After sandbox testing, Swift is preparing to develop a beta version of the new way to connect central bank digital currencies (CBDC) with existing fiat infrastructures

Image: pixabay

Interbank cooperative Swift has conducted a series of successful experiments with central and commercial banks from different countries which proved the feasibility of developing an API-based CBDC connector, linking the centralised cryptocurrencies with existing fiat-based payment systems.

Describing the results of its CBDC sandbox project, Swift assured that its experimental interlinking solution had received strong support from the project participants, as the one able to meet the needs of central and commercial banks for CBDCs interoperability in cross-border payments. Therefore, the cooperative is going to proceed with the beta prototype of its CBDC connector.

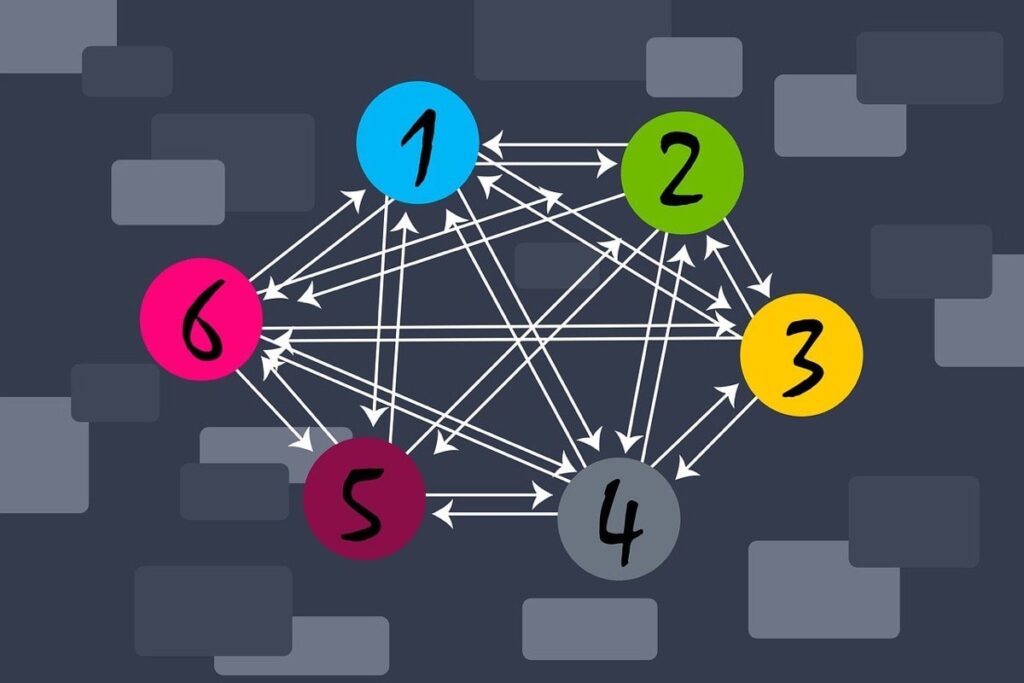

The sandbox hosted two blockchain networks used to run CBDCs and a simulated Real-Time Gross Settlement (RTGS) network. Each network had regulator nodes and bank nodes incorporated. Meanwhile, the experimental Swift CBDC connector linked those blockchains to a simulation of Swift’s enhanced platform.

The connector implemented the local message processing and CBDC network accessing logic. Thus, separate participants didn’t need to know how to process the message and access the destination network. Besides, the solution enabled the creation of a conditional payment, so that the funds were escrowed in each of the networks prior to settlement.

In the framework of the experiment, almost 5,000 transactions were simulated both between the two different blockchain networks and with existing fiat-based payment systems.

Sandbox participants included the Banque de France, the Deutsche Bundesbank, the Monetary Authority of Singapore, BNP Paribas, HSBC, Intesa Sanpaolo, NatWest, Royal Bank of Canada, SMBC, Société Générale, Standard Chartered and UBS. Some of them expressed their intention to continue collaboration on interoperability.

Hence, Swift not only intends to develop a beta version CBDC connector but also plans the second phase of sandbox testing. It will give Swift member banks an opportunity to collaborate further with a focus on new use cases, e.g. securities settlement, trade finance, and conditional payments.