The $58M funding round will allow Tabby to expand its BNPL offering and support the company’s growing operations

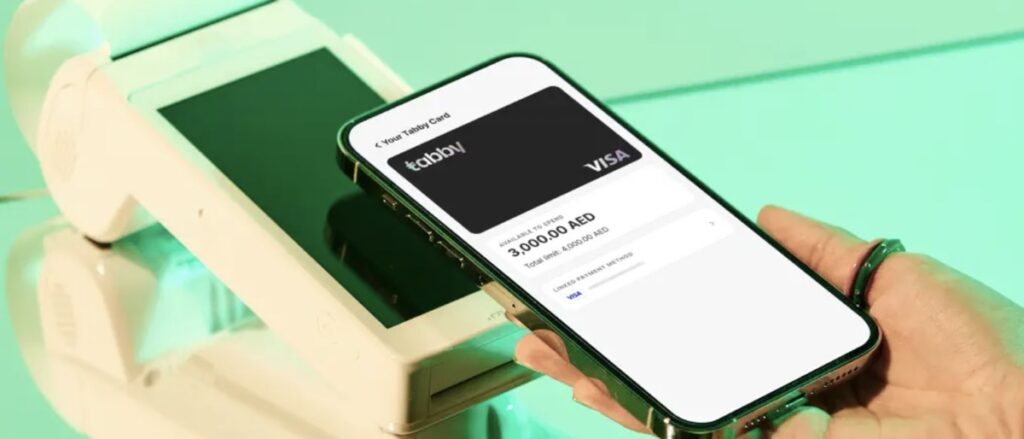

Source: Tabby

Tabby, the MENA-based payments and shopping app, closed a Series C funding round, which values the company at $660 million. The BNPL service provider will use the invested $58M to expand its operations and add next-gen consumer financial services to its offering.

The funding round was led by Sequoia Capital India, with the participation of STV, PayPal Ventures, Mubadala Investment Capital, Arbor Ventures and Endeavor Catalyst. For PayPal Ventures, this was the first investment in the Gulf Cooperation Council (GCC) and the second one in the MENA region (after Egyptian fintech Paymob).

With a total of $394M raised, Tabby has become one of the most valuable startups in MENA. The company currently cooperates with over 10,000 brands including top retail groups in the region, providing users with an opportunity to shop with flexible payments online and in-store from global brands. It has also recently partnered with noon – MENA’s largest e-commerce marketplace.

Last year, Tabby registered 3 million active shoppers, expanded its operations to Egypt and grew its revenue five-fold over the previous year.

Consumer demand for BNPL products differs across regions. Since western markets have a variety of credit opportunities, US, Australian and European BNPL players like Affirm, Klarna or Afterpay are now having tough times. Meanwhile, in developing markets credit penetration is low and BNPL has a more robust use case, as it’s illustrated by Tabby.