The Indonesia-Malaysia cross-border QR code payment linkage launches to make instant retail payments, expand markets for local businesses, and facilitate increased settlements in local currency

Image: pixabay.com

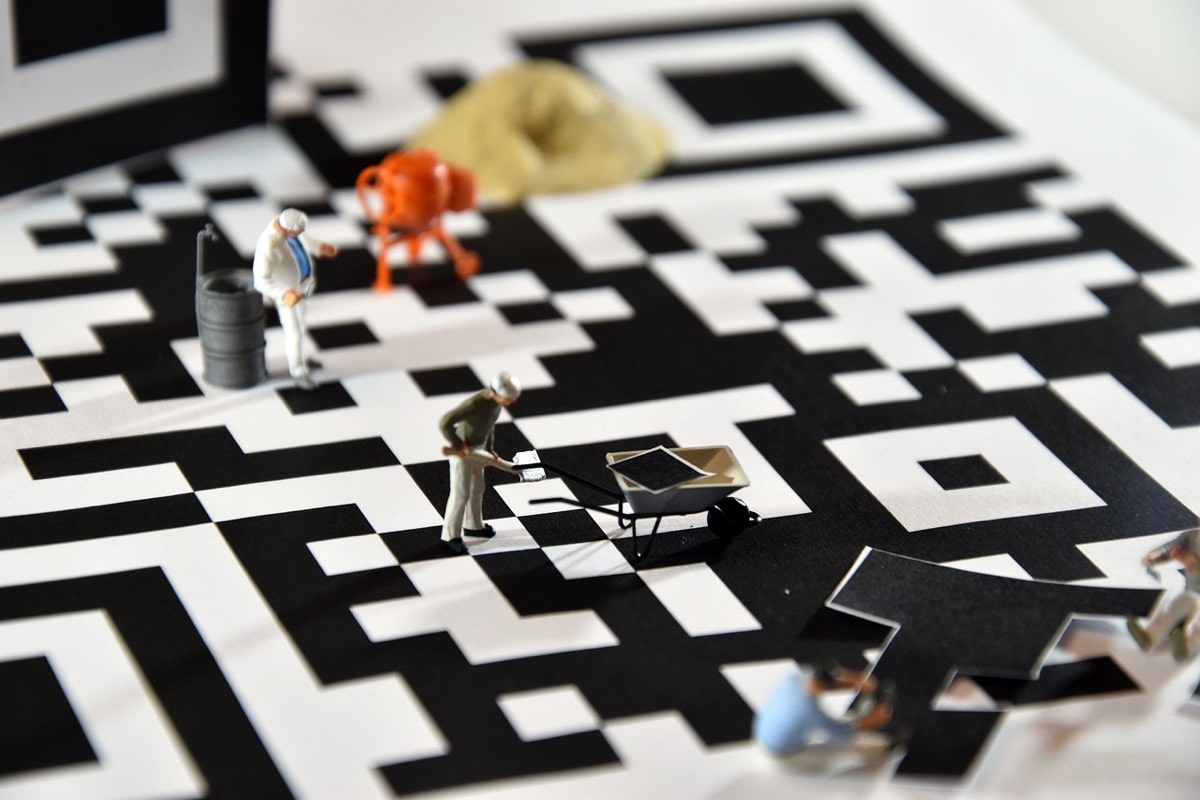

Bank Negara Malaysia (BNM) and Bank Indonesia (BI) have jointly announced the commercial launch of the cross-border quick response (QR) code payment linkage between the two countries.

The linkage has been tested during the pilot phase that started on Jan 27, 2022. It enables Indonesian and Malaysian citizens to make instant retail payments in both countries by scanning the Quick Response Code Indonesian Standard (QRIS) or DuitNow.

The two institutions believe that the linkage has significant potential to boost cross-border economic activities, tourism, and business interactions. The retailers in both countries will have an opportunity to expand their markets seamlessly and “benefit from a secure, more seamless and more efficient experience to make and receive cross-border payments.”

Besides improving the retail interactions between the two countries, the new linkage adds to a growing network of bilateral payment linkages within various Asian countries under the ASEAN Payment Connectivity Initiative. Thus, the project is contributing towards a more vibrant and developed economic environment in the region.

It illustrates strengthened cooperation on regional payment connectivity, aiming to promote “faster, cheaper, more transparent and more inclusive cross-border payments, particularly for the benefits of micro, small and medium enterprises,” believes BI governor Perry Warjiyo.

The QR code payment systems have already been linked between Singapore and Malaysia, as well as Malaysia and Thailand. Cross-border QR remittances have also been enabled across Indonesia, Thailand and Malaysia.

Moreover, the linkage aligns with the Group of 20 initiative in establishing the Roadmap for Enhancing Cross-Border Payments and promotes more extensive use of local currency for bilateral transactions under the Local Currency Transaction Framework.