency scam looks like.

If one hasn’t had the displeasure of being tantalised by pyramid, ponzi, or pump-and-dump schemes, this is the prime example of what to avoid when putting money in DeFi.

Source: @RichardHeart via YouTube

Richard Heart, real name Richard James Schueler, and his crypto projects HEX, PulseChain, and PulseX, have been charged by the US Securities and Exchange Commission (SEC) for conducting unregistered securities offerings totaling over $1 billion.

The SEC alleges Heart marketed HEX as a high-yield “blockchain certificate of deposit” investment to make people wealthy, while promoting a staking feature that promised unrealistic 38% returns, attempting to evade securities laws by encouraging investors to “sacrifice” their crypto assets instead of investing them.

The lawsuit filed in the US District Court for the Eastern District of New York cites evidence of misappropriation of funds from the offerings for PulseChain, where Heart spent millions on luxury goods, including a 555-carat black diamond. The SEC claims that HEX, PulseCoin, and PulseX have experienced massive price depreciation, rendering PLS and PLSX almost worthless, and HEX’s value has dropped significantly from its all-time high.

The SEC is seeking a jury trial and demands a permanent ban on Heart and his projects from selling crypto asset securities, the recovery of ill-gotten gains, prejudgment interest, and imposition of civil penalties.

HEX and Heart’s Other Hscams

Heart, a serial entrepreneur and crypto advocate, gained popularity making content about crypto, finance, and entrepreneurship. He founded several business ventures, including HEX, PulseChain, and PulseX.

In 2019, Heart launched HEX, an Ethereum-based cryptocurrency, advertised as a blockchain certificate of deposit (CD) that offers rewards to holders who stake their HEX tokens. HEX token’s value is “determined by market forces”, ergo price fluctuates based on demand. As more users participate in staking, the value of the HEX token should increase to the benefit of long-term holders. Token holders were heavily encouraged to lock up their assets for as long as possible (15 years) to maximise their returns over time.

PulseX and PulseChain followed with rocky launches in 2023. PulseX is a PancakeSwap fork that operates as an exchange on the PulseChain network. PulseChain is an Ethereum fork designed to support the HEX smart contract and offer a cost-effective environment for HEX users to transact. The fork was initiated to address high transaction fees on the Ethereum mainnet, which affected HEX users significantly. PulseChain operates as a separate blockchain from Ethereum, and allows users to “sacrifice” their ERC-20 tokens, converting them into Pulse tokens, which can be used on the PulseChain network.

Beyond relation to HEX, PulseChain and PulseX were riddled with their own murk. The projects garnered significant attention during the “sacrifice” funding phase, with billions reportedly invested, making it one of the largest funding rounds in crypto history. Funds were raised through the donation of ERC-20 tokens, and raised questions about potential impact on the value and liquidity of donated tokens, the value of Pulse tokens received, and the overall legitimacy of the project. When investors “donated” their Ethereum, it was supposedly “transformed” into HEX. Actually, the sacrificed Ethereum simply ceased belonging to the investors, and continued existing in the pocket of Richard Heart, who then began creating HEX endlessly out of nothing.

Further discussions surrounding the tokenomics and deflationary dynamics of PulseX, particularly the burn mechanism reducing PLSX tokens through fee collection, sparked debates about its long-term sustainability and token price impact.

Following the SEC’s announcement, the value of PLSX, PLS, and HEX tokens plummeted 50%.

HEX itself is among the many shitcoins which met no moderate reaction, collecting “scam” labellings from droves of the crypto-savvy, while gaining a substantial following of credulous get-rich-quick seekers. HEX’s red-flag bouquet did not dissuade the rapacious. In fact, HEX swiftly utilised its blatant scheme-ness to prey upon the targets of all treachery: narcissistic conspiracy theorists. It wouldn’t be until March 2023, when Heart surprised many by deleting all references to HEX, PulseChain, and PulseX from his social media accounts, that HEX holders would become concerned.

And yet, concern was not enough for Hexicans to sell their tokens. HEX even experienced a price spike that same month, reaching $0.118, before plummeting to below $0.0047 where it sits at the time of writing.

Interestingly, the aspects of HEX and Heart’s other ventures which demonstrate obvious fraudulence are the same ingredients successfully baiting the desperate time and time again.

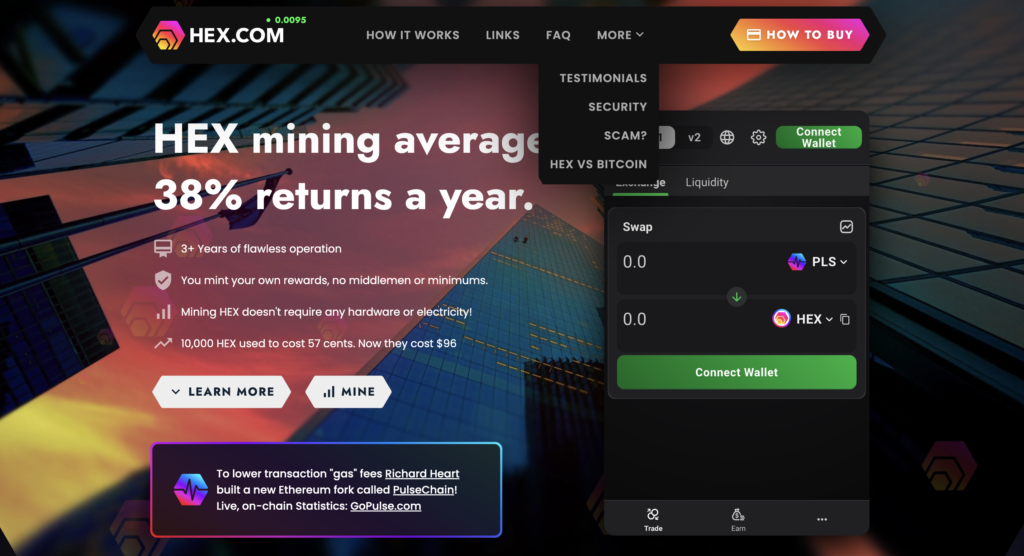

Source: HEX.com

Scam Sublime

From landing page to the not-whitepaper, HEX is full of fascinating embellishments — compelling the gullible, repelling the wary.

HEX’s plot is riddled with contradictions, all barging through sober scepticism, appealing to the scam’s targets from any angle possible. The only coherent thought intended for retention after visiting HEX.com is that “you won’t ever have to work another day in your life” once you devote yourself to HEX. Garrulous lying seemingly answers every question common people could have for something so special as HEX, regardless of whether these answers make any sense. And before the euphoric bubbles of hope are burst by the needling idea that HEX is too good and gaudy to be true, Heart will deliver an assembly of faithful storytellers and confidently recite statistics he created himself.

Keeping as many people invested in HEX for as long as possible enriches only Heart himself, who gains money even when people withdraw early in form of penalties. As the technical explanation document states: The origin address receives 50% of the HEX removed from a staker’s return due to early or emergency unstaking penalties, as well as a copy of all bonus payments, including speed claim bonus, referral bonus, We Are All Satoshi increments, Critical Mass/Virality bonuses, and others.”

Early iterations of the hexsite (2019) blatantly spell out what’s really happening: “HEX rewards most those who acquire HEX the earliest, stake more for longer and refer others to do the same.” Wait… that’s exactly how pyramid schemes work… And the leader is always the original evangelist, having the most to reap. Unfolding the cultish wrapper, there is nothing decentralised and financially secure at the heart of HEX.

Effective Funnel

HEX’s landing page exhibits everything you need to know about the magic token. 4 out of 5 call-to-action buttons lead to purchasing HEX, while the fifth takes you down to learn more, boldly claiming “the future of finance is here”.

Source: HEX.com

The text below reads: “You can mine HEX by running some code on your computer or phone once and waiting anywhere from 1 to 5555 days, you choose how long. Then you can mint your rewards by running some code once more. You earn larger rewards based on how long you commit to wait. Longer Pays Better. The APY for HEX mining of average length is 38%. Imagine minting HEX rewards while the price of HEX is going up, you win twice.”

However, infinite supply of a currency leads to perpetual and uncontrolled inflation, ridding the token of any real value, while opening doors for infinite HEX to ETH abuse. Heart explains how that works:

“Let’s pretend you launched a coin, and you raised money. And then you put that money into Ethereum. And then Ethereum went up 40X, and you dumped that s**t, and you had a f*****g stack of cash. I bet if you reinvested in your original coin, you could have actually net put more into that coin than you took out. Do you know what I’m saying?”

Heart, who is a big fan of displaying his watches and Louis Vuitton bags in piles behind him while recording life-changing advice videos, seems to know what he’s talking about.

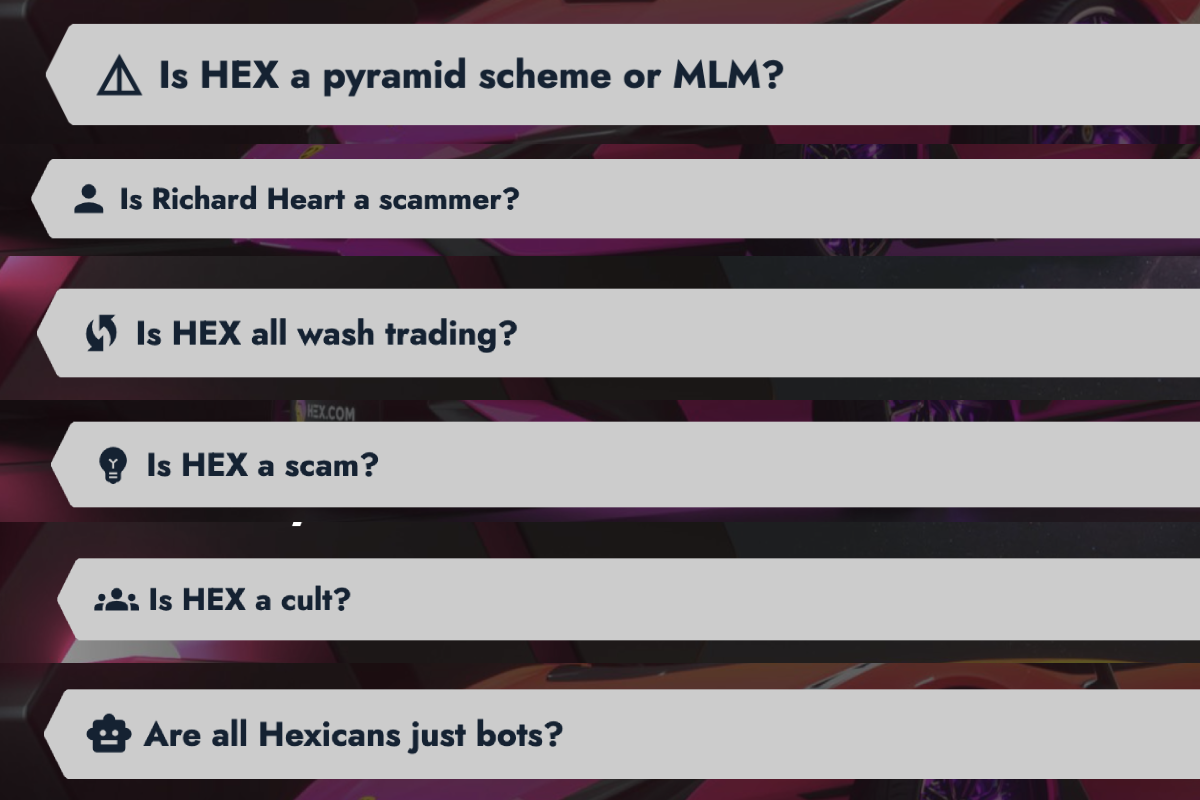

Beyond a deranged “HOW IT WORKS” page, of note are the FAQ and the “MORE”, which features intriguing sections such as “TESTIMONIALS”, “SCAM?”, and “HEX VS. BITCOIN”.

Source: HEX.com

The pages reiterate the same convoluted points of revolutionary wealth generating possibilities, exploit misleading terminology (Heart’s wikipedia suggests he has at least some technological awareness, so it is unlikely the product of genuine mistake) and exhausting the reader as they spiral down the funnel. In the end, you retain a sense that everything was coherently explained, but nothing adds up.

Back to the front and centre, the boldest writing announces HEX mining averages 38% returns a year. Unprecedentedly high and not true, starting from HEX not being a cryptocurrency which can be mined. Heart refers to rewards reaped from staking HEX (minting) as “mining”, because following the rebrand, HEX’s marketing largely included comparisons to Bitcoin. Indeed, the “HEX VS. BITCOIN” page deserves to be looked at.

Bitcoin vs. HexBitcoin

HEX, branded as BitcoinHex prior to its marketing pivot, claims to be the better Bitcoin. Let’s examine the points.

1. Inflation rate

Bitcoin: “Bitcoin’s inflation was high earlier on due to mining rewards and that its price went up faster when it was a younger network.” This is generally true; Bitcoin has a halving event every four years, reducing the block reward and slowing down its inflation rate over time.

HEX: “Comparatively, HEX completed its high inflation phase in the first year and now has a capped inflation rate of 3.69% annually.” This is misleading, as staking rewards can be limitlessly minted, rather than taken from a designated pool.

2. Inflation usage

Bitcoin: “Bitcoin’s Proof of Work (PoW) consensus mechanism is dubbed as a waste of energy.” This has been proven wrong, through PoW’s capability to use residual energy and renewable energy.

HEX: “HEX’s Proof of Wait (staking) is argued to be more environmentally friendly as it doesn’t require the energy-intensive mining process.” This would be true, if Bitcoin was only capable of using non-renewable, non-residual energy, however, that is not the case.

3. Inflation distribution

Bitcoin: “Mining allows BTC to be released based on the hashrate, which can lead to centralization of mining power.” Currently, the size of Bitcoin’s mining network would make it implausibly difficult to overtake the network, be it an attack by a government or other organised group.

HEX: “Stakers mint new HEX based on the number of shares they hold, promoting a fairer distribution as staking doesn’t require specialised hardware.” Given the Heart has control of the origin and genesis addresses for HEX, and likely control of the “decentralised” PulseX and PulseChain, is the allocation of 50% of all staking penalties and rewards to Heart also fair?

4. Network protection

Bitcoin: Heart alleges that the hashrate protects the Bitcoin network from 51% attacks, and is insufficient. As stated above, the scale of Bitcoin’s mining network is enormous, making it difficult to amass the required hashing power to dominate the network. The cost of acquiring such computing power would be exorbitant, and the attacker would risk significant financial losses due to the potential rapid response from the community and the market’s negative reaction.

HEX: Heart claims that HEX doesn’t need protection against 51% attacks as it operates on PulseChain, which provides security. This cannot be verified.

5. Complexity

Bitcoin: “Mining Bitcoin requires significant setup and operational complexity.” This is true, however, Bitcoin’s purpose, as evidenced throughout this article, was never to provide users with investment rewards. Bitcoin was created to facilitate peer-to-peer transactions without third parties. Bitcoin is not a get-rich-quick scheme.

HEX: Staking HEX is claimed to be simpler and doesn’t require specialised hardware. If it was too complex, HEX’s targets wouldn’t be able to sacrifice their money to it.

6. Profitability

Bitcoin: Mining profits vary due to block difficulty and halving events.

HEX: HEX Stakers can allegedly earn higher annualised profits compared to Bitcoin mining. Likely the ones Heart onboarded early on did earn money, but not lastingly. Since HEX doesn’t generate revenue, yet is capable of paying out ‘interest,’ the only source of realised returns is other investors. Since by the time PulseChain launched, everyone who could be convinced to on-board had already done so, no one ‘pumped’. But there was definitely a substantial ‘dump’. Even if annualised profits for the first HEX missionaries may have been high (proof cannot be found), these profits are no more.

Source: CoinMarketCap

7. Cloud mining

Bitcoin: The text criticises cloud mining services, which is a completely optional feature for those who cannot afford to mine BTC independently.

HEX: “HEX doesn’t involve third-party intermediaries and allows users to stake directly.” Arguably, the origin address of the smart contract, which collects and transacts all HEX, should be classified as a third-party, since a third-party has control of and benefits from it.

8. Counterparty risk

Bitcoin: Heart points out counterparty risk associated with lending Bitcoin to third parties. This potential risk is the third party, and is not inherent to Bitcoin.

HEX: “HEX’s staking system eliminates counterparty risk as users earn yield directly by staking their HEX.” In turn, HEX investors risk early or late withdrawal penalties and depreciation through pumping-and-dumping of HEX or the emptying of the genesis address (more on that later).

9. Whales

Bitcoin: “Addresses holding a significant portion of Bitcoin’s supply (“Whales”) pose threats of market manipulation and centralisation.” However, Heart states that newer miners also pose the threat of centralisation with more efficient mining technology.

HEX: Heart suggests that Hexicans can own a larger percentage of HEX’s total supply compared to Bitcoin. This is obvious and means nothing. Since the value of HEX is exorbitantly lower, it is “easier” to own more HEX, which is unlimited in supply. Given the aforementioned transfer of $7 million Ethereum from HEX’s genesis address in 2020, coupled with aggressive marketing leading up to the launch and subsequent plummet of PulseChain, Heart isn’t one to talk about market manipulation.

10. 1000x

Bitcoin: Heart claims a 1000x increase in Bitcoin’s price is practically impossible. That’s probably ok, considering the 200% difference between Bitcoin’s current lowest and highest values.

HEX: Heart promotes the potential for 1000x returns with HEX. He doesn’t provide anything to back these claims.

11. Addressable market

Bitcoin: “Bitcoin aims to replace gold.” Bitcoin has the capacity to do that due to its scarcity and immutability, making it a reliable long-term store of wealth, both throughout time and space.

HEX: HEX allegedly addresses multiple markets, including Store of Value, currency, and Certificates of Deposit. However, if no one were to stake HEX, there would be no source of return interest, which is derived from minting and staking rewards and penalties of HEX investors. Without them, HEX is worthless.

In reality, taking this comparison page at all seriously is taking Heart’s words with more seriousness than he warrants. Every point in support of HEX is merely a common misconception or criticism thrown at Bitcoin flipped on its head. This is a marketing cheatsheet in case there are any crypto-antis Heart can con.

“It [HEX] does what Bitcoin cannot.”

HEX does nothing, Heart even states so on the website. If anyone has ever earned anything from investing in HEX, it was thanks to the third-party — other investors who minted and staked.

The Not-Whitepaper

According to Heart, it’s “more important to put work into a good website than a good whitepaper.” Indeed, the praises for HEX.com’s expertly-crafted hooks have been expressed in the previous passage. Still, he does provide a technical explanation of HEX, and it is worth looking at.

HEX features an expansive multi-level referral system. You can even refer yourself.

“Self referring works, meaning you can generate a referral link for your own ETH address, click it, claim your HEX, and receive the 20% referral bonus. I mention this because it should be obvious that you could do this using a “dummy” ETH address to receive claim bonuses and your “real” address to claim against. Then consolidate or not at your leisure. If this now means you don’t want to click my referral link at the top, consider simply sending a HEX tip to 0xd30bc4859a79852157211e6db19de159673a67e2.”

Where is gainful self-referral possible? Only where value is generated out of thin air, and someone else stands to benefit more from your self-devotion.

HEX lacks any genuine underlying economic activity or interest. Its contract code focuses on generating new inflationary tokens and distributing them to users who lock up their tokens. This scheme is dependent on Heart’s control and creation of tokens without any real asset backing. The promise of extremely high returns is unrealistic and non-existent when their value is built upon nothing, and the nothing depreciates further as it is multiplied.

Since those who choose to lock up their tokens in HEX receive half of the penalties imposed on those who prematurely open or fail to unlock their funds within the agreed timeframe, with Heart taking the other half. Essentially, the HEX contract’s sole objective is to shift value from certain token holders to others.

Source: @RichardHeartWin via Twitter

At the Heart of it All

Many alleged previous aliases, Richard Heart, that is Richard Schueler, James Hart, and J. Schueler, united as the Spam King. The moniker rolodex was tied to spam lawsuits, Panamanian criminal network extortion activity, and ardent support of the Methuselah Foundation. Later, the itch to spam was scratched by sending physical unsolicited mail shilling HEX to addresses made public during the Ledger leak.

Richard Heart has made a career of persuasion and promises to those who hopelessly desire it most. Now he is the central entity controlling and benefitting from the feeble ecosystem he created.

Is the SEC pursuing someone worthy for once? Consider if the following is a sales of unregistered securities:

Over the course of the first year’s claim period, HEX was received by sending Ethereum to the smart contract’s origin address. Conversion back to Ethereum or otherwise a refund was impossible. That is already a basis for HEX not being a Certificate of Deposit.

Any questions pertaining to the ownership of the origin address were evaded, although it should be obvious who holds the keys to the smart contract of their own creation.

As the SEC regards ICOs to be securities, Heart has therefore operated an unregistered ICO for over a year, receiving assets in exchange for his product.

Heart likely also holds the keys to the genesis address, which serves as the starting point for all transactions and coin distributions within that network, as well as holds all the tokens invested in HEX. Heart was not at all perturbed by the nearly $7 million worth of Ethereum (ETH) withdrawn from the address in January 2020. The funds were withdrawn through 36 separate transactions, with each transfer taking exactly 1,337 ETH, valued at approximately $192,500 each. Each transfer went to a different address. A nice way to exit.

Heart earned money through an infinite loop of his creation, and perhaps a few others who got out in time were able to reap their percentage of what he didn’t claim. Doesn’t that deception warrant incontestable trust?