India’s UPI has gone from a domestic game-changer to the world’s leading real-time payment system in less than a decade of its existence, surpassing the industry giant – Visa – with over 650 million daily transactions.

Unified Payments Interface (UPI), India’s nationwide instant payment network, has reached a major milestone by surpassing Visa’s daily transaction count: the system processed 650.26 million daily transactions compared to Visa’s 639 million.

The achievement is even more remarkable, given the fact that it took UPI just nine years to outpace the daily transaction volume that Visa has amassed throughout its 60+ year financial journey. Besides, Visa’s reach spans over 200 countries and territories, while UPI is present in just seven.

UPI debuted in 2016, quickly growing its acceptance for peer-to-peer and merchant payments first within India’s borders and then abroad. In just four years since the rollout, UPI’s success in India has fueled international interest in exporting the simple and efficient payment model.

The first cross-border UPI deployment happened in Bhutan. Nepal, Singapore, UAE, France, Sri Lanka, and Mauritius were soon to follow. Today, the payment system is also being piloted in Qatar. The NPCI International Payments Ltd (NIPL) entity, established to expand UPI globally, is also conducting ongoing negotiations in the UK, USA, Oman, and Southeast Asia.

The real-time payment system is supported by popular apps like PhonePe, Google Pay, Paytm, and others that have hundreds of millions of users. Combined, PhonePe and Google Pay process over 80% of all UPI transactions in India. However, other apps also bring their fair share of payment volumes.

Along with international expansion, UPI is rapidly reaching new regions and user groups within India itself, in particular, becoming the preferred payment method in rural and semi-urban areas. It’s also gaining traction among older adults, helped by initiatives like the GenWise–Axis Bank partnership, which brings UPI convenience to seniors through a dedicated app-based platform.

To support mass adoption and smooth interoperability, the NPCI has introduced a new standard for UPI transaction IDs, banning the use of special characters starting February 1, 2025. This change enforces uniform alphanumeric ID formats across all platforms, reducing errors, ensuring consistency, and improving cross-platform compatibility. As UPI continues to scale across diverse users and providers, such standardization is key to maintaining system efficiency and reliability.

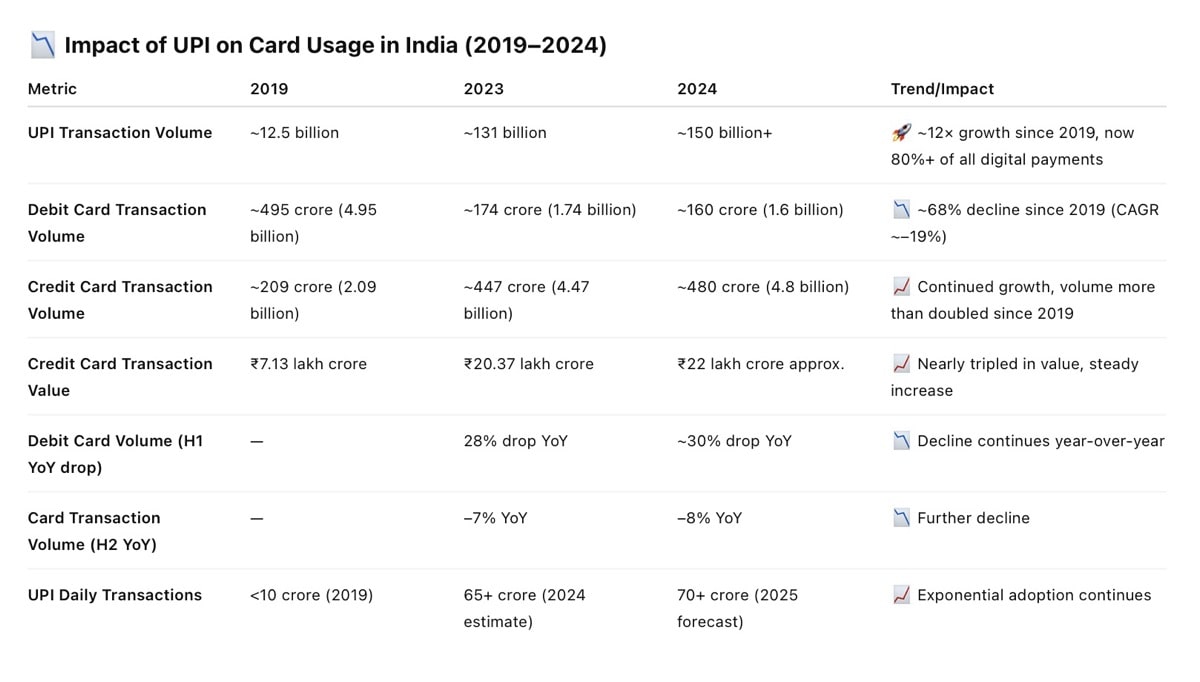

As UPI keeps growing, the usage of debit cards in India steadily declines, reflecting changing consumer preferences and greater digital penetration. However, credit cards remain resilient, primarily for higher-value and online purchases, where flexible payments are preferred.

At the same time, some fintech players and banks have already introduced “Buy Now, Pay Later” (BNPL) and installment schemes that integrate with UPI for seamless payments. Besides, recent UPI updates have added features like overdrafts, intent-based payments, and invoice payments, which open doors for credit-like services through UPI channels, which might gradually shift credit payments to the UPI network as well.